|

|

|

|

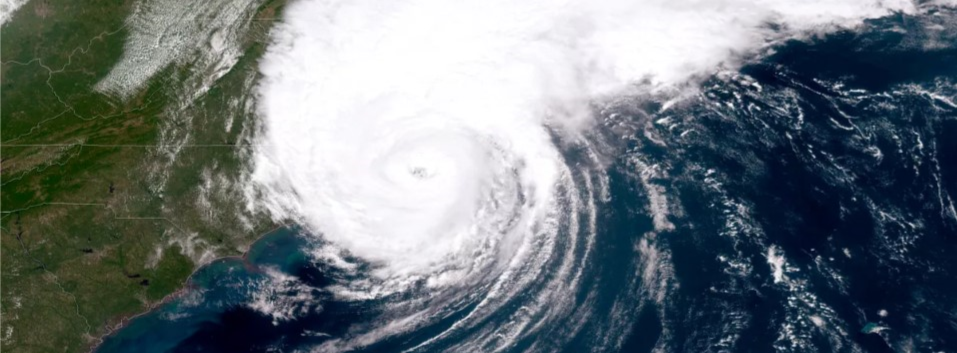

Hurricanes Do More Damage than What’s on the Surface

In the wake of hurricane season, many people only think about the physical path of destruction these natural disasters leave behind. From property damage to death, hurricanes have a lasting impact. Hurricane Dorian became a monstrous category 5 that devastated the Bahamas. The death toll as of September 10th totaled fifty, and it’s still climbing. Parts of Grand Abaco still are not fully accessible, except by helicopter. Over 60% of homes were completely destroyed, leaving thousands homeless.

Aside from physical aftermath of a hurricane, many economic impacts exist as well. The Congressional Budget Office estimates that government costs for hurricane damage is near $30 billion per year and gradually increases each year. Whatever government agencies do not pay out for damage, the remainder is covered by state and local governments, insurance companies, and the individuals affected. This article features some of the commonly overlooked economic disruptions resulting from a hurricane.

Local Business Disruption. Local businesses typically shut down prior to the storm and days to weeks following the impact, depending on how severe. Closing doors means days where sales and production are low to none. Many small companies that shut down cannot reopen for extended periods of time due to unexpected damages. If the damage is far beyond repair, such as the damage done by Hurricane Dorian, these small businesses are not able to open their doors again. Among these are typically restaurants and other small service businesses.

Commodity Prices. Natural disasters, especially hurricanes, can have a huge impact on commodity prices. A perfect example of this is Hurricane Katrina’s destruction to the refineries in the Gulf. More than 50% of the gasoline consumed by the U.S. passes through those refineries. Consequently, gas prices rose, and the transportation sector saw shrinking margins as they had to increase their rates.

Financial Services. Regarding investments, companies such as insurance have to pay out millions to their insured clients following a hurricane. The large payouts take a toll on their earnings, which is then reflected in the stock price. Many small companies are not prepared to take on these payouts all at once. Portfolios or ETFs with companies that are directly affected may not see positive returns for many quarters.

Property Value. When hurricanes sweep through certain areas and leave long-term damage, the property value of the homes decline. An expensive neighborhood a couple of miles away from an area that was leveled by a hurricane will see a decline in the property value because the surrounding area is no longer up to value. Other factors that can negatively impact property value are the number of business that had to close or schools that are no longer functional.

With our highly integrated economy, almost every sector will see a direct or indirect impact from a hurricane. Besides the infrastructure damage, many people may not see the economic consequences beyond that. From largecap companies to smallcap local business and restaurants, almost everyone can feel the impact. Commodity prices are affected, financial service groups have to payout millions, and the property value of homes in these areas often decline. So when it comes to preparing for a hurricane, besides the bottled water and extra snacks, remember to take a look at your portfolios and surroundings to properly prepare for the worst possible scenario.

Sources:

https://www.npr.org/2019/09/05/757858192/in-bahamas-officials-assess-generational-devastation-from-hurricane-dorian, Brakkton Booker September 5, 2019

https://www.thebalance.com/hurricane-damage-economic-costs-4150369, Kimberly Amadeo June 25, 2019

https://www.investopedia.com/financial-edge/0311/the-financial-effects-of-a-natural-disaster.aspx, Mary Hall August 30, 2019