Image Credit: Crypto 360 (Flickr)

Infrastructure Bill Headed to House May Contain Impossible Terms for Crypto-Miners

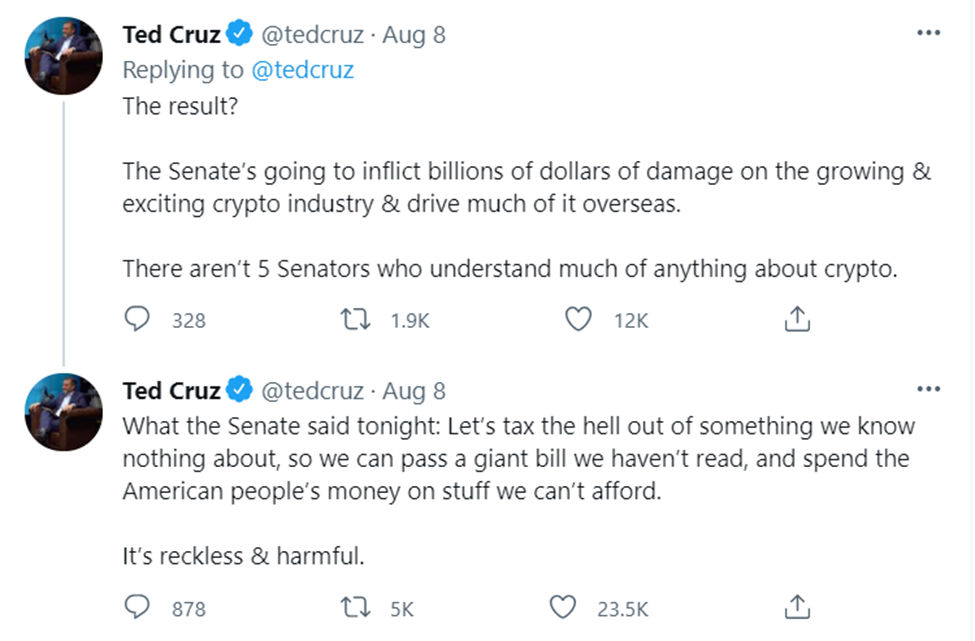

Is the infrastructure bill “reckless and harmful” to the crypto market? At least one senator thinks so. The bill passed today 69-30 in the Senate; it will likely see a House vote in the Fall. The concern is that within the bill is tax treatment for some in the digital currency industry that is arduous or even impossible.

The 2,702-page bill has now been passed in one branch of Congress. Despite the title “Infrastructure,” the bill contains IRS rules that impact the blockchain industry within the U.S. As passed, the language that challenges those involved within the U.S. is the crypto-tax that provides that miners, network validators, software developers, and others may be defined as brokers for tax-reporting purposes. According to a glossary on the FINRA website, a broker is defined as:

Broker – An individual who acts as an

intermediary between a buyer and seller of securities and who executes such

transactions.

The Securities and Exchange Commission (SEC) is similar:

Broker – any person engaged in the business of effecting transactions in securities for the account of others.

Language in the infrastructure bill clarifies the definition of “broker” to include crypto-miners for IRS purposes. The language was opposed by the crypto-mining and blockchain industry since it could be interpreted to impact crypto-miners and other companies involved in operating blockchain networks, including software and hardware developers. Although Senators from both major parties struck a compromise on Monday before today’s vote to exclude miners and other transaction “validators” from these IRS reporting requirements, the agreed-upon measure didn’t clear the Senate after Senator Shelby and Senator Sanders fought over allowing any amendments on the floor. This was not targeted at crypto, but it caused the compromise to be excluded.

The bill is now heading to the House for a possible vote. Representatives in the House may seek to insert and pass the Senate’s negotiated amendment, but that could be procedurally difficult as it would open the bill to other amendments. This could be a Pandora’s box the architects of the bill would find risky and therefore oppose.

Blockchain professionals are concerned that miners would be faced with unworkable reporting requirements if they are considered to be brokers. Their duty to collect tax information on transactions and issue 1099 forms, they argue, is not in line with their function. Those within the industry say blockchain operators have no way of knowing a transaction’s cost basis; they can’t track “customers” and certainly can’t issue 1099 forms. They simply can’t comply with the rule, and therefore may need to set up shop outside any U.S. jurisdiction.

The industry also argues that miners validate transactions that have taken place between two parties—they don’t conduct or broker a trade. They then add blocks of transactions to a decentralized network, (known as a blockchain). They don’t know the identity of others involved or their cost basis. They argue that the law would be unworkable.

Take-Away

Crypto-mining tax reporting requirements passed today by the Senate could impact the future of mining in the U.S. The Bill is now in the hands of the House of Representatives. The House is not likely to take up the bill until the fall. They’re out of session for August Recess and Speaker Nancy Pelosi has said that the chamber won’t take up the bill until Senate Democrats pass a separate and more expansive infrastructure package under the budget reconciliation process.

Suggested Reading:

Coinbase Nasdaq Listing a Diversifier

|

The Fed and MIT are Experimenting With Digital Money

|

Decentralized Apps, Using Blockchain to Change the Internet

|

Decentralized Finance, Is It the Future?

|

Sources:

https://www.washingtonpost.com/business/2021/08/07/cryptocurrency-infrastructure-bill-lobby-bitcoin/

Stay up to date. Follow us:

|