AMC and APE Now Have a Most Unusual Combined Stock Chart

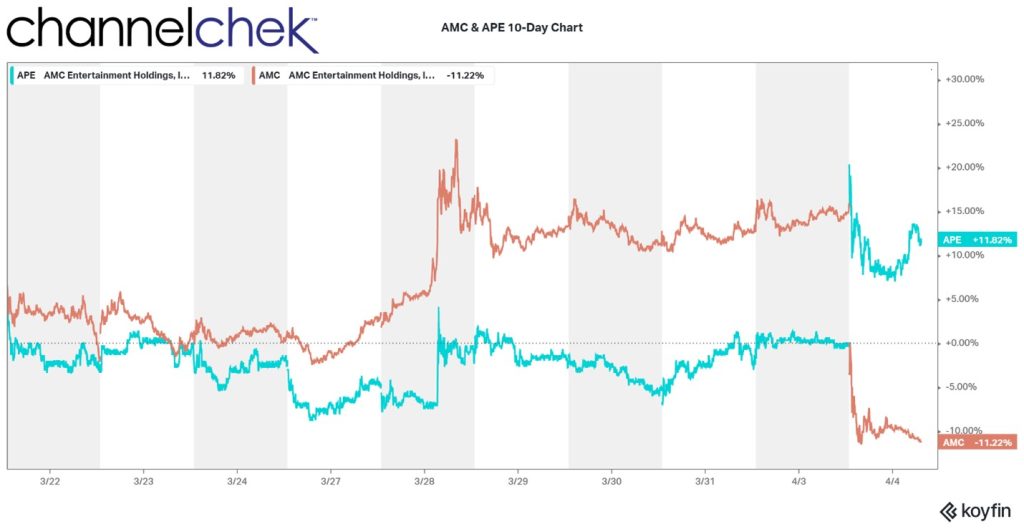

AMC Entertainment (AMC – common) took a big hit on Tuesday (April 4), shaving over 20% off its per-share price. At the same time its preferred shares (APE) climbed over 10% as the so-called meme-stock movie-theater company announced it reached a settlement with shareholders over its planned stock conversion. The settlement with the group of mostly institutional shareholders allows management to complete its plan to convert its AMC preferred equity, or APE, units into shares of AMC common stock.

Where are the Arbitrageurs?

After the announcement that the case had been settled, AMC stock dropped, and simultaneously APE units rose to. Arbitrage opportunities may still exist for those that expect the price of the two share types to converge as the conversion moves even closer to reality with final approval still needed.

APE units began trading in August 2022 after management announced a unique dividend that paid each AMC shareholder one APE unit for every common share they owned. The APE shares eventually experienced the market pricing them at a steep discount to the AMC common shares.

The Complaint

At issue in the litigation was the claim that shares would be diluted without offsetting compensation to existing shareholders. It was initiated by a group of mostly large shareholders (think pension funds). The terms of the settlement, announced in a filing by AMC late Monday, will allow common stockholders to receive one share for every 7.5 shares held after the reverse stock split. The payment would represent around 4.4% of AMC’s stock, or 6.9 million shares.

“The settlement provides investors with additional shares in satisfaction of their voting claims, while allowing the company to move forward with its plan to pay down its debt,” plaintiff lawyers from Bernstein Litowitz Berger & Grossmann, Grant & Eisenhofer, Fields Kupka & Shukurov, and Saxena White said in a joint statement.

Management’s Goal

As of the end of 2022, the company owed $4.9 billion in debt. The settlement may allow the company to raise in excess of this amount which could go a long way in helping management reach its goal of ridding itself of debt.

A Word on Price Discrepancy

Arbitrage can occur when the price of preferred units is lower than the price of common shares, even though the ownership level is substantially similar, or if the dividend rate on the preferred units is higher. In these scenarios, an investor can buy the preferred units and sell the common shares short (i.e., borrow the shares and sell them with the hope of buying them back at a lower price in the future), thus profiting from the difference in prices.

As the price movement in the chart above shows, related arb. opportunity pre-announcement are likely to have paid well.

Arbitrage can also occur when the price of common shares is lower than the price of preferred units, even though the shares should trade in parity or the dividend rate on the preferred units is lower. In this scenario, an investor can buy the common shares, sell the preferred units short, and receive a higher return on investment by benefiting from the price difference.

There is not yet “final approval” on AMC’s next step. However, the shares and reverse split are shareholder approved and the settlement clears the way for the final board decision.

Managing Editor, Channelchek