Natural Gas Inventories are Low, Biden Administration Calls on OPEC for More Oil

Energy inventory levels are running below average. Heading into the heating season, the U.S. Energy Information Administration (EIA) forecasted natural gas inventories would enter November well below the five-year average. Separately, in a surprise yesterday, the U.S. National Security Adviser called on OPEC, Russia, and other oil-exporting countries to produce more oil.

Natural Gas

In its August 2021 Short-Term Energy Outlook, the EIA forecast that inventories of natural gas will reach 3,592 billion cubic feet (Bcf) by November 1, which is considered the beginning of the heating season. The level is 159 Bcf below its 2016-2020 average. Contributing to this forecast is the above-average use of natural gas experienced last heating season and the below-average additions since. Another factor considered is the higher natural gas exports coupled with relatively flat production.

U.S. production of dry natural gas (consumer-grade/methane) has been flat at 91.5 Bcf/d (billion cubic feet per day). This is 0.4 Bcf/d below the same period last year (January-July). Extreme cold weather in February is partly responsible as well freeze offs caused production to decline by more than 6.5 Bcf/d.

Record high levels of exports so far this year can be attributed to the increased ability to ship liquid natural gas (LNG) along with increased international LNG and natural gas prices. Through last year, U.S. LNG exports averaged 6.5 Bcf/d during a period of low global natural gas demand following pandemic-related reduced economic activity. Comparatively, U.S. LNG exports have averaged 9.4 Bcf/d so far in 2021. The EIA forecasts that LNG exports will average 9.5 Bcf/d for the remainder of the year. Exports via natural gas pipelines are also higher in 2021. U.S. pipeline exports of natural gas have averaged 8.5 Bcf/d in 2021, compared with 7.9 Bcf/d in 2020. The EIA forecasts that U.S. pipeline exports of natural gas will average 8.8 Bcf/d for the remainder of the year.

Send Your Oil Please

To the surprise of many, the talk of renewables was put on hold yesterday (Aug. 11) as the U.S. national security adviser Jake Sullivan urged OPEC and other oil-exporting countries (including Russia), to increase output and urged them to produce more oil.

|

Statement by National SecurityAdvisor Jake Sullivan on the Need for Reliable and Stable Global Energy Markets

AUGUST 11, 2021 Higher gasoline costs, if left unchecked, risk harming the ongoing global recovery. The price of crude oil has been higher than it was at the end of 2019, before the onset of the pandemic. While OPEC+ recently agreed to production increases, these increases will not fully offset previous production cuts that OPEC+ imposed during the pandemic until well into 2022. At a critical moment in the global recovery, this is simply not enough. President Biden has made clear that he wants Americans to have access to affordable and reliable energy, including at the pump. Although we are not a party to OPEC, the United States will always speak to international partners regarding issues of significance that affect our national economic and security affairs, in public and private. We are engaging with relevant OPEC+ members on the importance of competitive markets in setting prices. Competitive energy markets will ensure reliable and stable energy supplies, and OPEC+ must do more to support the recovery.

|

The reason is in part to curtail this inflation input. Today’s price of crude is higher than it was in early 2020 before the global response to the novel coronavirus. Oil prices saw little impact as WTI rose 0.1% and Brent increased by 0.2% overnight. OPEC + have been at odds with themselves on the best level of production. The market seems to understand that admonishment from the U.S. is now a small voice compared to those interests actually seated at the table.

Take-Away

As the energy industry seeks to regain its balance, there will be supply issues, (surpluses/shortfalls). Until the economy is on solid enough footing to project future needs, providing the proper output and getting it to where it is needed may continue to prove difficult.

Read more from a recent

newsletter provided by Channelchek reviewing the industry.

Suggested Reading:

Tax Treatment for Crypto Mining May Cause Exodus from U.S.

|

Will the U.S. Continue to Subsidize Renewable Energy?

|

Why Uranium Prices Have Been Rising

|

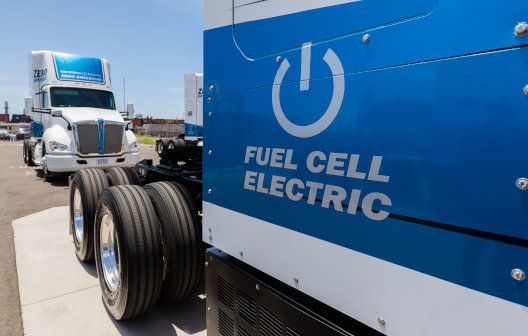

Lithium Battery vs. Hydrogen Fuel Cell Vehicles

|

Sources:

https://www.eia.gov/todayinenergy/detail.php?id=47576

https://www.eia.gov/todayinenergy/detail.php?id=46896

https://www.eia.gov/todayinenergy/detail.php?id=49096

White House Briefing Room Statement

Stay up to date. Follow us:

|