The Reasons High Employment Concerns the Market

Maximum employment is one of the top mandates of the Federal Reserve, so why is it trying to reduce the number of jobs available? On the surface this would seem backwards. But in economics, everything is related, intentionally slowing growth to the point where resources aren’t stressed, can provide a better balance across the Feds other mandates. These Congressional mandates are stable prices, and moderate long-term interest rates.

Current Employment Situation

The most recent U.S. Employment Report was released on July 7th. It showed that payroll employment was still climbing during June, and 209,000 new employees were added to company payrolls. The same report showed that the unemployment rate dropped to a historically low 3.6%, and workers earned 4.4% more than a year earlier (In May, it was 4.3% more).

The markets immediately viewed these strong job gains, coupled with an acceleration of wage increases and the drop in unemployment, as foreshadowing a Fed hike in late July. And also viewed is as increasing the probability of additional tightening before year-end. Employment is high, and the labor market is so tight that employers are increasing what they have paid workers in order to attract suitable personnel.

A day earlier, the payroll company ADP released its National Employment Report, which is produced in collaboration with the Stanford Digital Economy Lab. This report also showed a strong labor market. The private sector (non-government) jobs increased by 497,000 in June. This was approximately double the strong number of new hires from the previous month.

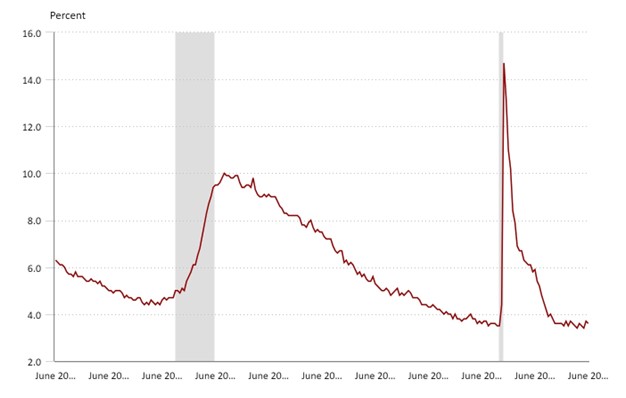

Civilian Unemployment Rate

How More Jobs Translate to Stock Market Concerns

The U.S. Unemployment Rate continues to remain very low despite the Fed’s aggressive efforts to slow the economy and only a modest 2% GDP growth rate. In fact, in April unemployment hit a 50 year low at 3.4% which is just below the June level.

Employment levels in the U.S. are now a key focus of the Federal Reserve (the Fed) in its effort to slow U.S. economic growth to combat persistent inflation well above the Fed’s target. Fed officials have repeated what most market participants know, that achieving lower inflation would be difficult without addressing the increasing prices that employees are receiving for their labor. A strong jobs market pushes wages higher, which filters into higher consumer inflation.

The job market’s continued strength has been somewhat surprising in what appears to be a slowing economy, with consistently low unemployment and solid job growth. This likely reflects unusual dynamics that stem from the novel economy during the pandemic. The economy hasn’t yet balanced out after massive government stimulus, low production, and a changed sense of work among many that are still of working age.

The employment numbers this year show there are still 1.6 job openings for each person that is looking for work. Considering those looking for work and the positions open are largely mismatched, this leaves employers either bidding up what they are willing to pay to attract the right person or producing less than is demanded by the market for their goods or services. Both situations are inflationary.

There are two sides to every problem; while potential employees willing to work represent far fewer workers than there are jobs, there are fewer, of age, adults willing to participate in the labor force. The labor force participation rate now stands at 62.6%, unchanged from the previous four months. Improving labor participation would be a preferred way to address the tightness in the labor market that’s leading to wage inflation, but the Fed doesn’t have the tools to incentivize this. So it is back to raising rates, draining money from the system, and otherwise taking the punchbowl away to end the party.

Good News is Bad News

This is why the Fed is not excited about job growth and low unemployment. And if the Fed isn’t happy, the markets aren’t happy. The bond market selling off in expectation that the Fed is going to raise interest rates lowers bond prices, and the stock market is concerned on many fronts, as high rates increase costs for companies, slow purchases that are typically financed, and with each tick up in rates, bonds and C.D.s become more attractive as an alternative to stocks.

So the good news which is that almost anyone who wants a job can have one, as it turns out, leads to a chain of events that causes concern among those invested in stocks.

But while unfortunate, the Fed actions are long-term good. Inflation quietly erodes the purchasing power of financial assets. So the Fed is focused on what is driving inflation, wage inflation being chief among them.

Take Away

The job market’s continued strength and the wage growth that comes with it creates a perplexing situation for all involved. The Fed has to work to reduce employment pressures, and stock and bond market participants are cheering on bad economic news – this is perplexing for investors of all levels.

Managing Editor, Channelchek

Sources

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.cnn.com/2023/07/06/economy/june-jobs-report-preview/index.html