Image Credit: Bloomberg TV (August 4, 2022)

MicroStrategy’s Huge Bitcoin Portfolio is Now Expected to Expand

There is possibly no greater bitcoin (BTC.X) supporter than Michael Saylor. So when he stepped down last week from his position as CEO of MicroStrategy (MSTR), the firm he founded, there was concern among bitcoin investors, speculators, and enthusiasts, that they were losing an advocate and a loud, supportive voice. It turns out their fears may have been premature. Saylor, who now fills a role as the Executive Chairman of the company he ran for over three decades, has more time to extol the benefits of adopting bitcoin in business and individually. It is beginning to look like he will become an even greater voice cheerleading for bitcoin. The new position will actually allow him to double his focus on cryptocurrency at Microstrategy.

MicroStrategy had put more than $4 billion into bitcoin since its first purchase during the second half of 2020. To do this, the data analytics firm stepped outside of its normal business and raised capital by issuing stock, convertible bonds, and corporate debt. It then borrowed against the bitcoin position and increased its exposure.

As bitcoin’s price rose, the company stock price rose in tandem; when bitcoin fell, the stock fell. As a result, when investors were looking for an equity investment with exposure to bitcoin, some bought MSTR. Similarly, when crypto was selling off, they shorted the company. This year has been a rollercoaster ride for stocks and cryptocurrency. This is why there was speculation Microstrategy was preparing to lessen its aggressive posture toward bitcoin. Saylor’s transition out of the CEO role caused speculation that the company would be less positive toward bitcoin.

It has been eight days since Saylor stepped down, and bitcoin supporters, particularly those that would like to see broader adoption by businesses as an accepted currency, have been surprised on the positive side.

Image: Saylor tweet to demonstrate stock outperformance since adopting bitcoin policy.

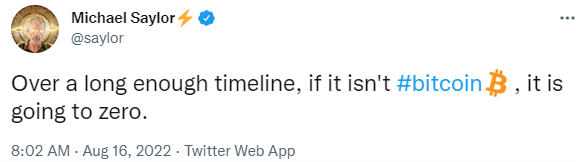

One of the more obvious signs of Mr. Saylor’s continued support is his Twitter account, with its endless stream of pro-bitcoin messages. Last Wednesday, the former CEO tweeted, “In my next job, I intend to focus more on #Bitcoin.”

The move is now considered more bullish for bitcoin and perhaps helps to further acceptance of all digital assets. Although Saylor himself may not agree with the word “all,” the only asset that he believes will stand the test of time is bitcoin.

MicroStrategy issued word that the company has not sold any bitcoin holdings and doesn’t have any plans to do so. It is making it clear that this change in leadership roles does not indicate a change in the company’s strategy to acquire and hold bitcoin long-term.

According to MicroStrategy’s Q2 earnings report, it held approximately 129,699 bitcoins, for which it paid a total of $3.977 billion. The market value n June 30 was about $2.451 billion. $2.4 billion is also the total of loans and debt that MicroStrategy has taken on to acquire bitcoin.

Bitcoin was trading for $23,500.30 per coin on Wednesday; the cryptocurrency fell to $17,593 in June, its lowest point since December 2020. Bitcoin reached an all-time high of more than $68,000 per coin in November 2021. Amid discussion of a margin call on a bitcoin-backed loan from Silvergate, Saylor said in June that the company had enough collateral to cover the loan.

MicroStrategy share prices were up 11.82% Wednesday, trading at $311.15. The company’s shares traded as high as $860 in November 2021, when its bitcoin holdings were worth as much as $7 billion.

To be sure, the MicroStrategy bitcoin story is not ending. The reward has been great for those that held MSTR since mid-2020, but the volatility during that time was also substantial.

Managing Editor, Channelchek

Suggested Content

When the History of Bitcoin is Written, This Story Will be in the Book

|

Cowboys and Cryptocurrency

|

Dogecoin Group Works to Give Currency Greater Purpose

|

What Might be in a Portfolio Allocated for a Republican Majority in the House?

|

Sources

https://www.microstrategy.com/en/investor-relations

https://twitter.com/saylor?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

https://fortune.com/2022/08/03/michael-saylor-microstrategy-stock-bitcoin-bet-debt-outlook/

https://www.marketwatch.com/story/michael-saylor-drops-microstrategy-ceo-role-heres-what-it-means-for-bitcoin-11659556705?mod=search_headline

Stay up to date. Follow us:

|