Extraordinary Measures as Outlined by US Treasurer Janet Yellen

There’s no doubt, the US Secretary of the Treasury, Janet Yellen, has been working overtime to provide an austerity plan as the US debt ceiling has just been reached. In the absence of the legal ability to sell debt in excess of the current outstanding, going to the bond markets and issuing Treasury Bills/Notes/Bonds is off-limits to the US government. So what’s a Treasury Secretary to do? The government has bills and other liabilities that are coming due, and today’s higher interest rates create a larger discount and nets less for the Treasury when rolling over some securities. This can be very problematic if the US stops paying bills on time or if there is a risk of default on debt; the US dollar can tumble, interest rates can skyrocket, and faith in our economic engine can unravel. You can imagine what this has the potential to do to equity markets.

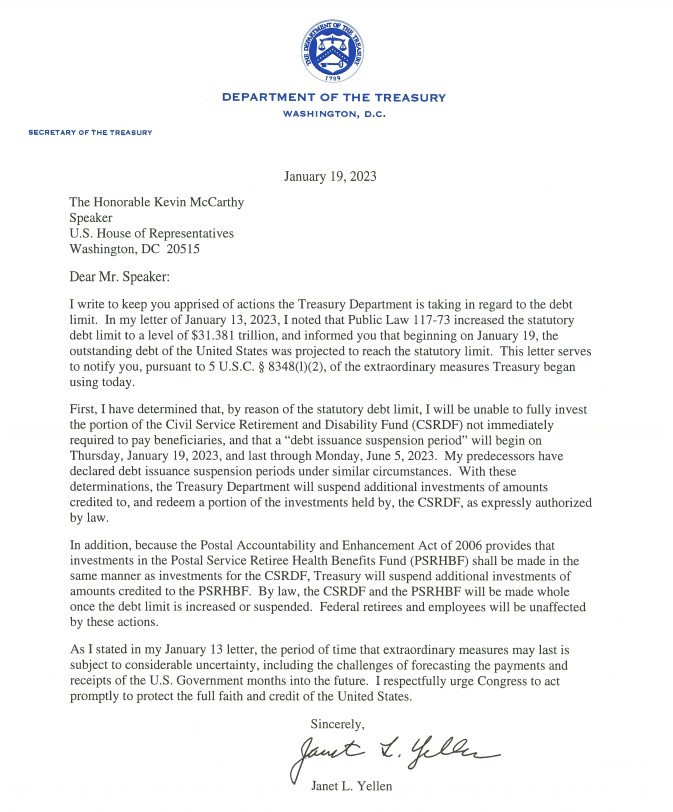

In a letter, Yellen wrote to Congress dated January 19, she outlines the Treasury Department’s contingency plan, while Congress is expected to develop its own more permanent financial solution.

In the letter, she says the Treasury will cease adding to the Civil Service Retirement and Disability Fund (CSRDF) for those values not currently required to pay beneficiaries. Under ongoing business practices the CSRDF invests in special-issue Treasury securities specifically for its use. These securities count against the debt limit.

Similarly, the Postal Accountability and Enhancement Act of 2006 provides that investments in the Postal Service Retiree Health Benefits Fund (PSRHBF) are made in the same manner as investments for the CSRDF. The treasury will suspend additional investments of amounts credited to the PSRHBF.

It is expected that the CSRDF and the PSRHBF will be made whole as part of the eventual solution.

She ends the letter by urging Congress to act swiftly as her measures will not provide a solution beyond late Spring.

Take Away

When the US bumps up against its debt limit it creates many problems. From a macro approach, if they raise the debt limit automatically may only serve to kick the spending can down the road. To have no upper limit long term can come back to hurt the US dollar and those that use it for purchases. Creating a strict upper limit serves to provide fiscal restraint but may stand in the way of economic stimulation. A government with its spending hands tied may find it problematic in times of war or other crises.

As the Secretary of the Treasury postpones payments or debt issuance, this has in the past not saved money, it has only delayed acquiring it through borrowing.

Depending on how intense the game of chicken becomes in the halls of Congress, the debt, equity, and Forex markets could become tumultuous.

Managing Editor, Channelchek