Image Credit: Third Way Think Tank (Flickr)

Has the Crypto Crunch Accelerated SEC Plans to Regulate the Market?

The Securities and Exchange Commission (SEC) Chairman Gary Gensler says he’s concerned and expects other crypto tokens will fail, and it could undermine overall faith in financial markets. The comments came after May’s implosion of TerraUSD, which was the third-largest stablecoin by total value. The SEC chairman was speaking before the House Appropriations Committee on May 18.

“I think a lot of these tokens will fail,” Gensler told reporters after the Committee panel hearing. “I fear that in crypto…there’s going to be a lot of people hurt, and that will undermine some of the confidence in markets and trust in markets writ large.”

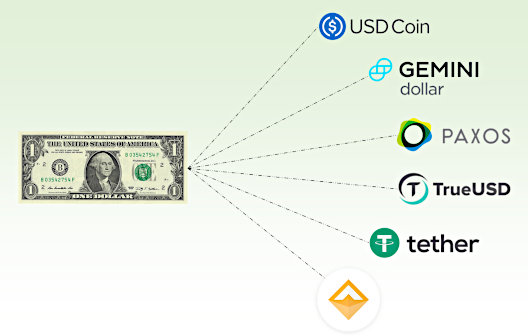

Assets in the cryptocurrency markets have shrunk by more than $1 trillion in value since December as signs that the Federal Reserve would unwind its accommodative policies became accepted. Around the same time, regulators began placing crypto under a spotlight with the intent to protect speculators by providing rules and constraints. The use of crypto by Russia cast the tokens under an even darker light for much of the world. The accelerated crypto selloff came after the U.S. central bank raised interest rates. TerraUSD, a token whose price was supposed to remain 1:1 with the $US, suddenly crashed. It’s sister coin, Terra Luna, that was meant to back it, also fell apart.

The token price action has caused concern about the possibility of other asset classes getting spooked. Chairman Gensler said that exposure to crypto by SEC-registered asset managers isn’t significant but that the agency has less knowledge of family offices and other private funds. Back in January, the SEC proposed a rule that would increase the speed and quantity of confidential information that private-equity and hedge funds provide the Commission through Form PF filings.

SEC Standing

The SEC

announced in early May that it plans to add 20 investigators and litigators to its unit dedicated to cryptocurrency and cybersecurity enforcement, nearly doubling the unit’s size. During the House meeting, which concerned budget items, Gensler said he wished he had more to work with for oversight. “We’re really outpersonned,” he said.

Most cryptocurrencies likely meet the legal definition

of a security that should be registered with the SEC, both Mr. Gensler and his predecessor, Jay Clayton, have said. No major cryptocurrency issuer or trading platform has proactively opted into the commission’s oversight. If there is going to be more oversight, it will be forced.

Gensler’s is a former MIT professor that taught blockchain and cryptocurrencies. As the top SEC cop, he has been working on persuading trading platforms such as Coinbase to be regulated as exchanges, saying many of the assets they provide trading in are securities. The platforms take a different stance. From a legal point of view, it isn’t clear how an SEC-registered exchange could allow trading in securities that have not been registered with the commission.

Managing Editor, Channelchek

Suggested Content

Will the Current Stablecoin Situation Hasten Regulation and Oversight?

|

Global Regulators Release Principles for Financial Market Infrastructures to Stablecoin

|

The SEC Wants to Extend Investor Protections to Crypto Platforms

|

SEC Climate Change Disclosure Rules and Challenges

|

Sources

https://www.sec.gov/news/press-release/2022-78

Stay up to date. Follow us:

|