|

|

|

|

There’s Opportunity When Stock Market Indices are Reshuffled

(Note: companies that

could be impacted by the content of this article are listed at the base of the

story [desktop version]. This article uses third-party references to provide a

bullish, bearish, and balanced point of view; sources are listed after the

Balanced section.)

After the close of regular trading on Monday, April 13, it was announced by S&P Dow Jones Indices that they would be moving LHC Group (LHCG) out from the SmallCap 600 index and into the MidCap 400 index. The release also informed that they would fill the open spot in the S&P 600 with YETI Holdings (YETI).

It’s not uncommon for an index to change and adjust the underlying measures by listing or delisting companies used as a component. It’s something they often must do. Listed corporations merge or are acquired, companies like LHC grow out of their market cap definition, and industries may gain or lose relevance as technologies change. One major index that does a thorough scheduled rebalance is the Russell 2000.

As you might expect, being listed or delisted causes out-of-the-ordinary price action around the stocks that are moved in or out of an index. The first rule of investing is; only where there is movement is there opportunity. Being listed or delisted causes price movement. As with most trading and positioning, if it were a sure thing, everyone would be doing it. Let’s look at some history.

Typical Activity for Newly Listed

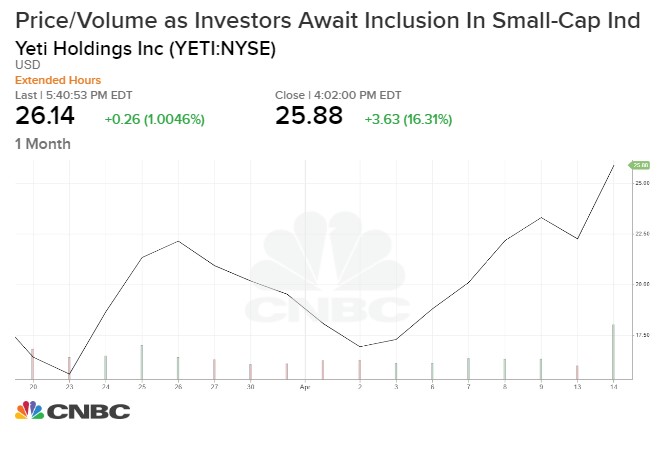

The announcement of YETI being added let investors know that the companies price action will be represented in the S&P 600 as of the market open on Friday, April 17. The graph below shows the price and volume activity since the announcement (note that major market indices were also up 3-4%). The companies price rose while volume spiked the day after the unscheduled surprise announcement.

The reason a company becomes more active and sought after when it’s included in an index is simple. With the popularity of index funds and indexed ETFs, whenever a company is added, the mutual funds that are looking to mirror the index will act to develop a position with a similar weighting near the date of the change. And an ETF is required to own the index they represent, ETF administrators have no choice but to hold the stock, based on their prospectus. Conversely, when a stock is dropped from an index demand may fade as interest by the index fund managers disappears.

This is one example of what price activity often looks like after a new listing announcement and before the inclusion date. Price often improves and trading volume is typically much higher than average. The index will begin measuring YETI Friday, April 17; it will be interesting to see how it performs on that day and over the coming weeks relative to the market.

Activity Immediately After Listing

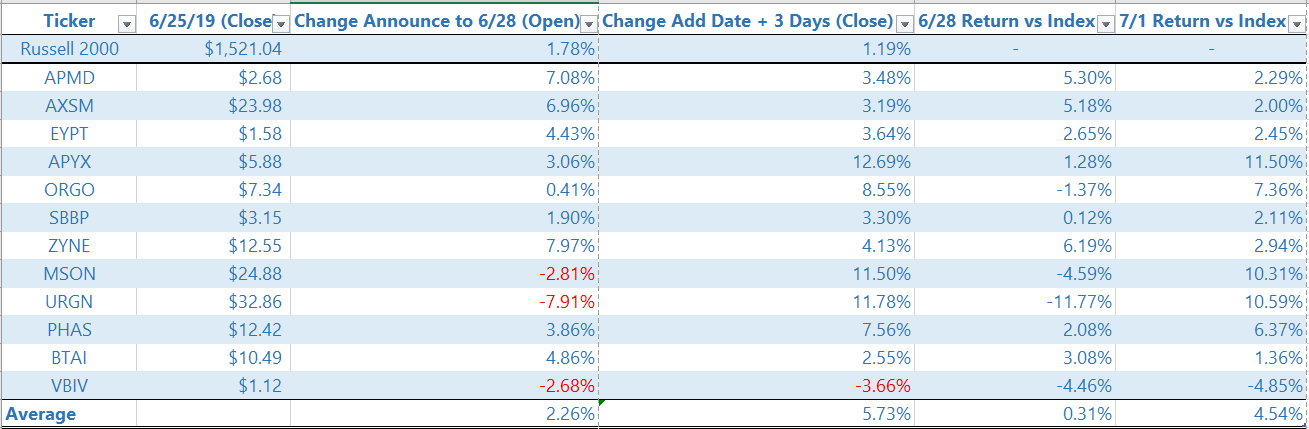

In late June 2019, FTSE Russell reconstituted its indices, including the Russell 2000. Presented below is a table of all 12 Biotech firms added. The table lists the price at close (two hours before the announcement,) the percent increase/decrease as-of the open on the date included in the index, and lastly, the percent change for there three days after it was inserted into the index.

Included at the top of the table is the percent change of the Russell 2000 (RUT) during this period. On the very right side two columns of the table the RUT change is netted out of each companies’ price movement. This allows you to view movement from the baseline of where the market was on that day.

On Friday, June

28, 2019, twelve stocks were added to the FTSE Russell 2000 and/or Russell 3000

indices. As with most reconstitutions, the shares of the companies did show

inordinate activity and movement.

Affimed N.V., Axsome

Therapeutics, Eyepoint

Pharmaceuticals, Apyx

Medical, Organogenesis, Strongbridge

Biopharma,

Zynerba Pharmaceuticals, Misonix

Inc., Urogen

Pharma, PhaseBio

Pharmaceuticals, BioXcel

Therapeutics, V

B Industries.

Analysis

The price from announcement date to open on inclusion date was up on 9 of the 12 included stocks. The increase in price beat the index in 8 of the 12. The average of all 12 increased by 2.26% as compared to the RUT, which only increased by 1.78%.

Three days after inclusion in the index, 11 of the 12 stocks beat the index, with only one showing a negative return. The average return for the 12 companies over the three days was 5.73% (RUT gained 1.19%).

Opportunity

These examples demonstrate that finding plays as indexes reshuffle their underlying stocks is possible. In fact, if price increases before inclusion date are the norm, this could actually have the effect of the index listing the company at a higher than average or inflated price. This would weigh down the index performance and give the advantage to the investor seeking individual opportunity outside index investing.

In June, FTSE Russell will once again be adjusting the underlying listed securities. It’s always smart to watch the activity surrounding this, even if you’re uninvolved. A link to the schedule is below under “Sources.”

Suggested Reading:

Do

Market Scares Provide Uncommon Opportunity?

Additional

Balance in the 60/40 Asset Mix

Channelchek Community:

Unlimited,

no cost subscription to company research and premium features

Sources:

FTSE Russell 2020 Reconstitution Calendar