|

|

|

|

Economic Decline and Resurrection

Bull-Markets are like recessions; you don’t know for sure if you’re in one until well after it has begun. So, while investors may think they’re experiencing bear market bounces and short-covering rallies, they may well be missing a new upward direction. Recessions, for their part, keep pundits, politicians, and other people speculating for six months as the definition is based on two-quarters of scheduled economic releases. A Bull-market for its part is not determined by exact indicators — Stock market direction is an economic indicator.

About This Recession

The definition of an economic recession is two consecutive quarters of decline in Gross Domestic Product (GDP). This makes it a useless number for investors. By the time you get a read on even one-quarters growth or contraction, it’s ancient history. The Bureau of Labor Statistics (BLS) won’t release the first estimate of First Quarter, 2020 GDP until April 29. But, I’m going to take a wild stab at this and say the U.S. economy contracted during the quarter. I don’t think I’m going out on a limb by forecasting that the economy will contract again in the Second Quarter. Using the most widely accepted definition, this would place us in a recession — But it may not.

There is another possibility, and it takes even more than two quarters to confirm. What if we’re in a depression? By definition, an economic depression is a sustained long-term downturn in economic activity with persistent large increases in unemployment. In a depression, consumers reduce consumption, suppliers reduce output, investment dries up, and credit evaporates. Whether or not we’re in a depression right now is not knowable. Eighteen months from now we’ll have our answer.

Source: Dictionary.com

Here is why we probably aren’t in a depression. Businesses in all economies of the world want to resume their activities, and their governments are being supportive of making sure credit does not dry up. The cause of the sharp global downturn is likely to have an end. That end is expected to be months, not quarters or years. Resuming business will take some priming. The U.S. is typically the engine that reignites global growth, and Washington already has a bipartisan commitment to supporting business and consumers.

Whether a recession or a depression it means there will be a comeback. That rebirth in the world’s economies is an opportunity for investors. Indeed, today’s economic climate is a reminder to all of us how markets can change, but it also gives reason to expect the next change, whether it occurs this Summer or next, it is growth. The first sign of growth may well come from that leading indicator, the stock market. The collective wisdom of equity investors isn’t always right, but it is one of the more accurate forecasting tools.

About This Bear-Market

The widely accepted definition of a bear-market is a market that experiences prolonged price declines. Some definitions say the declines need to be 20% or more from recent highs. There is also pessimism as to future price movement, and as it relates to equities, questions on the future health of the economy. I’m old-school, I include all of the above definitions, plus the original bear usage which defines the opposite of bull (charging ahead). This describes a bear market as sleepy, hibernating, not moving particularly fast. Whatever the definition one uses to define a bear-market, we may not be in one now. We won’t know until we look back weeks or months from now.

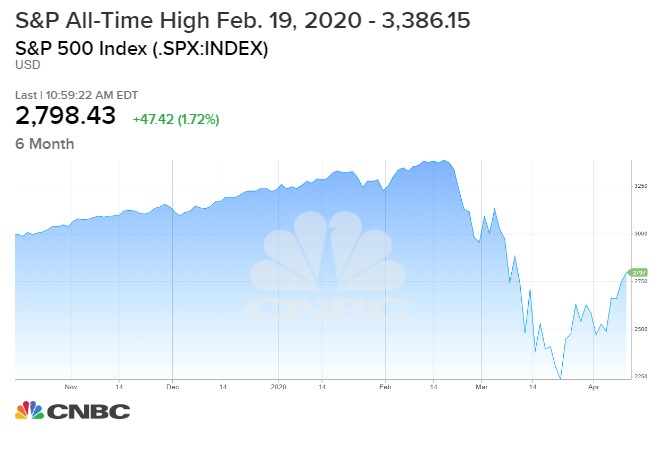

What if we’re not in a bear-market? There are three directions a market can go; up, down, and sideways. If you agree with the definition above, only one of those directions leads to a bull market. Could we be in a bull-market? The last bull market ended in February, is it too soon for the forward-looking (leading indicator) stock market to believe the future of GDP and the future of earnings will be better than they are today? It doesn’t sound like a big leap of faith to me if they are pointing to resurrection of growth. We are in a recession or maybe a depression; the future is extremely likely to be much stronger than today. It’s just a question of when.

Something to Consider

It was 11-years ago on March 9, 2009, that all three major stock market indices ticked up and ended the bear market, which had begun only five months earlier. After having just experienced the S&P values being cut in half during those five months, very few market participants were thinking that they were possibly in a bull market until July when the S&P crossed 900 for the second time since the March low. Only then did market analysts start talking about the rise. As mentioned, markets don’t get confirmation that they are in a bull market until they can look back at a period of price movement. Fortunately for most of us, the 2009-2020 bull market gave plenty of time to get involved and benefit. On February 19 of this year, the equity markets began another harsh decline in what has since been recognized as a bear market. Is the bear market over? Has another bull market begun? It’s unknowable until we can look back.

Every economic number that is released covering the beginning of this year, will, at first, be meaningless. We all know the economy has come to a halt. It is only when a second and third periods release is announced that we can determine trends. Stay focused by ignoring the hype, watch for early trends in leading indicators including; stocks, factory orders, manufacturing, inventory declines, building permits, and employment.

As we all wait for safer times, stronger economies, and more clarity, be sure that just as the promise of Spring follows cold Winters, hardship is fertile ground for future growth and beauty.

Paul Hoffman

Managing Editor

Suggested Reading:

Bear

Market Cycles, is it Different This Time?

Factors

to Consider when Setting a New Investment Course

Do

Market Scares Provide Uncommon Opportunity?