Looking Back at the Markets in July and Forward to August

Enthusiasm for the overall stock market remained strong in July. The major indices were all up, and every S&P sector closed in positive territory. Despite the Federal Reserve which continued its monetary policy tightening, and suggestion that it is not finished, markets looked at waning inflation and still strong employment and began to believe a soft landing is now more likely. During the month Nasdaq decided to rebalance the Nasdaq 100, this was completed as of the market open on July 31. The purpose was to allow the index to better reflect price movements in the top 100 Nasdaq stocks. As with the S&P 500, the weighting of the five largest companies represented in the index, has been a concern for many investors that don’t believe the index represents the overall market moves well. On the other side of the scale, for the second month in a row, the small cap Russell 2000 index led the other popular market indexes by a wide margin.

Earnings season or second quarter reporting, which kicked off mid-July, has so far exceeded estimates for many highly followed companies; this has also kept the markets rising in July. Whether the strong market momentum continues through August may depend on if inflation continues to show signs of coming down toward the Fed’s 2% target.

Look Back

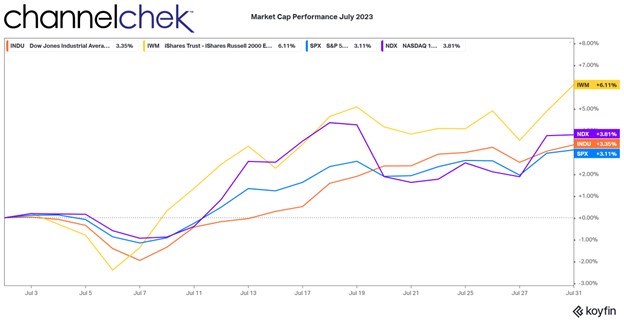

Four broad stock market indices were positive in June. In order, the Russell 2000 Small Caps, Nasdaq 100 Large Caps, the Dow Jones Industrials, and S&P 500 Large Caps.

Small cap stocks are the big winner in June as investors went looking for value. The Russell 2000 rose 6.11%, which follows a large 8.07% gain the previous month. The smaller stocks may now have more positive impetus that could carry over into August. Just prior to the beginning of July, Goldman Sachs had estimated that based on their models, small cap stocks could rise 14% over the next 12 months. This helped small cap stocks continue their outperformance as more investors begin to exercise caution toward the high P/E ratios in larger companies and recognize the historical value still represented in small cap company valuations.

The Nasdaq maintained its growth as big tech retained its appeal despite individual company market caps that have exceeded those of developed countries. The Nasdaq 100 was up 3.81%, following 6.49% in June. The Dow 30 Industrials made headlines for a week as it had a 13 day winning streak. It returned 3.35% during July after a 4.56% increase in June. The S&P 500 was the worst performing index at 3.11% after rising 6.47% the previous month. All major indices are off their all time highs that were reached in Winter 2021.

Market Sector Lookback

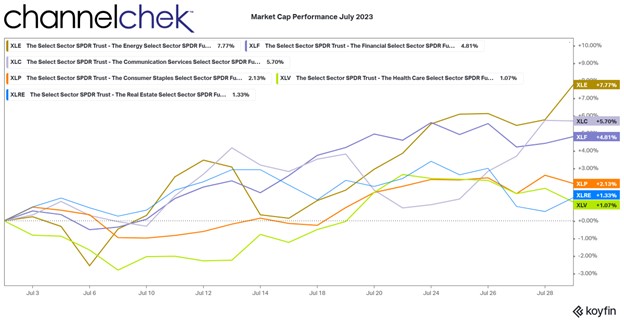

Of the 11 S&P market sectors (SPDRs), even the lowest performer had an above-average one-month return. The chart above reflects the three best-performing sectors and the three worst. The top performer demonstrated the strength of energy during the month as oil and natural gas prices rose.

The energy sector had the best return at 7.77% during July. Continued disruption as countries work toward renewables, the war in Ukraine, and even a coup in Niger all helped the sector attract investors.

Communications was second with a 5.70% return. On June 26, the White House announced internet infrastructure spending plans that helped support and should continue to help many companies in this sector.

Investors began returning to companies in the financial sector as a rebound from March and April when investors became leary after a few bank failures. Bank earnings in July showed better-than-expected performance on many of the large banks. This helped the move back into financials. The sector returned 4.81% in July.

The three worst-performing sectors also indicate the month was very positive. Consumer Staples which was third from the bottom returned a respectable 2.13%. Investors view this sector as a defensive play in times of economic uncertainty. Its move shows less interest as investors become more positive on the economic outlook.

The second to weakest performer is Real Estate. The sector has held up fairly well considering how closely its performance can be tied to interest rates. The 1.33% return in June is indicative of the entire market’s resilience yet lower probability of the sector in light of a still hawkish Fed.

Health Care is still out of favor. Investors had a lower level of interest in healthcare stocks, which are also considered defensive. Lower market volatility and a brighter economic outlook have investors less interested in defensive stocks. Also, interest rates could be affecting big pharma as dividends on the stocks become less appealing as bond yields rise.

Looking Forward

The job market is strong, inflation is tapering, and consumers are more confident. Analysts are now expecting that companies that have been waiting for a more friendly market to go public are considering now as a good time for their IPO.

Bitcoin and other cryptocurrencies, along with stocks of crypto exchanges, are still faced with uncertain legal outcomes and regulatory positioning. Artificial intelligence as a growing component of many industries, is driving interest as investors look to uncover those companies that will benefit the most both directly (ie: selling chips) or indirectly (ie: gain efficiency).

The rotation to small caps and sectors that perform better when the economy improves has a lot of momentum heading into August. This sector has a long way to run before it catches up with the large cap sectors that it historically surpasses over time.

Take-Away

The market showed more signs of relief in July as the conversation changed from an upcoming recession to a likely soft landing. With five more months in 2023, the markets have rallied and are not showing signs of retrenching. This is especially true of small cap stocks that for the second month have handily outperformed large caps.

Managing Editor, Channelchek

Sources