Should Investors Consider Taking Different Steps for Diversification?

Diversification reduces risk; at least, this is what we’re told. It could also limit the upside, but it’s downside that is most concerning to investors. True diversification is a goal embraced by most. Investors used to try to achieve this by buying a broad stock market ETF coupled with a bond ETF. Well, the Fed-induced bond bear market, which is feeding the equity bear market, is a double whammy for these investors. So else is there to pivot to?

Investors’ goals used to be to make sure they achieved above index results, what I am hearing from investors now is they just want to stop losing money. The return benchmark has been changed.

Is Diversification Attainable

Historically, when stock prices have gone down, bonds have appreciated. That’s because rates tended to sink when economic activity faltered and rose when demand for money was higher; this is because the economy was growing. Bond rates today are less driven by economic pace and natural market factors. An active Fed has more control over yields. So this yin and yang relationship between stocks and bonds is much less negatively correlated.

While the U.S. and global economy are in unchartered waters, the scenario where the Fed has promised negative returns on bonds, and while stocks continue to falter from past stimulus being pulled from the economy by the Fed, alternatives may be worth exploring.

Investors, have been told to diversify using registered securities from a young age, at a young age these are often the only options. Securities include registered company stocks and bonds. They are then told the best way to do this is with funds (Mutual funds and ETFs) that contain many securities, thus assuring diversification across that asset class. But, over time, as more have taken to the idea of buying “the market” or selling ”the market” using funds, movements by those getting in or out of the market en-masse impact more and more people. This year trillions have been lost by investors because of this.

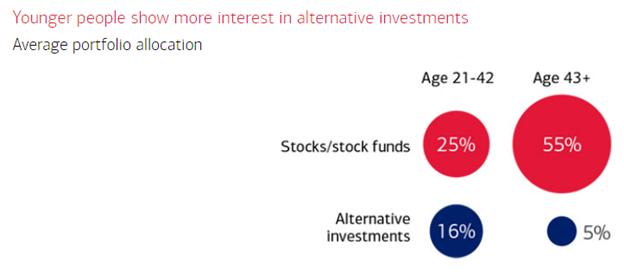

Do publicly traded securities still make sense? Chris Hyzy, Chief Investment Officer for Merrill and Bank of America Private Bank says, “We have transitioned into a new investment cycle driven by higher inflation and a pivot by global central banks, among many other factors. This is likely to create higher asset price volatility and new market leaders.” Speaking for B of A he said, “We believe alternative investments can play a role in helping qualified investors pursue today’s opportunities.”

One “Alternative” that more traditional investors are now looking at is private equity. Private equity involves investment partnerships that buy and manage companies before selling them. Private equity firms operate these investment funds for institutional and other accredited investors. This subset of investment alternatives is often grouped with venture capital and even hedge funds. The Investors are usually required to commit capital for extended periods, the lack of market price swings allows a level of stability not found in the bid/ask tick-by-tick valuations found in the stock or bond markets. This same advantage which allows management to be more focused on managing the company’s long-term viability limits liquidity for investors. This is why access to such investments is limited to institutions and qualifying individuals.

Other Asset Classes

In addition to qualifying as an accredited investor in private equity deals, those interested in alternatives may look to real estate, which also tends to fall with rising interest rates. Precious metals are also an alternative that investors use to diversify. The hedge fund universe provides an assortment of ideas and strategies that the fund managers use that are often de-linked from traditional markets.

Take Away

The Federal Reserve has indicated an unbending resolve to bring inflation. Mathematically this brings bond prices down with higher yields. Higher yields siphon money out of the stock market, which is already at a dimmer point of the business cycle. Alternatives, including private equity, has outperformed public markets and may also help manage portfolio volatility.

Investors that are uncertain if they qualify as an accredited investor may want to Pre-approve. There is no cost, Noble Capital Markets can do this and then provide those that meet the requirements access to its private deals. Knowing the options available and how to use them can provide uncommon and uncorrelated returns to a portfolio.

Source

https://www.finra.org/rules-guidance/guidance/faqs/private-placement-frequently-asked-questions-faq

https://www.privatebank.bankofamerica.com/articles/wealth-study-2022.html