What to Expect Out of This Year’s Jackson Hole Symposium

Since 1978, the Federal Reserve Bank of Kansas City has sponsored an annual event to discuss an important economic issue facing the U.S. and world economies. From 1982, the symposium has been hosted at the Jackson Lake Lodge at Grand Teton National Park, in Wyoming. The event brings together economists, financial market participants, academics, U.S. government representatives, and news media to discuss long-term policy issues of mutual concern. The 2023 Economic Policy Symposium. “Structural Shifts in the Global Economy,” will be held Aug. 24-26.

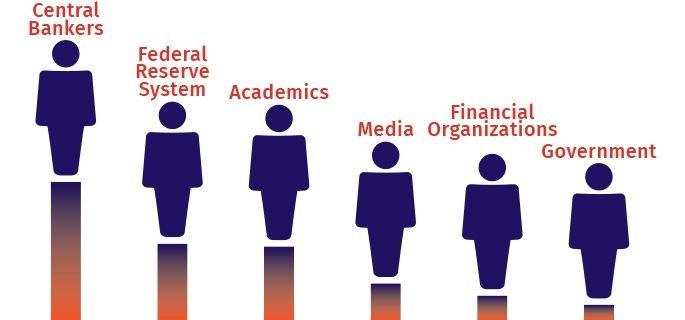

Those attending are selected based on each year’s topic with consideration for regional diversity, background, and industry. In a typical year, about 120 people attend.

The event features a collegiate feel with thoughtful discussion among the participants. The caliber and status of participants and the important topics being discussed draw substantial interest from the financial community in the symposium. Despite the interest in the annual event, The Jackson Hole event works best as a smaller open discussion, attendance at the event is limited.

Similarly, although the Federal Reserve District Bank receives numerous requests from media outlets worldwide, press attendance is also limited to a group that is selected to provide important transparency to the symposium, but not overwhelm or influence the proceedings. All symposium participants, including members of the press, pay a fee to attend. The fees are then used to recover event expenses.

What’s discussed?

The Kansas City Fed chooses the topic each year and asks experts to write papers on related subtopics. To date, more than 150 authors have presented papers on topics such as inflation, labor markets and international trade. All papers are available online.

Papers provided to the Bank in advance and presented at the annual economic policy symposium will be posted online at the time they are presented at the event. Other papers, such as conference comments, are posted as they become available. Additionally, transcripts of the proceedings are posted on the website as they become available, a process that generally takes a few months. Finally, the papers and transcripts are compiled into proceedings books which are both posted on the website and published in a volume that is available online or in print, free of charge.

Worldwide Representation

The goal of the Economic Policy Symposium when it began was to provide a vehicle for promoting public discussion and exchanging ideas. Throughout the event’s history in Jackson Hole, attendees from 70 countries have gathered to share their diverse perspectives and experiences.

This year’s theme will explore several significant, and potentially long-lasting, developments affecting the global economy. While the immediate disruption of the pandemic is fading, there likely will be long-lasting aftereffects for how economies are structured, both domestically and globally, as trade networks shift, and global financial flows react. Similarly, the policy response to the pandemic and its aftermath could have persistent effects as economies adjust to rapid shifts in the stance of monetary policy and a substantial increase in sovereign debt. The papers will share how these developments are likely to affect the context for growth and monetary policy in the coming decade.

The full agenda will be available at the start of the event on Thursday, Aug. 24 at 8 p.m. ET/6 p.m. MT. Federal Reserve Chair Jerome Powell’s remarks will be streamed on the Kansas City Fed’s YouTube channel, on Friday, Aug. 25 at 10:05 a.m. ET/8:05 a.m. MT. Papers and other materials will be posted on the Kansas City Fed’s website as they are presented during the event.

What Else

The markets seem to be expecting hawkish comments from the US Central Bank President on Friday at Jackson Hole. This is being priced in, as investors expect the Fed Chair may say something that spooks the bond market which naturally impacts stocks. There has been a lot of talk about how central banks globally should treat target inflation, all ears will be on that subject.

Managing Editor, Channelchek