Image Credit: Peat Bakke (Flickr)

Market Leverage Swings Both Ways

There is a direct correlation between large increases in margin debt and increases in stock prices. This makes sense since the increased borrowed money allows higher demand for stocks. The uptrend and borrowing may even feed on itself for a while. If the market later unwinds, as it sometimes does, investors may find themselves required to shore up their accounts financially or sell affected positions. This mechanism, called a margin call, can have overall market implications, especially if it’s widespread and impacts widely held stocks. In the past, there have been major stock market events associated with sharp declines in leverage. According to recent FINRA data, margin has been decreasing since last year.

Some Data

Margin debt dropped by $20 billion in May from April to $753 billion, according to FINRA. FINRA is charged with oversight over brokers in the U.S. . Margin debt peaked in October 2021 at $936 billion. The following month it began to decline. The Russell 2000 and the Nasdaq 100 both peaked in November. The small-cap index is now down 31.5% from its high, and the Large Cap Nasdaq 100 is down 32.5% from its November high.

There are also other forms of margin debt, it is smaller in size, but these figures are more difficult to attain accurate information on. They could include opening a brokerage account with revolving credit, even home equity loans, personal loans, and bank securities-based lending.

Forced selling in widely held stocks is likely to have impacted names like Amazon (AMZN), down 45% from its high, Netflix (NFLX), down 76% from its peak, and Meta (META), which slid 57% from its high, Nikola (NKLA) is down 93%, and even Peloton (PTON) experienced a 94% decline.

Some Charts

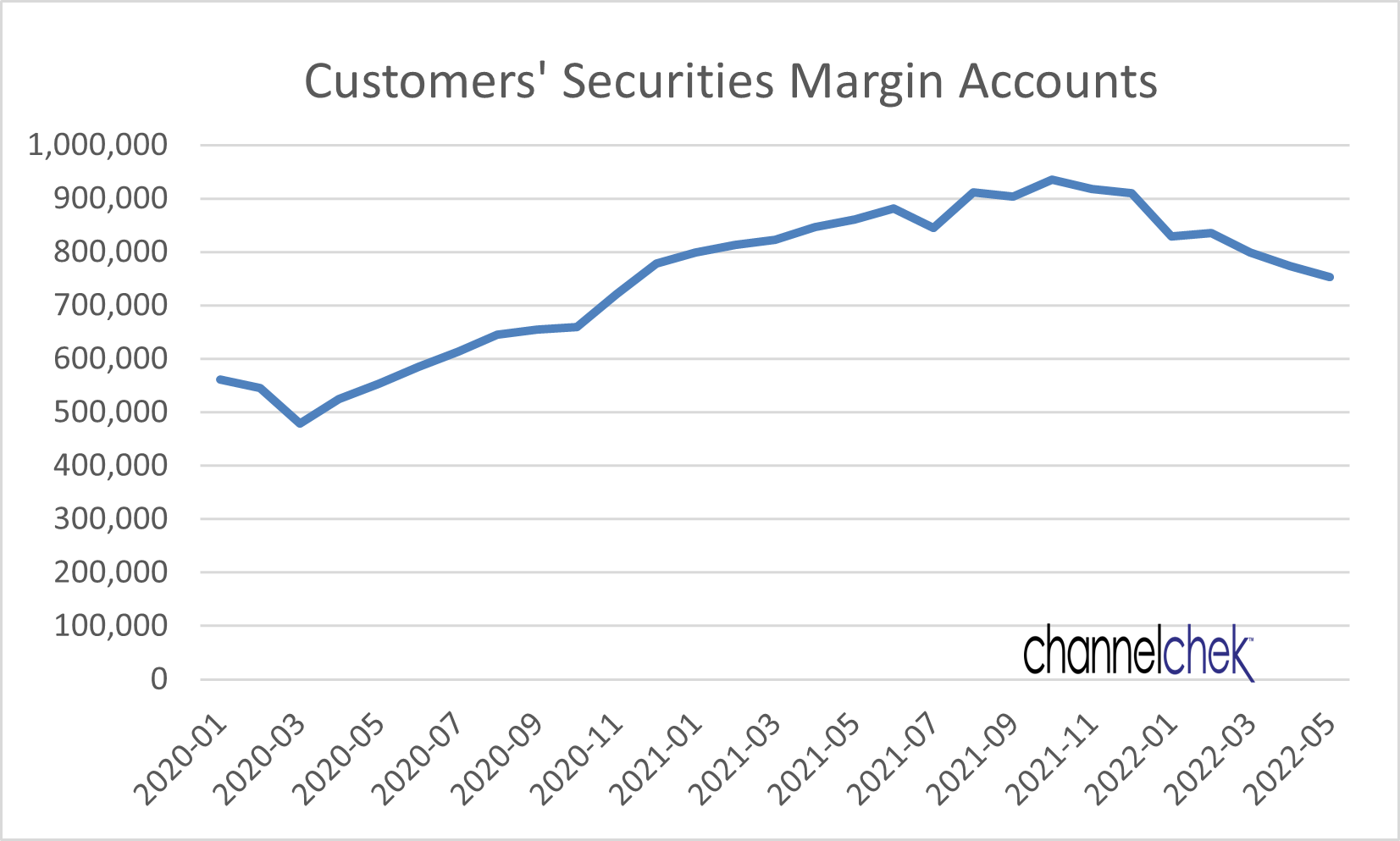

Data Source: FINRA

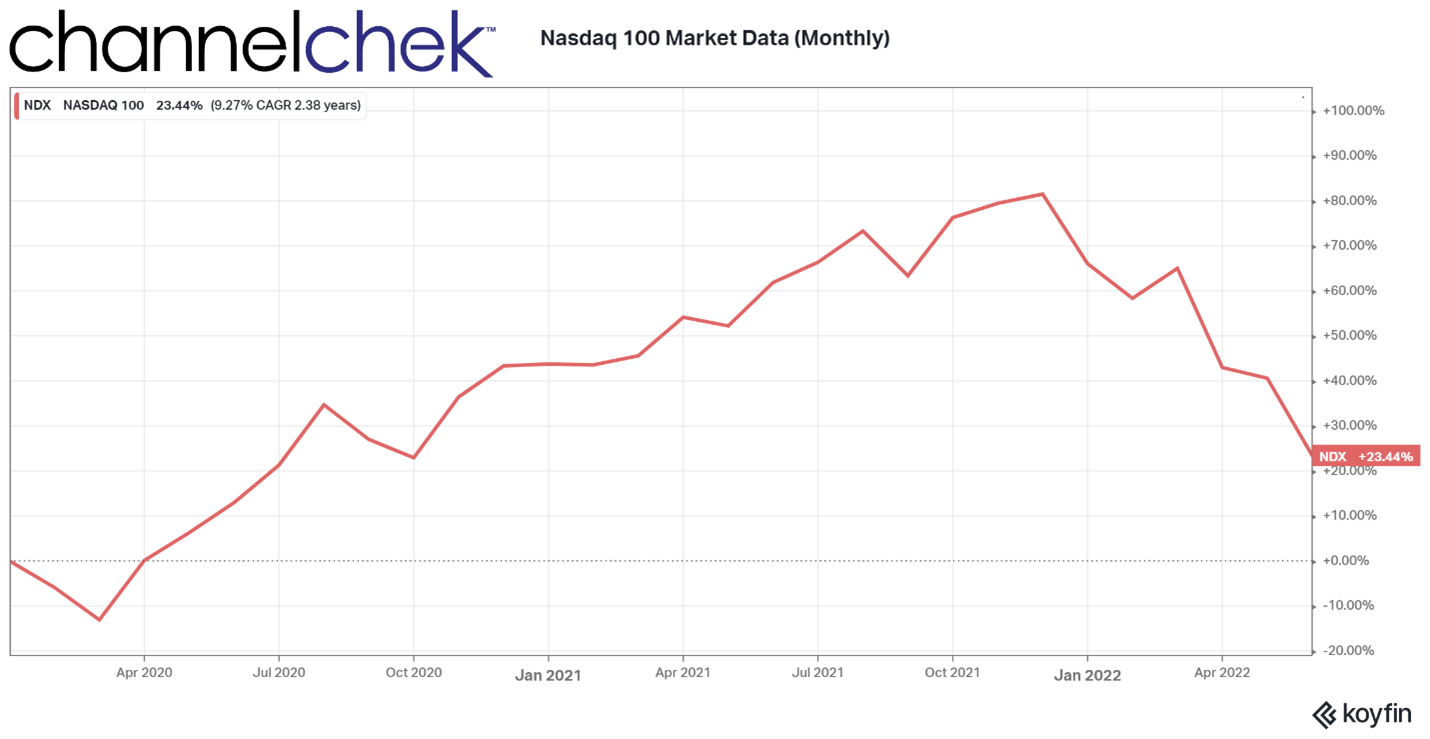

Margin debt nearly doubled from March 2020 to November 2021 as borrowing reached its high. The levels have now shaved 20% from the highest balance. Below is a Nasdaq chart of the same period. The trend closely tracks the change in margin outstanding in brokerage accounts overseen by FINRA.

Source: Koyfin

Some Insight

Margin has an impact on market movements, just as any other factor that may increase or decrease cash available to invest. These factors could include stimulus checks, taxes, increased household costs, higher employment situation, etc. Investors should keep aware if margin debt levels are higher than normal and growing or shrinking – especially when the market begins to lose ground. The same is true for investors that see increased use of margin debt at an increased rate. This could create momentum on the upside.

For investor insights and to explore and discover lesser-known opportunities, sign up for

emails from Channelchek.

Managing Editor, Channelchek

Suggested Content

Margin Debt Increases are Eye-Popping

|

Understanding Family Offices

|

The Beveridge Curve Indicates Aggressive Fed Action Shouldn’t be Feared

|

Will Investors Keep Reducing Leverage?

|

Source

https://www.finra.org/investors/learn-to-invest/advanced-investing/margin-statistics

Stay up to date. Follow us:

|