Is Warren Buffett or Elon Musk Making the Right Bet?

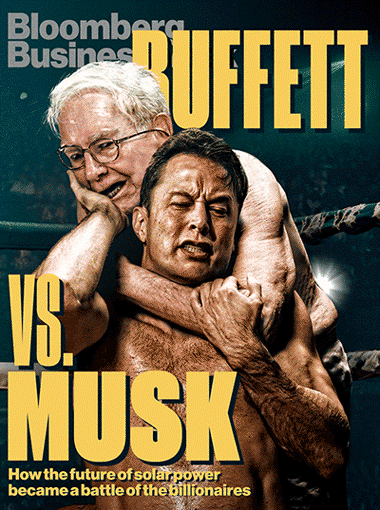

Warren Buffett’s Berkshire Hathaway is acquiring the natural gas transmission and storage assets from Dominion Energy for approximately $10 billion. At the same time that Berkshire is investing in the carbon-based energy infrastructure, Elon Musk and Tesla are preparing for “Battery Day” (see Channelchek article on June 17, 2020, “Is Elon Musk’s ‘Battery Day’ Losing its Charge?” Many believe that Tesla is on the brink of announcing significant improvements in the capacity and life of car batteries and the ability to store power generated from solar electricity. This is technology that could reduce the value of utility assets such as those bought by Berkshire. The two have a long history of butting heads. To quote Elon Musk, Buffett “does a lot of capital allocation” and “we should have, I think, fewer people doing law, fewer people doing finance, and more people making stuff.” So, who is right: the reigning champ of value investing or the upcoming king of growth investing?

Source: Bloomberg Businessweek

The Case for Warren Buffett and Value Investing

Warren Buffet is an unabashed supporter of value investing. He favors taking passive investment in well-known brand names that have dominant market positions. He likes companies that are well run but are facing a weakened financial position due to external events outside of managements’ control. Berkshire has long favored the stability of utility stocks dating back to the purchase of MidAmerican Energy in 1999. Berkshire followed the MidAmerican Energy acquisition by acquiring PacifiCorp, Northern Powergrid, CalEnergy Generation, Kern River Gas Transmission, Northern Natural Gas, NV Energy, and AltaLink. With the acquisition of assets from Dominion Energy, Berkshire will now own 18% of the gas transmission assets in the United States. The purchase, which includes spending $5 billion in cash, will hardly put a dent in Berkshire’s cash position, which was $137 billion as of May. From management’s point of view, the acquisition is putting cash to use that is earning a low return. As such, the company’s return on investment will increase even if it is being used to buy low-growth utility assets. As you might expect, the shares of Berkshire Hathaway tend to trade in a manner reflective of its underlying assets. Analysts following Berkshire project a growth rate in the single digits, and the shares trade at valuation multiples similar to the broader market.

The Case for Elon Musk and Growth Investing

Elon Musk and Tesla, Inc. take a different approach to investing. Tesla designs develops, manufactures, and sells electric vehicles, energy storage systems, and solar products. Tesla is a product disruptor that is not interested in acquiring out-of-favor companies. The few acquisitions that Tesla has made, such as Maxwell Technologies or SolarCity, have been done to support its drive to make technological breakthroughs. It does not want to purchase utility assets; it wants to make utility assets irrelevant. Some believe its development of solar energy and Powerwall and electric car batteries is a way to create a virtual power plant (see Channelchek article on June 22, 2020, entitled “Virtual Power Plants and Tesla Car Batteries. Tesla is investing in the future, and the shares of Tesla reflect that strategy. Tesla has a market capitalization of $260 billion even though it does not report a profit or positive cash flow.

A Review of How Utilities Work

Utility operations can be broken down into three primary categories: generation, transmission, and distribution. Gas utilities are somewhat different from electric utilities in that the “generation” of natural gas is typically done by unregulated exploration and production companies. Natural gas prices can vary in different points in the country, depending on production supply and consumption demand. Different price points create the need for gas transmission pipelines to move natural gas from areas of low prices to areas of high prices. Natural gas is used primarily for space heating, creating the need for storage fields that are filled in the summer and drained in the winter. Natural gas prices are constantly changing as supply and demand changes, sometimes creating the need for new pipelines or storage to be built or sometimes, meaning existing pipelines or storage are not profitable.

So, is Warren Buffett or Elon Musk Making the Right Bet?

Are utility assets temporarily out of favor, or has their importance been permanently reduced due to changes in technology? It is probably safe to say that utilities will continue to be involved in the generation of power. The emergence of solar and wind power has gone a long way towards reducing the nation’s reliance on carbon-based fuels for generations. That said, solar and wind power have reliability issues that will only partly be solved by improved battery technology. Natural gas is often viewed as the bridge from a carbon-based energy system to a renewable-based energy system and will remain a primary source of power generation. As such, the need for natural gas transmission and storage assets such as that being purchased by Berkshire Hathaway is not going away anytime soon. What’s more, the need for natural gas to heat homes will continue. Yes, increased use of solar generations combined with battery storage may result in increased use of electric heaters. However, people typically do not change their furnaces until they are broken, meaning natural gas heating will be around for decades if not centuries. In the end, then, the real question to ask is not “who is the better investor?” but “what time frame are we talking about?”

Suggested Reading:

The Last Thing You’ll Ever Need to Read About the Berkshire Hathaway Meeting

Raw Materials and the Scalability of Tesla’s Vision

Cobalt and Rare Earth Metals from the Ocean Floor Eyed to Meet Growing Battery Demand

Enjoy Premium Channelchek Content at No Cost

Sources:

https://www.cnbc.com/2020/07/06/why-warren-buffett-made-his-latest-blockbuster-deal-a-bet-on-electric-vehicles.html, Yun Li, CNBC, July 6, 2020

https://www.cnbc.com/2020/07/05/warren-buffetts-berkshire-buys-dominion-energy-natural-gas-assets-in-10-billion-deal.html, Becky Quick, CNBC, July 5, 2020

https://www.businessinsider.com/elon-musk-not-biggest-fan-warren-buffett-joe-rogan-interview-2020-5, Alex Wong & Rebecca Cook, Getty and Reuters, May 7, 2020

https://www.nytimes.com/2018/05/07/business/dealbook/warren-buffett-elon-musk.html, John Foley, The New York Times, May 7, 2018

https://www.bloomberg.com/features/2016-solar-power-buffett-vs-musk/, Noa Buhayar, Bloomberg Businessweek, January 28, 2016

https://www.youtube.com/watch?v=ZPgiBzJzR6M Elon Musk: I am not Buffett’s biggest fan, CNBC, May 7,2020