Image Credit: NeilsPhotography (Flickr)

The Latest GDP Growth Number Should Squelch All Stagflation Conversation

The just-released 4Q GDP numbers should put on hold, at least for now, any conversation suggesting stagflation is imminent. While the stock market has been racking up consecutive red days, the economy is growing quite rapidly. This eliminates half of the stagflation debate. The other half, however, seems to be firmly in place. Here’s why the GDP trend is excellent news and the stagflation forecast is unlikely.

Stagflation

Source: Dictionary.com

The term stagflation was first used in the ’70s to describe an environment where the economy is effectively “stuck in the mud.” The wheels are spinning, but it isn’t going anyplace, and the driver, in this case, the Fed) applies the gas pedal, the more costs that are likely to rack up without any forward motion. Using the more refined definition from Dictionary.com, let’s look at two numbers related to the economic numbers released today (2/24/22).

The definition mentions employment and business activity. The Department of Labor reported the seasonally adjusted initial unemployment claims was 232,000. This is a 17,000 decrease from the previous week. The 4-week moving average is 236,250, which is a decrease of 7,250 from the previous week’s. This is just one employment indicator, but it is the most recent and it is a positive indicator of economic health.

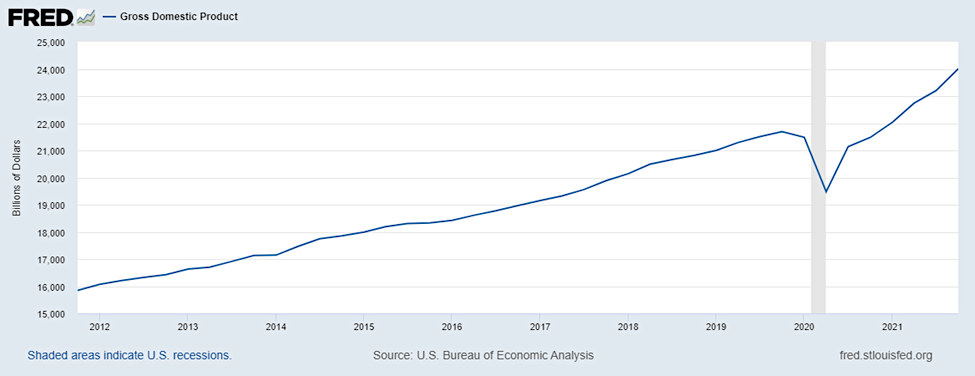

The U.S. Gross Domestic Product (GDP), while a lagging indicator, is the most all-encompassing measure of economic activity. It’s an actual measure of all goods and services produced within the U.S. borders. The report showed the U.S. grew 7% in the 4th quarter. This is a large number and does more than just make up for the one (significantly) down quarter in 2020. The GDP is now trending at a slightly accelerated pace than the previous five years. At almost any other

time in market history, the stock market would have celebrated with a

substantially up day.

Lately, the market looks for bad news. Granted, today the negative news (Russia invades Ukraine) was the focus.

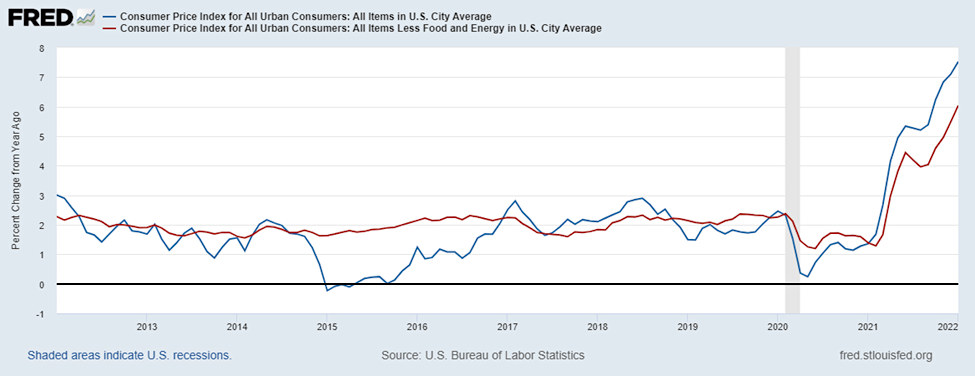

Inflation

As indicated in the below graph, using CPI as a measure, we see inflation is running well above the Federal Reserve’s stated 2% target. It is doing this whether food and energy are included in the measure or not.

The graph demonstrates just how rampant inflation has been since the second quarter of 2021. And it has been accelerating. In the past, an inflation trend like this would cause the Fed to move the overnight lending rate to a level much closer to the pace of inflation. The current stated Fed Funds target is 0.00% to 0.25%. At almost any other time in market history, the stock market might view the Fed as careless, and the bond market would have already been priced to have a positive real yield (yield net of inflation).

One reason this hasn’t happened is the Fed is exercising “yield curve control” which is keeping the bond market from increasing the price of borrowing.

If it’s not Stagflation, What is it?

With 7% growth and jobs plentiful, the current economic situation doesn’t meet the basic definition of stagflation. Yet, one of the most widely followed leading indicators, the stock market, tells us there is something just around the corner to worry about. Weakness in the equity markets is not just a leading indicator, it is also a driver of corporate and consumer behavior. When an individual or entity feels wealthy and has easy access to capital, economic activity thrives, when financial means are diminished by lower stock market prices, activity slows.

It may be that the markets are aware that the Fed, although it hasn’t changed the overnight lending rate, is dramatically reducing the still ongoing stimulus (tapering purchases of public market securities). Billions of dollars that have been entering the fixed income markets each month, billions that held rates down and provided new capital to the economy will no longer be available. And, perhaps what has continued to fuel 7% GDP growth, job growth, and yes even partially responsible for inflation, will now slow growth.

While this is not stagflation, it puts the Fed in a position where it has to choose a battle. Fight inflation by stunting economic growth, or keep the proverbial punch bowl out and not worry about the potential hangover (more inflation).

Take-Away

The cost of borrowing is climbing as the Federal Reserve prepares to raise overnight bank lending rates for the first time in four years. Inflation has soared to a 40-year high. Meanwhile, ongoing shortages of labor and supplies have handcuffed the ability of businesses to produce enough goods and services to meet customer demand. Even though production is being stymied, GDP is roaring at 7%.

The markets are trading off and it isn’t all because of the unsettled Russia Ukraine situation. Higher energy prices, after all have the same impact on the economy as raising rates does (higher cost of capital).

This isn’t a stagflation scenario, yet the markets are spooked. Does the combined wisdom of the stock market participants know something? This remains to be seen. While the U.S. economy continues to show solid fundamentals for growth, it is faced with increasing headwinds from significant, less overt, policy tightening (bond purchase taper).

Suggested Reading

Will the Market Soon Reach New Heights?

|

Why 2022 Investing Will Need to be Different

|

It’s Officially Warren Buffett Season – Hints on What to Expect

|

The Various Ways to Allocate into “War Investments”

|

Sources

https://www.dol.gov/sites/dolgov/files/OPA/newsreleases/ui-claims/20220331.pdf

https://data.bls.gov/pdq/SurveyOutputServlet

Stay up to date. Follow us:

|