Research News and Market Data on DRCT

November 12, 2024 4:01 pm EST Download as PDF

Company Launches Colossus Connections to Accelerate Direct Integration Efforts with Leading Demand-Side Platforms

New Unified Buy-Side Operating Structure Creates Additional Business Lines and Revenue Opportunities

Company to Host Conference Call at 5:00 PM ET Today

HOUSTON, Nov. 12, 2024 /PRNewswire/ — Direct Digital Holdings, Inc. (Nasdaq: DRCT) (“Direct Digital Holdings” or the “Company”), a leading advertising and marketing technology platform operating through its companies Colossus Media, LLC (“Colossus SSP”) and Orange 142, LLC (“Orange 142”), today announced financial results for the third quarter ended September 30, 2024.

Mark D. Walker, Chairman and Chief Executive Officer, commented, “The past few quarters have presented significant challenges for our company due to a targeted and defamatory disinformation campaign. We describe this as disinformation not only because it contained factual inaccuracies, but also because it omitted key insights and context that would have clarified our business practices. As a result, Direct Digital Holdings experienced an unexpected business disruption among our partners, advertisers, and clients, including a major customer who paused its connection with our supply-side platform, Colossus SSP, which led to a temporary reduction in our revenues.”

Walker continued, “We moved swiftly to address these claims, working closely with all of our partners to ensure they understood the truth of our practices and taking legal action against the author of the defamatory claims. Our paused customer has since restored its connection, with volumes through our sell-side platform steadily increasing, though not yet fully returned to previous levels. Throughout this, we have been working diligently with our multi-national HoldCo agencies, our Fortune 500 brand partners, and demand-side partners, to resume business, which many already have. While we are confident we will return the Company to normalcy, it will take time to rebuild. We are grateful for the resiliency and focus of our employees as they work to position us to rebound from these challenges.”

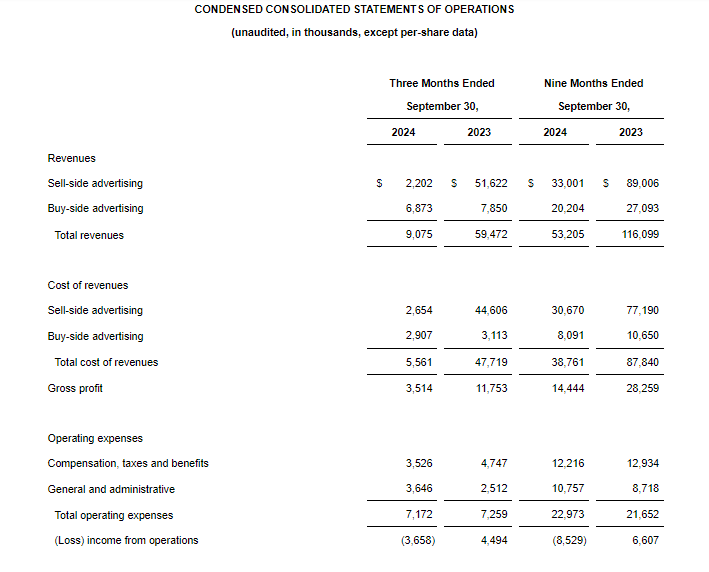

Revenues for the third quarter of 2024 were $9.1 million, consisting of $2.2 million in our sell-side advertising segment and $6.9 million in our buy-side advertising segment. The key driver for the reduction of our revenue from prior periods was the pause by our customer as described above.

Keith Smith, President, commented, “Our recently announced $20 million Equity Reserve Facility with New Circle Principal Investments provides us with enhanced financial flexibility to execute on our strategic initiatives while also strengthening our balance sheet. This new financing source will support both our technology investments and growth objectives as we continue to evolve our platform capabilities and position Direct Digital Holdings for sustainable, long-term growth.”

Walker added, “Over these past few months, we have innovated and optimized our business and are now in a position of strength, well-situated to capitalize on several of our key growth initiatives. Direct Digital Holdings’ technology platform, diversified client base, optimized cost structure and new financing sources allow us to expand into new industry verticals, accelerate our direct integrations with leading demand-side platforms, advance our technological capabilities across our business and maintain our commitment to bringing underrepresented publishers into the programmatic ecosystem.”

Advancing Innovation for Colossus SSP

The Company expects to make investments to drive technological advancements for Direct Digital Holdings’ supply-side platform, Colossus SSP, including the launch of Colossus Connections, an aggressive initiative the Company is already executing to accelerate direct integrations with leading demand platforms. This initiative will aim to unlock direct access to more demand partners and revenue, while optimizing transaction costs and efficiency for Colossus SSP and its clients. As a result of Colossus Connections, the Company has already signed two of the leading demand-side partners, with those direct connections expected to go live in 2025.

Additionally, for Colossus SSP, the Company is developing new curation and segment-based products in areas such as carbon, attention, and media quality, which are in high-demand among advertisers. The Company is also expanding efforts to bring underrepresented publishers and creators into the programmatic ecosystem, with their unique and premium inventory available through Colossus SSP.

Enhancing Growth on the Demand Side

On the demand-side, the Company expects that funding will support the recently announced unification of Direct Digital Holdings’ buy-side divisions, Orange 142 and Huddled Masses. This will enable the delivery of new capabilities, particularly in helping clients navigate emerging technologies, such as artificial intelligence and machine learning, as well as emerging, high-growth channels such as marketing-enabled services, connected TV, social media and retail media. Small- and mid-sized clients will be a key focus for the combined entity, as these clients are increasingly shifting advertising budgets to digital and require support to navigate its complexities and optimize their ad spend. Currently, the Company serves hundreds of small- and mid-sized clients, enabling over 2,000 campaigns each year.

Third Quarter 2024 Financial Highlights:

- For the third quarter of 2024, revenue was $9.1 million, a decrease of $50.4 million, or an 85% decline compared to the $59.5 million in the same period of 2023.

- Sell-side advertising segment revenue fell to $2.2 million compared to $51.6 million in the same period of 2023, 96% decrease year-over-year. As described above, the key driver for this reduction was the suspension by one of our large customers following the defamatory article against the Company, and this customer has since restored its connection.

- Buy-side advertising segment revenue fell to $6.9 million compared to $7.9 million in the same period of 2023, a 12% year-over-year decline.

- Gross profit was $3.5 million, or 39% of revenue, in the third quarter of 2024 compared to $11.8 million, or 20% of revenue, in the same period of 2023.

- Operating expenses were $7.2 million in the third quarter of 2024, a decrease of $0.1 million, or 1%, over $7.3 million in the same period of 2023.

- Consolidated operating loss was $3.7 million, compared to operating income of $4.5 million in the same period of 2023, a decrease of $8.2 million or 181%.

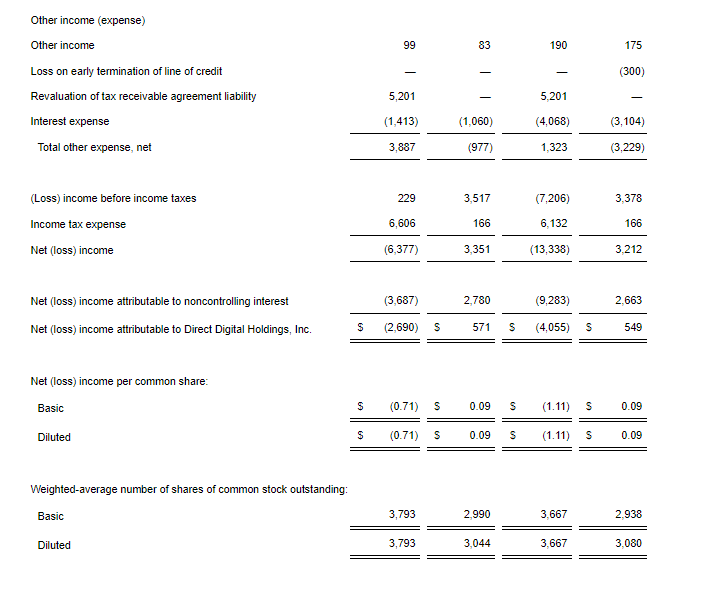

- Net loss was $6.4 million in the third quarter, compared to net income of $3.4 million in the same period of 2023.

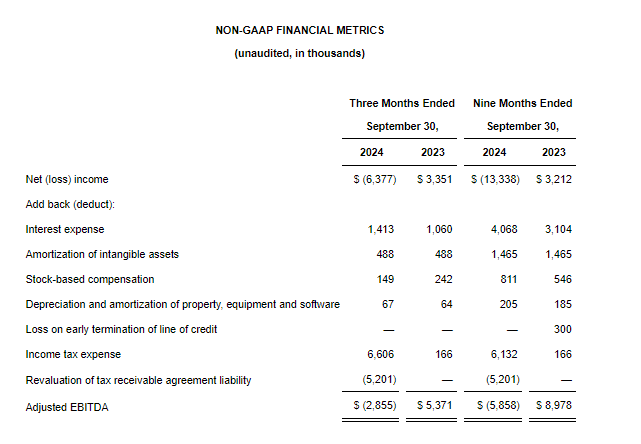

- Adjusted EBITDA(1) was a loss of $2.9 million in the third quarter of 2024, compared to positive Adjusted EBITDA of $5.4 million in the same period of 2023.

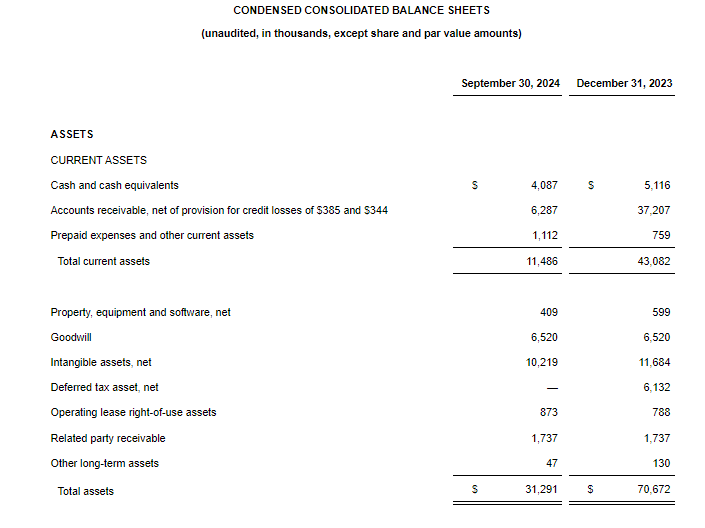

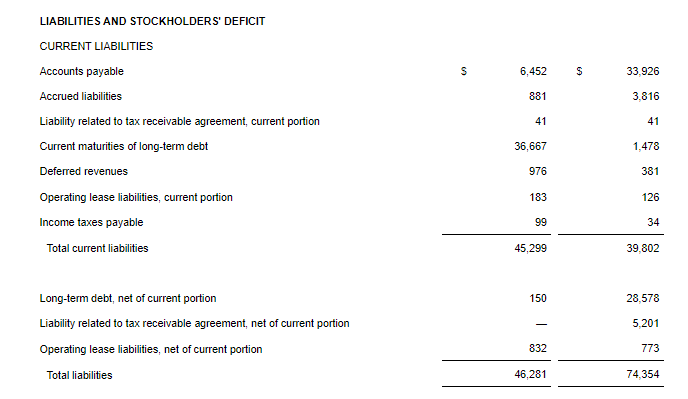

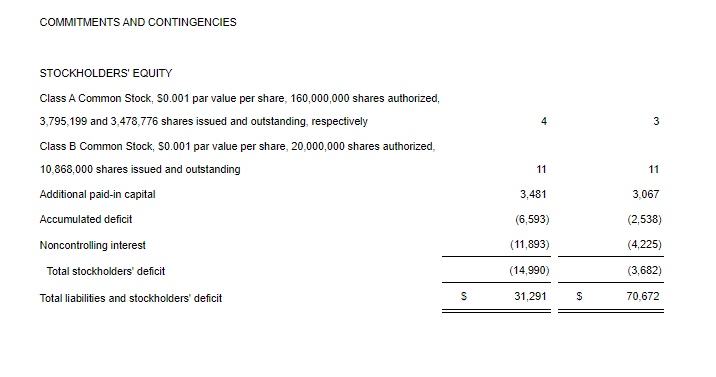

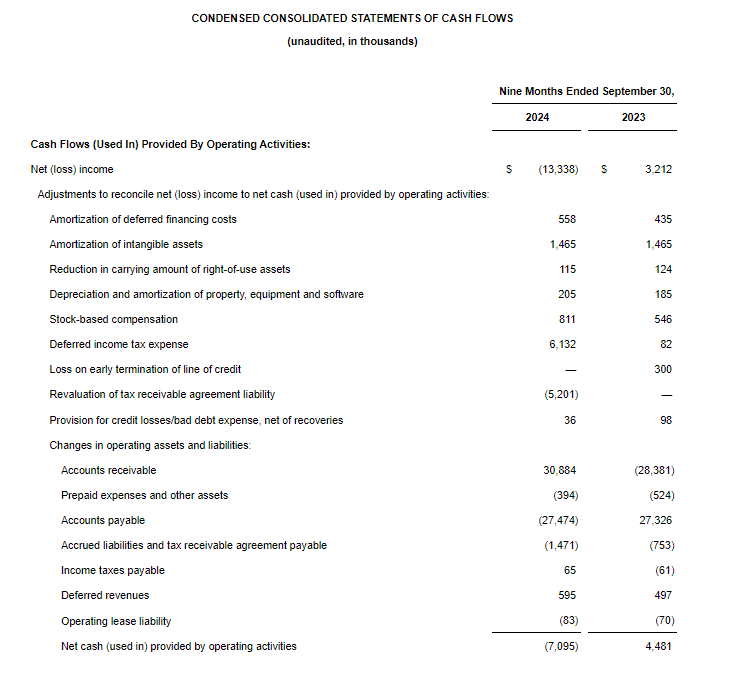

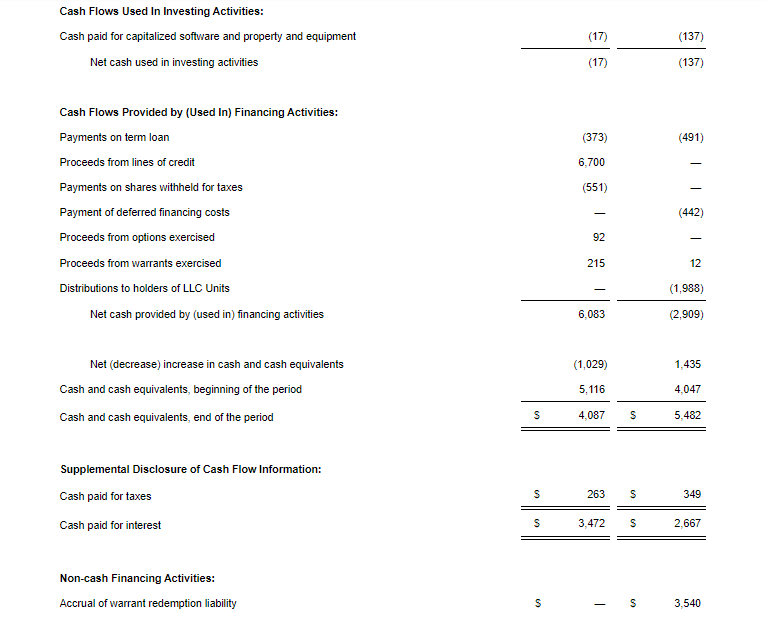

- As of September 30, 2024, the Company held cash and cash equivalents of $4.1 million compared to $5.1 million as of December 31, 2023.

| (1) “Adjusted EBITDA” is a non-GAAP financial measure. The section titled “Non-GAAP Financial Measures” below describes our usage of non-GAAP financial measures and provides reconciliations between historical GAAP and non-GAAP information contained in this press release. |

Financial Outlook

Assuming the U.S. economy does not experience any major economic conditions that deteriorate or otherwise significantly reduce advertiser demand, and subject to certain uncertainties related to the ramp-up of our businesses and general market conditions, Direct Digital Holdings is providing full-year revenue guidance of $60 million to $70 million for FY 2024 and full-year revenue guidance of $90 million to $110 million for FY 2025 as the Company rebuilds to previous levels.

Diana Diaz, Chief Financial Officer, stated, “As we move forward, we are pleased to return to a normal cadence of reporting our financial results which will provide our investors with the timely and accurate information they deserve. We’re committed to delivering sustainable growth for our investors while offering our partners industry-leading marketing and advertising capabilities.”

Smith added, “While Direct Digital Holdings is working to overcome these recent challenges, defamatory disinformation attacks go far beyond the advertising technology industry, distorting public perception, manipulating stock prices, often to the disadvantage of everyday investors, and stifling innovation. The weaponization of disinformation is posing a profound risk to small and up-and-coming businesses such as ours, and calls for a deeper dive into this pernicious and increasingly ubiquitous issue and an appropriate systemic response.”

Conference Call and Webcast Details

Direct Digital will host a conference call on Tuesday, November 12, 2024 at 5:00 p.m. Eastern Time to discuss the Company’s third quarter 2024 financial results. The live webcast and replay can be accessed at https://ir.directdigitalholdings.com/. Please access the website at least fifteen minutes prior to the call to register, download and install any necessary audio software. For those who cannot access the webcast, a replay will be available at https://ir.directdigitalholdings.com/ for a period of twelve months.

Cautionary Note Regarding Forward Looking Statements

This press release contains forward-looking statements within the meaning of federal securities laws that are subject to certain risks, trends and uncertainties. We use words such as “could,” “would,” “may,” “might,” “will,” “expect,” “likely,” “believe,” “continue,” “anticipate,” “estimate,” “intend,” “plan,” “project” and other similar expressions to identify forward-looking statements, but not all forward-looking statements include these words. All of our forward-looking statements involve estimates and uncertainties that could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. Accordingly, any such statements are qualified in their entirety by reference to the information described under the caption “Risk Factors” and elsewhere in our most recent Annual Report on Form 10 K (the “Form 10-K”) and subsequent periodic and or current reports filed with the Securities and Exchange Commission (the “SEC”).

The forward-looking statements contained in this press release are based on assumptions that we have made in light of our industry experience and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. As you read and consider this press release, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties (many of which are beyond our control) and assumptions.

Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual operating and financial performance and cause our performance to differ materially from the performance expressed in or implied by the forward-looking statements. We believe these factors include, but are not limited to, the following: conditions to our ability to sell Class A common stock under our equity reserve facility; the restrictions and covenants imposed upon us by our credit facilities; the substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing; our ability to secure additional financing to meet our capital needs; our ineligibility to file short-form registration statements on Form S-3, which may impair our ability to raise capital; our failure to satisfy applicable listing standards of the Nasdaq Capital Market resulting in a potential delisting of our common stock; failure to remedy any listing deficiencies noted in the deficiency letters from the Listing Qualifications Department of The Nasdaq Stock Market LLC; the risk that the Listing Qualifications Department of The Nasdaq Stock Market LLC does not accept the Company’s plan to regain compliance with applicable rules to maintain its listing on The Nasdaq Capital Market; costs, risks and uncertainties related to the restatement of certain prior period financial statements; any significant fluctuations caused by our high customer concentration; risks related to non-payment by our clients; reputational and other harms caused by our failure to detect advertising fraud; operational and performance issues with our platform, whether real or perceived, including a failure to respond to technological changes or to upgrade our technology systems; restrictions on the use of third-party “cookies,” mobile device IDs or other tracking technologies, which could diminish our platform’s effectiveness; unfavorable publicity and negative public perception about our industry, particularly concerns regarding data privacy and security relating to our industry’s technology and practices, and any perceived failure to comply with laws and industry self-regulation; our failure to manage our growth effectively; the difficulty in identifying and integrating any future acquisitions or strategic investments; any changes or developments in legislative, judicial, regulatory or cultural environments related to information collection, use and processing; challenges related to our buy-side clients that are destination marketing organizations and that operate as public/private partnerships; any strain on our resources or diversion of our management’s attention as a result of being a public company; the intense competition of the digital advertising industry and our ability to effectively compete against current and future competitors; any significant inadvertent disclosure or breach of confidential and/or personal information we hold, or of the security of our or our customers’, suppliers’ or other partners’ computer systems; as a holding company, we depend on distributions from Direct Digital Holdings, LLC (“DDH LLC”) to pay our taxes, expenses (including payments under the Tax Receivable Agreement) and any amount of any dividends we may pay to the holders of our common stock; the fact that DDH LLC is controlled by DDM, whose interest may differ from those of our public stockholders; any failure by us to maintain or implement effective internal controls or to detect fraud; and other factors and assumptions discussed in our Form 10-K and subsequent periodic and current reports we may file with the SEC.

Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove to be incorrect, our actual operating and financial performance may vary in material respects from the performance projected in these forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and except as required by law, we undertake no obligation to update any forward-looking statement contained in this press release to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances, and we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. New factors that could cause our business not to develop as we expect emerge from time to time, and it is not possible for us to predict all of them. Further, we cannot assess the impact of each currently known or new factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

About Direct Digital Holdings

Direct Digital Holdings (Nasdaq: DRCT) brings state-of-the-art sell- and buy-side advertising platforms together under one umbrella company. Direct Digital Holdings’ sell-side platform, Colossus SSP, offers advertisers of all sizes extensive reach within the general market and multicultural media properties. The Company’s buy-side platform, Orange 142, delivers significant ROI for middle-market advertisers by providing data-optimized programmatic solutions at scale for businesses in sectors that range from energy to healthcare to travel to financial services. Combined, Direct Digital Holdings’ sell- and buy-side solutions generate billions of impressions per month across display, CTV, in-app and other media channels.

NON-GAAP FINANCIAL MEASURES

In addition to our results determined in accordance with U.S. generally accepted accounting principles (“GAAP”), including, in particular operating income, net cash provided by operating activities, and net income, we believe that earnings before interest, taxes, depreciation and amortization (“EBITDA”), as adjusted for loss on early termination of line of credit, revaluation of tax receivable agreement liability and stock-based compensation (“Adjusted EBITDA”), a non-GAAP financial measure, is useful in evaluating our operating performance. The most directly comparable GAAP measure to Adjusted EBITDA is net income (loss).

In addition to operating income and net income, we use Adjusted EBITDA as a measure of operational efficiency. We believe that this non-GAAP financial measure is useful to investors for period-to-period comparisons of our business and in understanding and evaluating our operating results for the following reasons:

- Adjusted EBITDA is widely used by investors and securities analysts to measure a company’s operating performance without regard to items such as depreciation and amortization, interest expense, provision for income taxes, stock-based compensation, revaluation of tax receivable agreement liability and certain one-time items such as acquisition costs, losses from early termination or redemption of credit agreements or preferred units and gains from settlements or loan forgiveness that can vary substantially from company to company depending upon their financing, capital structures and the method by which assets were acquired;

- Our management uses Adjusted EBITDA in conjunction with GAAP financial measures for planning purposes, including the preparation of our annual operating budget, as a measure of operating performance and the effectiveness of our business strategies and in communications with our board of directors concerning our financial performance; and

- Adjusted EBITDA provides consistency and comparability with our past financial performance, facilitates period-to-period comparisons of operations, and also facilitates comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results.

Our use of this non-GAAP financial measure has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our financial results as reported under GAAP. The following table presents a reconciliation of Adjusted EBITDA to net income (loss) for each of the periods presented:

Contacts:

Investors:

Brett Milotte, ICR

[email protected]

View original content to download multimedia:https://www.prnewswire.com/news-releases/direct-digital-holdings-reports-q3-2024-financial-results-302303281.html

SOURCE Direct Digital Holdings

Released November 12, 2024