Taking Advantage of Bitcoin’s Momentum

With BlackRock filing for a Bitcoin-related ETF this month, and then Citadel, Charles Schwab, and Fidelity backing a cryptocurrency exchange, there is again talk of Bitcoin (BTC) more than retracing its previous all-time high. BlackRock’s proposed product is designed, as are other crypto ETFs, to trade like a stock. This helps satisfy those that want ease of trading, exposure of their qualified retirement money, and all investments on one statement. A consolidated statement is also a benefit of Citadel, Schwab, and Fidelity’s exchange plans.

This adds fuel to the momentum Bitcoin has relative to other assets.

Another reason for increased expectations for Bitcoin’s performance is, next year Bitcoin’s is scheduled to halve, sometimes called its “halving event.” This halving happens every four years as Bitcoin rewards to miners are cut in half (miner’s payout will be reduced to 3.125 BTC). The event is viewed as positive for Bitcoin’s price. This is because halving helps in reducing supply. Historically, halving has brought higher Bitcoin values.

Exposure to Bitcoin price movements are, for some investors, already in their traditional brokerage accounts, and when desired, has found its way into IRA’s and other tax-advantaged retirement accounts. This is accomplished using the strong correlation between Bitcoin mining stocks, and the trend and momentum of Bitcoins measured against US Dollar value (BTCUSD) .

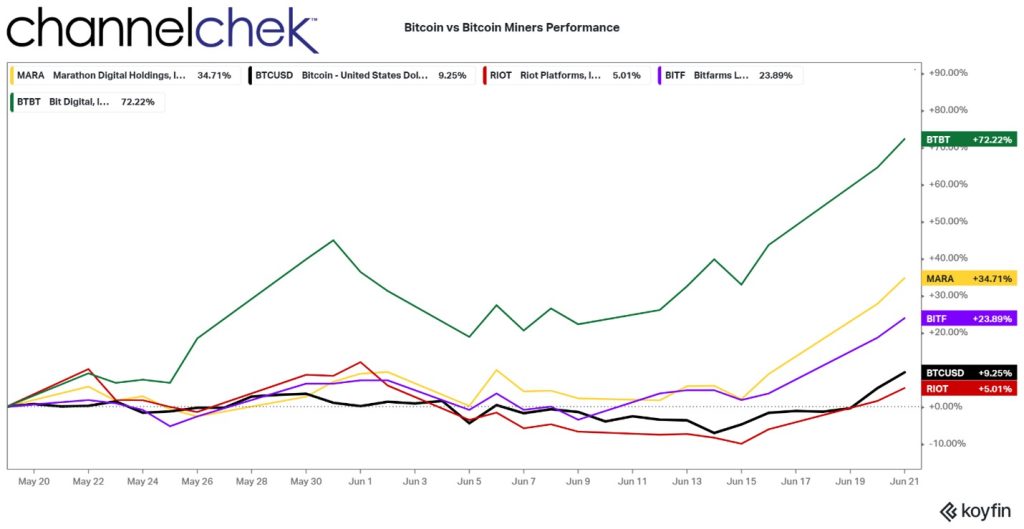

Over the past month as Bitcoin rose more than double that of the S&P 500 as a percentage, many Bitcoin mining stocks crushed the crypto’s performance. Both Bitcoin and Bitcoin miners historically move in the same direction, but the magnitude varies.

Currently, many mining stocks are experiencing a much greater magnitude.

To demonstrate how mining stocks provide stock portfolios the overall direction of Bitcoin, but differ in terms of degree, the chart above plots four Bitcoin mining companies against the BTCUSD. The overall direction is visually correlated to $Dollar/Bitcoin percentage moves. However, there are huge variations in that performance. The top performer represented above is Bit Digital, Inc. (BTBT). The New York-headquartered, large-scale mining business, with operations across the U.S. and Canada also acts as a validator of Ethereum. This is common stock and avoids the contortions and management fees of gaining exposure through an ETF, and of course, can be obtained through an investors traditional stockbroker. While Bit Digital rose 72.22% during the last 30 days, Bitcoin rose near 10%.

The weakest Bitcoin mining company pictured here is Riot. Riot has deployed one of the mining industry’s largest fleets of self-mining hardware. While the period represented above is only the past 30 days, Bitcoin strength is still represented in this laggard.

Take Away

The new possibility that BlackRock gets approval for a Bitcoin ETF and that a consortium of brokerage firms create a crypto exchange, is expected to lead to a growth in demand for cryptocurrency. Investors may be able to capture directional performance of Bitcoin using the stocks of Bitcoin miners, and have these assets listed on their current brokerage holding reports, and even house them in qualified tax-advantaged accounts.

The launch of a Bitcoin ETF could certainly help increase exposure to the token and drive up demand because it makes it easier for consumers to purchase, and crypto exchanges have also come under regulatory scrutiny as of late. If an investor is looking to accomplish this, they may wish to evaluate whether they can meet their needs using Bitcoin mining stocks.

Managing Editor, Channelchek

Sources

https://www.reuters.com/business/finance/blackrock-close-filing-bitcoin-etf-coindesk-2023-06-15/