Image Credit: K putt (Flickr)

Golden Age of Sports M&A to Take Place Over Next 24 Months

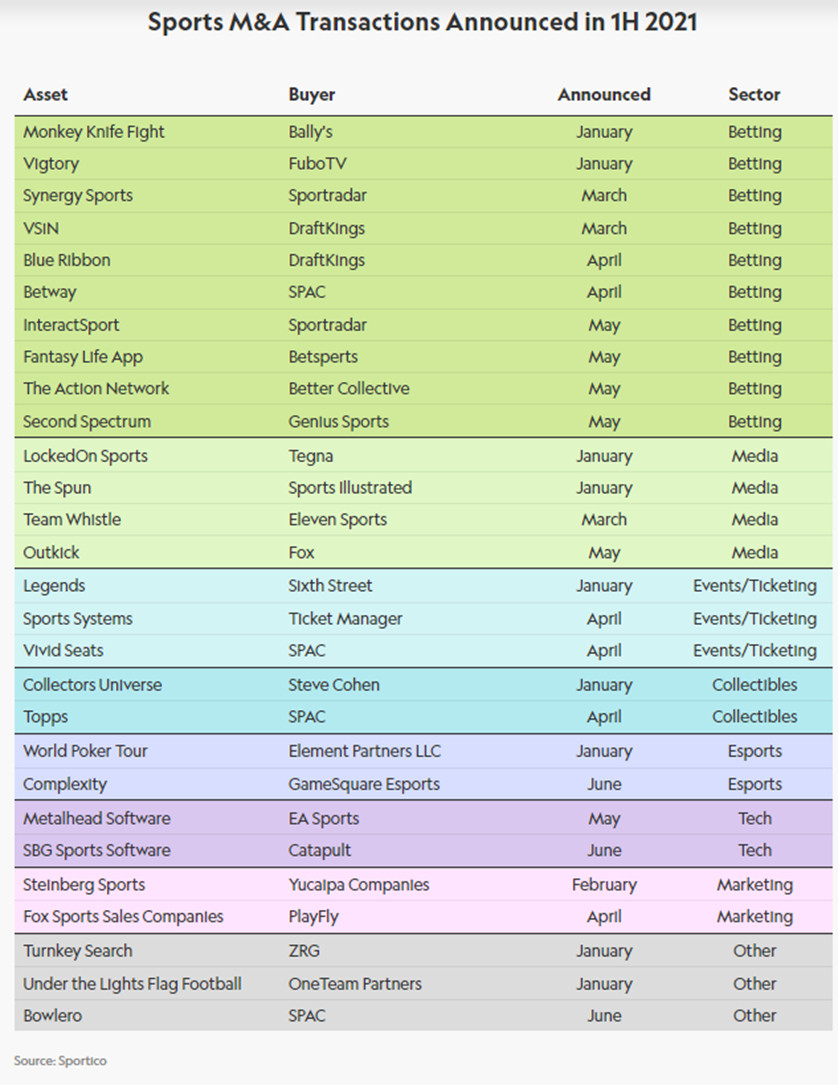

The first half of 2021 was particularly active for sports-related mergers and acquisitions. There were at least 10 deals announced within the sports betting and data category; a handful of large-scale transactions within collectibles (Topps, Collectors Universe, Goldin Auctions 2x), ticketing (Vivid Seats), events/experiential (Bowlero) and hospitality (Legends); and several smaller, more opportunistic acquisitions sprinkled across the ecosystem (The Spun, Locked On Sports Podcast Network). By comparison, one could count the number of deals announced in all of 2020 on two hands.

But dealmakers and private equity executives alike believe the second half will be even busier. In fact, Fifth Generation Sports CEO Chris Russo suggested the industry is likely headed into “the biggest bull market of sports M&A that [anyone] has ever seen.”

|

This article was originally published July 6, 2021 as part of the JohnWallStreet daily e-newsletter in Sportico. The e-newsletter is well respected in how it covers the business of sports. Cha |

Our Take: H1 2021 may well be considered the beginning of sports M&A’s golden age, as several catalysts could drive transaction volume to even greater heights over the next 18 months. These include pent-up consumer demand (a result of the pandemic), the existence of three sectors ripe for consolidation (see: esports, sports betting, and collectibles) and the SPAC frenzy (a once-in-20-year phenomenon).

Coming out of social lockdown, the desire to live life again is high. It’s believed strong demand for live events will drive M&A opportunities. Experiential businesses were “hit really hard [over the last 15 months]. So, some [companies] are challenged [financially] and may need to sell,” Russo said. “People are also thinking about [creating] new retail experiences because of all the retail [businesses] that went belly up.” How much of that deal flow is M&A versus new business origination remains to be seen.

Enormous amounts of investment capital have been pumped into esports in recent years. But the disruption has not really led to consolidation within the business—at least not yet (save GameSquare Esports’ recent purchase of Jerry Jones’ Complexity Gaming). Russo suspects some could take place within the next 12-24 months, as businesses hurt by the absence of live events look to be swallowed up.

Sports betting was a particularly active M&A category in H1 2021. But there are a couple of reasons to think activity will accelerate. With nearly all of the large media outlets spoken for (in terms of content partnerships), operators will be looking for other ways to distinguish themselves. That could result in the acquisition of some marketing-tech companies and affiliate businesses. Of course, the process of picking off affiliate sites has already begun. We counted at least seven transactions involving sports betting affiliates over the last 18 months. The pending/potential legalization of mobile sports betting in large states, like New York and Florida (plus Canada), could also lead to some deals as operators look to quickly acquire users in those markets.

The fragmented collectibles business is ripe for consolidation. The industry now has a handful of big fish (see: SPAC-supported Topps, Steve Cohen-backed Collectors Holdings, Fanatics and Dapper Labs), but the majority of legacy collectibles-related companies still operate as mom-and-pop shops. Said Russo, “There is certainly potential for a lot of those [entities] to get rolled up or bought by some of the bigger players.” That would include companies looking to find their place in the digital collectibles world. It should be noted that Sportico reported Collectors Holdings agreed to purchase The Chernin Group-backed Goldin Auctions late last week.

One vertical unlikely to serve as a growth engine for M&A, however, is sports media. “When you think about sports media, a lot of the major deals have already been done (think: Fox RSNs),” Russo said. “There may be some smaller deals—we saw Outkick, The Spun and Locked On Sports Podcast Network all sold in H1 2021—but [there is unlikely to be] a whole lot happening in between.”

The large number of SPACs looking for a sports-themed company is expected to drive M&A activity, too (assuming the PIPE market holds it up). Remember, each SPAC that goes public needs to complete a business combination within two years (or return the money raised to shareholders and shutter the SPAC). As of June 24, Sportico’s SPAC tracker shows there are 113 sports-focused SPACs and/or SPACs led by sports executives currently planning an IPO (12), pricing an IPO (51) or seeking a target (50).

SPACs that get through (i.e., consummate a business combination) should also be acquisitive moving forward. “There’s a lot of pressure on SPAC companies, once they get de-SPAC’d, to grow quickly and buy things now that they have access to liquid currency,” Russo said. “If each of those companies buys two more [assets] each year, the amount of deals that will occur over the next 24 months will be astounding.”

SPAC acquisitions will be larger transactions (simply because that is the nature of SPACs and the public markets). But most of the deals that take place over the next 18 or so months—“roll-ups and niche buys,” Russo said—are likely to be of the middle-market variety (think: $25 million to $100 million). Strong demand and competitive marketplace dynamics could push asset valuations higher than they might otherwise be.

One of the reasons demand is expected to be so strong is because institutional investors only recently discovered that sports is a viable business. “The combination of COVID and a lot of investment activity just opened up everyone’s eyes that this is a category you can invest in. [Sports] might not provide the full upside you get from tech and venture. But you also don’t have the downside,” said a partner at one sports PE firm.

While we anticipate an active sports M&A market through the summer of 2023, team control transactions are likely to be few and far between. “For the most part, owners today want these teams to be legacy businesses that they pass down to their kids,” Russo said. The PE executive we spoke to agreed, before suggesting that limited partnership stake sales could ramp up as “people now accept they can invest in a team either through a fund or separately.”

Suggested Reading:

How Does the Esports Industry Make Money

|

Esports Investors are Now Better Able to Evaluate Performance Comparisons

|

Ad Tech – Back in the Saddle and Riding High

|

The Lifecycle of a SPAC

|

Special thanks to Sportico.

You can stay up to date on the business of sports by clicking their logo above.

Stay up to date. Follow us:

|