Image Credit: Pixabay (Pexels)

Cowboys and Cryptocurrency

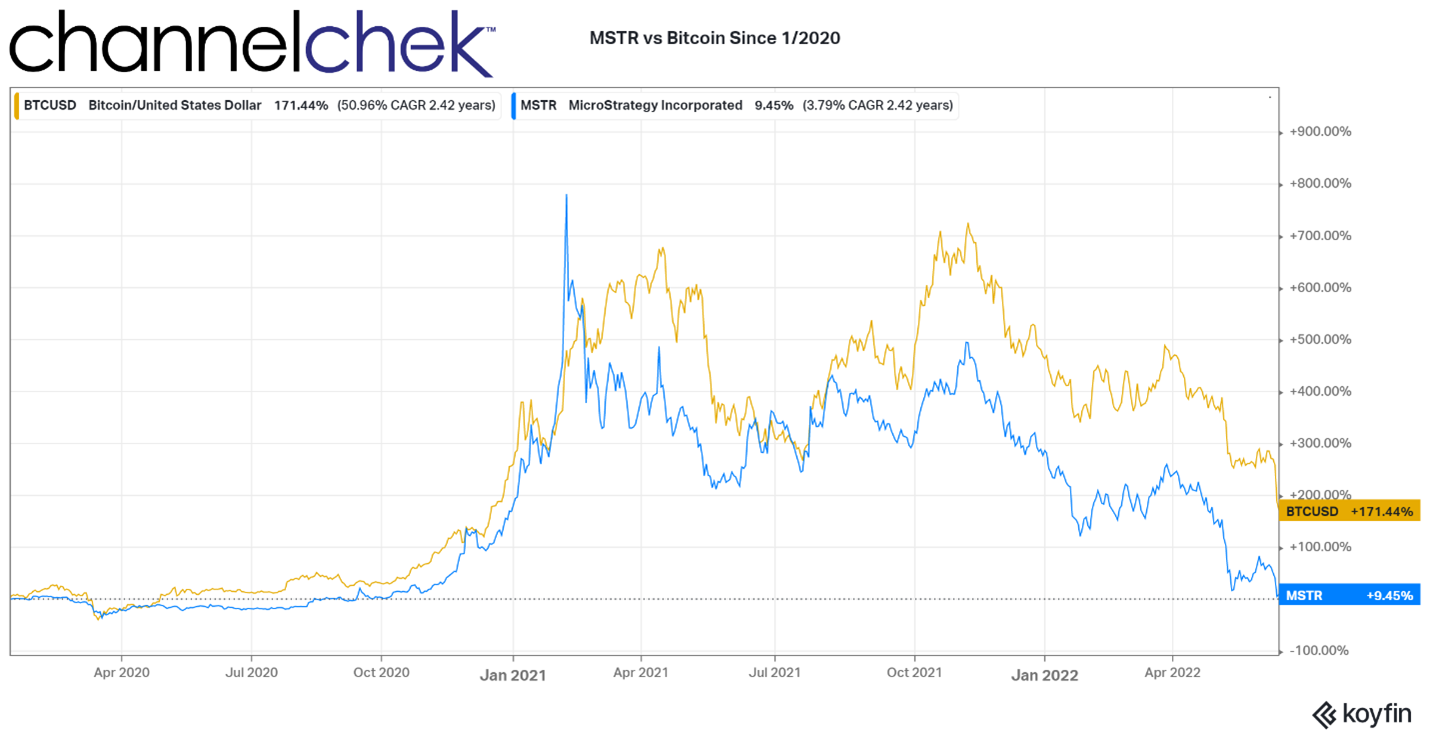

Is Michael Saylor of MicroStrategy ($MSTR) a “cowboy?” Many entrepreneurs are. But, the founder mindset often has blinders to risk; some only see possibilities. As CEO of the publicly traded software company he founded, Saylor is responsible for the purchase of $3.97 billion in bitcoin ($BTC.X), much of it by employing leverage. Bitcoin ownership is well outside of the software business realm. Since 2020, when MSTR first speculated on the cryptocurrency, it rose by 700% and Saylor’s company’s value rose in tandem. It must have been an exhilarating ride for management and investors. But the same “horse” that took them on that ride, may hurt them this go-around.

Source: Koyfin

Before engaging or enraging cryptocurrency believers, here’s another recent example of a company CEO rolling the dice: AMC Theaters spent

$27.5 million to buy 22% of a goldmining company. Since $AMC’s purchase, gold has declined 6.35%, and the company they purchased Hycroft Mining Holdings (

HYMC), is down 8.70%.

Bitcoin, over the last five days, is down 28.5%. Stepping back from the crypto hype, it’s worth exploring and understanding what Michael Saylor, and so many others have placed so much faith in. Specifically, at its most basic, what is cryptocurrency?

The Lure and Lore of Bitcoin

The seeds of bitcoin and other cryptocurrencies were first planted on Halloween in 2008. On that day a nine-page theoretical paper published by an unknown author named Satoshi Nakamoto was released. The impact of this theory was brought to life and has since caused some to become billionaires, even more people, to become millionaires, and quite a few to lose tens of thousands or much more through their speculation. It’s like trick-or-treat via blockchain.

Human behavior is not always rational. There are few people that can be in a crowd where “everyone is doing it” and not feel peer pressure to take part in whatever “it” is they’re doing. This is/was especially true when there have been big rewards for some, but certainly not all involved. Sometimes you’re late for the game and have to recognize the game may be over. It would have been nice to have speculated and then attained billionaire status in just a dozen or so years. But you may have to find another avenue for that. The crypto-zillionaires will always be part of the lore and mystique of bitcoin. But looking under the hood, and forgetting any previous hype, the idea of any large investment in crypto should leave most people scratching their heads in confusion.

Let’s discuss the author’s credentials. No one had ever heard of Satoshi Nakamoto when it was published. Even today, no one can identify this person. It is unknown whether the theory was created by a group of people, one person, or even a government entity. It is a mystery that remains unsolved. Does that sound like something worth investing $1,000 or more in?

Let’s discuss the author’s credentials. No one had ever heard of Satoshi Nakamoto when it was published. Even today, no one can identify this person. It is unknown whether the theory was created by a group of people, one person, or even a government entity. It is a mystery that remains unsolved. Does that sound like something worth investing $1,000 or more in?

The paper was called Bitcoin: A Peer-to-Peer Electronic

Cash System. It described for the first time a decentralized digital “currency” without central bank administration. Essentially what the paper proposed and later helped create was something that could possibly be used as currency instead of greenbacks or any other traditional currency. To date, it has barely become used as a currency, even in El Salvador where it is one of the national currencies. Each bitcoin that enters the blockchain is created by solving complicated math problems known as “Bitcoin mining.” Solve the math problem, and you have created a Bitcoin. Alternatively, you may exchange your native currency (hard-earned dollars) for this new currency that is barely accepted by any retailer and exists only on a ledger in cyberspace.

Up until 2010, the price of a Bitcoin, expressed in U.S. dollars, was under a penny. It jumped to 8 cents that year. Had you purchased Bitcoin after this huge leap, let’s say $0.80 worth, you’d have had something valued at over $600,000 in early 2021. This is because the price of one Bitcoin had jumped to over $60,000 a piece in just over ten years. So $10 in Bitcoin purchased back then would have provided you with well over a million if exchanged back to dollars in 2021.

Bitcoin and Cryptocurrency Today

Late last year, it would have cost you $64,000 for a single bitcoin; six months later (today), about $22,500. Is the current price a bargain, will the trend continue, and will MicroStrategy get a margin call that requires them to dump a billion worth of the asset into the market? How many other companies have crypto on their balance sheets may be weighing down their Net-Asset-Value (NAV)? The MicroStrategy story is probably causing people who sit on corporate boards to reevaluate whether it’s responsible to be holding or accepting payment in bitcoin, ether, Doge, or any other non-legal tender.

Bitcoin is currently trading at $22,400, MicroStrategy’s crypto holdings are now worth $2.9 billion. That translates to an unrealized loss of more than $1 billion. But, the company may face a required margin call, they’d then have to commit more funds to avoid losses on holdings that they enhanced with borrowed cash (margin).

Bitcoin and Cryptocurrency’s Future

Bitcoin is undergoing a brutal sell-off which has it approaching exchange rates not seen since December 2020. The market conditions have become erratic, with the crypto lending firm Celsius halting withdrawals on Monday (June 13). Celsius cited “extreme market conditions.” Also worth remembering is that a stablecoin recently broke the buck.

This is not intended to be a eulogy for bitcoin or any other cryptocurrency. As with most markets, stocks, real estate, gold, beany babies, etc., what lies ahead is never certain. Early investors are usually the bigger winners or losers in anything. But crypto now seems to have its back up against the ropes, central banks are coming down on it, regulators like the SEC are exploring ways to tighten what they see as the potential to abuse it, and those that are invested in it are questioning their own holdings. This all started as a theoretical paper, it is only backed by the belief that it is worth something, if that belief fades, so will its value.

Please leave any comment or discussion under this article on our Twitter Account.

Managing Editor, Channelchek

Suggested Content

AMC is Thinking Outside the Box Office and Diversifying

|

Tulip Mania Compared to Cryptocurrencies and Meme Stock Investing

|

Blockchain, Beverages, and Baloney

|

Expanded Blockchain Adoption and Adaptation in 2022

|

Sources

https://twitter.com/elonmusk/status/1501449525831081987

https://www.cnbc.com/2022/06/14/bitcoin-plunge-spells-trouble-for-michael-saylors-microstrategy.html

Stay up to date. Follow us:

|