Research News and Market Data on VVX

Third Quarter Highlights

- Record revenue of $1.08 billion, up 8% y/y

- Indo-Pacific revenue growth of 31% y/y driven by increased demand

- Operating income of $49.9 million; Adjusted operating income1 of $76.9 million

- Record net income of $15.1 million, up $21.5 million y/y; Adjusted net income1 of $41.3 million, up 76% y/y

- Record adjusted EBITDA1 of $82.7 million, up 28% y/y with a margin of 7.6%

- Diluted EPS of $0.47; Adjusted diluted EPS1 of $1.29, up 77% y/y

2024 Guidance:

- Raising full-year revenue and adjusted EPS1 guidance midpoint and reaffirming adjusted EBITDA and operating cash flow1

MCLEAN, Va., Nov. 4, 2024 /PRNewswire/ — V2X, Inc. (NYSE:VVX) announced third quarter 2024 financial results.

“V2X reported strong third quarter results with record revenue, net income, and adjusted EBITDA1, driven by our continued alignment to well-funded critical missions and the ability to deliver capabilities at scale across the globe,” said Jeremy Wensinger, President and Chief Executive Officer of V2X. “Revenue increased 8% year-over-year and adjusted EBITDA1 increased 28% year-over-year, reflecting strong program performance. Adjusted net income1 increased 76% year-over-year and adjusted diluted EPS1 increased 77% year-over-year.”

Mr. Wensinger continued, “During the third quarter we demonstrated continued growth in the Indo-Pacific region with revenue increasing 31% year-over-year. This performance was tied to the DoD’s continued focus on enhancing U.S. readiness in the region. We are seeing additional opportunities for growth in the region that align to improving the capacity and capabilities of U.S. allies and our partners.”

“Our full spectrum capabilities across the mission lifecycle serve as a differentiator. The fact that we are with our customers across the globe at every phase of mission execution, gives us prodigious knowledge, allowing us to deliver best of breed cost effective solutions that are enhancing outcomes. This unique position is yielding results with V2X securing approximately $5 billion of awards in the third quarter. This includes the $3.7 billion Warfighter-Training Readiness Solutions (W-TRS) award that represents a milestone win for V2X. We delivered a technology enabled solution that was compelling and will ensure every Army soldier has the tools necessary to conduct accurate training preparing them for whenever called upon to deploy. These wins validate our strong positioning in the marketplace and are expected to contribute to our financial performance for years to come.”

Mr. Wensinger concluded, “I believe there is additional opportunity to build on our momentum through further optimization of our business. This includes enhancing the breadth and depth of our pipeline as a result of the collective capabilities. W-TRS is a great example of a solution that leveraged the collective capabilities. We are building on that success to expand our addressable markets in all areas of the company. We are investing in this expanded pipeline to ensure we address opportunities with talent and solutions that will differentiate V2X offerings.”

Third Quarter 2024 Results

“V2X reported record revenue of $1.08 billion in the quarter, which represents 8% year-over-year growth,” said Shawn Mural, Senior Vice President and Chief Financial Officer. “We continued to deliver double digit revenue growth in the Indo-Pacific (31% year-over-year) and Middle East (13% year-over-year) regions, which was achieved through continued expansion of existing business as well as new programs.

“For the quarter, the Company reported operating income of $49.9 million and adjusted operating income1 of $76.9 million. V2X delivered record adjusted EBITDA1, increasing 28% year-over-year to $82.7 million, with a margin of 7.6%, reflecting our expected second half program performance. Third quarter GAAP diluted EPS was $0.47. Adjusted diluted EPS1 for the quarter increased 77% year-over-year to $1.29.”

“Third quarter net cash provided by operating activities was $62.7 million. Adjusted net cash provided by operating activities1 increased 35% year-over-year to $130.1 million. On a year-to-date basis, net cash provided by operating activities was $31.1 million. Adjusted net cash used by operating activities1 was $7.2 million.”

“At the end of the quarter, net debt for V2X was $1,089 million. Net leverage ratio1 was 3.27x, improving 0.29x sequentially. We continue to demonstrate progress on debt paydown and remain on track to be at or below a net leverage ratio of 3.0x, by the end of 2024.”

“Total backlog as of September 27, 2024, was $12.2 billion. Funded backlog was $3.0 billion. Book-to-bill in the quarter was approximately 1.0x. Backlog does not include the full contract value associated with recent awards.”

2024 Guidance

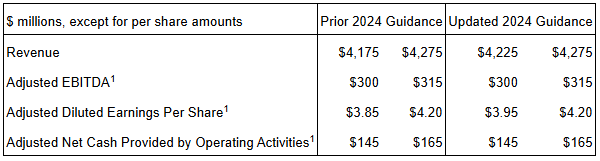

Mr. Mural concluded, “Given our strong performance through the first nine-months of the year we are updating our total year guidance.”

Guidance for 2024 is as follows:

The Company is not providing a quantitative reconciliation with respect to the foregoing forward-looking non-GAAP measures in reliance on the “unreasonable efforts” exception set forth in SEC rules because certain financial information, the probable significance of which cannot be determined, is not available and cannot be reasonably estimated. For example, unusual, one-time, non-ordinary, or non-recurring costs, which relate to M&A, integration and related activities cannot be reasonably estimated. Forward-looking statements are based upon current expectations and are subject to factors that could cause actual results to differ materially from those suggested here, including those factors set forth in the Safe Harbor Statement below.

Third Quarter Conference Call

Management will conduct a conference call with analysts and investors at 4:30 p.m. ET on Monday, November 4, 2024. U.S.-based participants may dial in to the conference call at 877-506-6380, while international participants may dial 412-542-4198. A live webcast of the conference call as well as an accompanying slide presentation will be available here: https://app.webinar.net/8eqdGbMZ6Xa

A replay of the conference call will be posted on the V2X website shortly after completion of the call and will be available for one year. A telephonic replay will also be available through November 18, 2024, at 844-512-2921 (domestic) or 412-317-6671 (international) with passcode 10193464.

Presentation slides that will be used in conjunction with the conference call will also be made available online in advance on the “investors” section of the company’s website at https://gov2x.com. V2X recognizes its website as a key channel of distribution to reach public investors and as a means of disclosing material non-public information to comply with its obligations under the U.S. Securities and Exchange Commission (“SEC”) Regulation FD.

Footnotes:

1 See “Key Performance Indicators and Non-GAAP Financial Measures” for descriptions and reconciliations.

About V2X

V2X builds innovative solutions that integrate physical and digital environments by aligning people, actions, and technology. V2X is embedded in all elements of a critical mission’s lifecycle to enhance readiness, optimize resource management, and boost security. The company provides innovation spanning national security, defense, civilian, and international markets. With a global team of approximately 16,000 professionals, V2X enables mission success by injecting AI and machine learning capabilities to meet today’s toughest challenges across all operational domains.

Safe Harbor Statement

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 (the “Act”): Certain material presented herein includes forward-looking statements intended to qualify for the safe harbor from liability established by the Act. These forward-looking statements include, but are not limited to, all the statements and items listed under “2024 Guidance” above and other assumptions contained therein for purposes of such guidance, other statements about our 2024 performance outlook, revenue, contract opportunities, and any discussion of future operating or financial performance.

Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “could,” “potential,” “continue” or similar terminology. These statements are based on the beliefs and assumptions of the management of the Company based on information currently available to management. Forward-looking statements in this press release, include, but are not limited to our discussion regarding the Army and its capabilities; our future performance and capabilities; investing in the expanded pipeline; future net leverage ratio; and our belief in our ability to achieve our updated total year guidance.

These forward-looking statements are not guarantees of future performance, conditions, or results, and involve a number of known and unknown risks, uncertainties, assumptions, and other important factors, many of which are outside our management’s control, which could cause actual results to differ materially from the results discussed in the forward-looking statements. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company’s historical experience and our present expectations or projections. For a discussion of some of the risks and uncertainties that could cause actual results to differ from such forward-looking statements, see the risks and other factors detailed from time to time in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings with the SEC.

We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.