Dominance of Indexed Funds May Be Giving Way to a Preference for Diversification

Not many years ago, the most widely followed stock market index was the Dow Jones Industrial Average, or Dow 30 (DJIA). This practice slowly changed and a broader benchmark, the S&P 500, became the new gauge of market moves. Both have the same purpose, to provide a big-picture view of whether stock prices generally are moving up, down, or sideways over a period – and by how much. The DJIA has fallen out of favor as investors grew more sophisticated and came to realize the Dow only tracks 30 stocks. So it was considered not representative of the entire stock market – which includes thousands of different companies. With only 30 stocks impacting its price, it was not disperse enough to be the preferred stock market index. After all, the DJIA’s performance can be significantly influenced by the performance of the 30 stocks, which at times can veer far from indicative of the broad market.

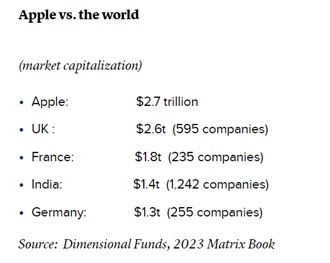

The S&P 500, which is weighted by market capitalization, is beginning to feel the impact of its own loss of diversity. As of June 2023, the top 10 companies in the S&P 500 account for over 25% of the index’s total market capitalization. That is, the weight of 25% of market moves impacting the index comes from just 10 stocks and these can all be considered technology stocks. For portfolios it means that investors who believe the S&P 500 reflects the market, might actually be more accurate if they went back to the index with 30 stocks in a wider array of industries.

I’m not suggesting that we should all start following the Dow. Instead, I am suggesting that there is risk to index investors that are looking to participate in the overall market and are using the S&P 500. Portfolio managers looking to spread risk may want to purposefully add diversity to their holdings.

In contrast to the upper 25%, the lower 25% of the S&P 500 is a diverse group of industries, with no single industry accounting for more than 20% of the weight. This means that the performance of the lower 25% of the S&P 500 is not as dependent on the performance of any single industry. From “stock market 101,” we know that the risk (not necessarily return) is greater in the top 25%. Focusing on risk-adjusted return is how most managing their portfolio do well over time.

Over the past several years, including last year’s down draft, tech has, on average, been the leader. Carrying companies that make up the top 25% in large cap indexes, MSFT, AAPL, META, GOOGL, etc. have been additive to performance. This has helped, as not only has it lifted large-cap indexed funds returns, but it sent more money into these indexed funds, which served to further increase the perfomranc of the funds including ETFs.

Ongoing, above-average growth in one sector, even tech, or a market cap segment (megacap), is as unsustainable as a Ponzi scheme. So while activity is sustaining movement into these stocks, performance is satisfying. But investor money is finite and investor behavior is fickle. So the above average performance must at some point should give way to these stocks being a drag on performance.

Are We Seeing the End?

According to data from Morningstar Direct through June 20, actively managed stock mutual funds and exchange-traded funds beat their passive peers across categories, except in the large blend category, which is less heavily weighted to one sector. The report data shows that as we reach mid-year 2023, small- and large-cap stock pickers had a strong first half of 2023. As reported by Barron’s, “The next six months may prove favorable for active managers if dispersion—the spread of returns in an index—or market breadth—which reflects how many stocks participate in a rally—increase, allowing other sectors and stocks to catch up to the mega-caps.” Stockpickers are beginning to win, as a wider dispersion of selected investments, on average, beat the “just buy the index” investment style.

Active managers’ improving performance versus index funds is building on 2022, which was the best year for active U.S. equity fund managers since 2009. Anu Ganti, senior director of index investment strategy at S&P Dow Jones Indices, said while S&P doesn’t yet have midyear performance data, one potential tailwind for active managers this year was high dispersion. “If you’re a stockpicker, and if you have skill, and if you make the call right, there’s greater potential to add value from stock selection when dispersion is higher,” she said. “What we saw in May is that the S&P 500 stock level dispersion rose to its highest level since March 2020.”

The Investment Advisors Association (IAA) Active Managers Council advocates for a more balanced narrative on passive versus active portfolio management among advisors. “Active and passive management are critical and play different roles in a broader portfolio,” said Apurva Schwartz, a member of the Active Managers Council’s research task force and a portfolio specialist at Harding Loevner. “Active management allows investors to navigate complexity, customize portfolios, manage risks, capitalize on specific skills, or try to profit from market inefficiencies. Passive management can help reduce costs and that’s important, especially in efficient market segments.” Over the years, there has been an overriding emphasis on passive funds among advisors, the Council seeks, through statistics and education, to provide a more balanced view.

Take Away

Over any period of time one sector or another may outperform. The one style of management that has provided solid performance is a diversified portfolio with an eye on risk-adjusted return. This style has faded as investors placed money in a large-cap indexed fund, believing the underlying assets were well diversified and had a positive risk/reward potential.

So far in 2023, large-cap indexed funds are underperforming managed funds. This outcome follows on top of late last year when managed money’s comparative performance improved. The underperformance is even highere when one nets out the higher fees associated with managed money.

Obviously there is no way to track non-professional, self-directed stock picker’s performance the way Morningstar ranks funds by category. But it is not a stretch to expect that a carefully selected portfolio with the help of high-quality research and basic diversification across market-cap and industry characteristics, could do even better than just paying fees and parking assets in a fund.

Managing Editor, Channelchek

Source