Image Credit: Worldspectrum (Pexels)

Crypto’s Ancillary Businesses as an Opportunity for Investors

There are more than 5,000 digital currencies available to trade. Many of them are partially accepted as currency; others have limited transactional value. They all rise and fall with speculative trades. Because the popular digital currencies tend to swing in value, traders have opportunities to profit if they are on the right side of a trade. But, where investors are concerned, there is only a short price history, so there is a lot still unknown about the long term, and probably too much as yet unknown for any cryptocurrency to be viewed as a prudent long-term position.

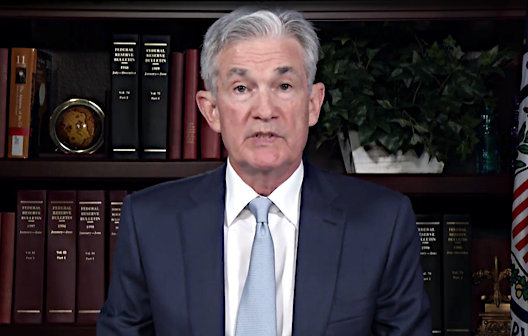

One glaring example of why some of the 5,000+ cryptos are unlikely to be trading in a few years (perhaps replaced by others) is because there is only room for so many mediums of exchange. Having too many is inefficient and stands in the way of commerce – this is one reason twelve European nations consolidated their currencies under one unit of exchange in 2002. Another concern is something the US Central Bank Chairman recently discussed. On May 20th Fed Chairman Powell spoke publicly about cryptocurrency as he announced a future discussion paper they will be releasing on the subject concerning a US Central Bank Digital Currency (CBDC). If the world’s most powerful central banks begin to go head-to-head with even the largest cryptos like Bitcoin, the “entrepreneurial” currencies may run into trouble.

Having said this, the technology that benefits and allows for digital currency appears to be growing in demand. This is why many would-be crypto investors are embracing the wisdom made famous during the 1850s gold rush – That is, invest in a store that sells shovels.

Crypto Exchanges Could be the Modern-Day Equivalent to a Shovel

Whether there are 5,000 cryptocurrencies five years from now or only 5, there will be trading. That trading will be in large and small numbers, just as it is with more traditional currencies and securities. With a great deal of attention focused on its IPO, crypto exchange Coinbase (NASDAQ:COIN) went public in mid-April. It instantly attained a market cap in excess of $60 billion (more than twice that of Nasdaq (NDAQ). Coinbase is a large cryptocurrency exchange and is seen as a play on the more robust tokens such as Bitcoin or Ethereum.

Another smaller company is Voyager (OTCQB: VYGVF, VYGR:CA), a publicly traded company in the crypto brokerage business. Voyager, which is growing at 35% month-over-month, has a market cap of less than $2.5 billion. Research coverage was initiated by Noble Capital Markets on Voyager today. In his report on the company, Senior Research Analyst Joe Gomes wrote: “ Voyager’s platform enables trading on over 60 (and growing) different cryptocurrencies and assets, the largest of any platform.” Noble bestowed an “Outperform” rating on the company. The report points toward the company’s competitive strengths stating, “In a nutshell, Voyager clients can trade commission free, get faster execution, more depth of liquidity, earn interest, get real-time market data, news and advanced charts, and can store digital assets using multiple custodial solutions.”

Voyager Digital seems well-positioned to benefit from increased transactions and growth of the overall market. This could benefit those who prefer a company with far more room to grow than an already behemoth exchange or any particular cryptocurrency.

Take-Away

Placing funds directly into a particular cryptocurrency has been very profitable for the early adopters and riskier for those just getting involved now. There are risks in digital currencies; these include convincing consumers to switch from cash, high fluctuations in value, possible CBDCs, and regulatory scrutiny. Nevertheless, the future would seem to involve more use of cryptocurrency, not less. Ancillary companies that are allowing for the growth of the asset class could provide less risk while rewarding investors as this market matures.

Suggested Reading:

|

|

What is the Feds position on Crypto, Stablecoin, and CBDCs?

|

Bill Ackman’s Most Unusual SPAC Deal

|

|

|

NFTs are Becoming More Popular with Sports Fans

|

The Benefits of DeFi

|

Sources:

https://channelchek.vercel.app/companies/VYGVF

https://www.sofi.com/learn/content/understanding-the-different-types-of-cryptocurrency/

Stay up to date. Follow us:

|

|

|

|

|

|

Stay up to date. Follow us:

|

|

|

|

|

|