If Dollar Weakness Persists – What Stocks May Benefit?

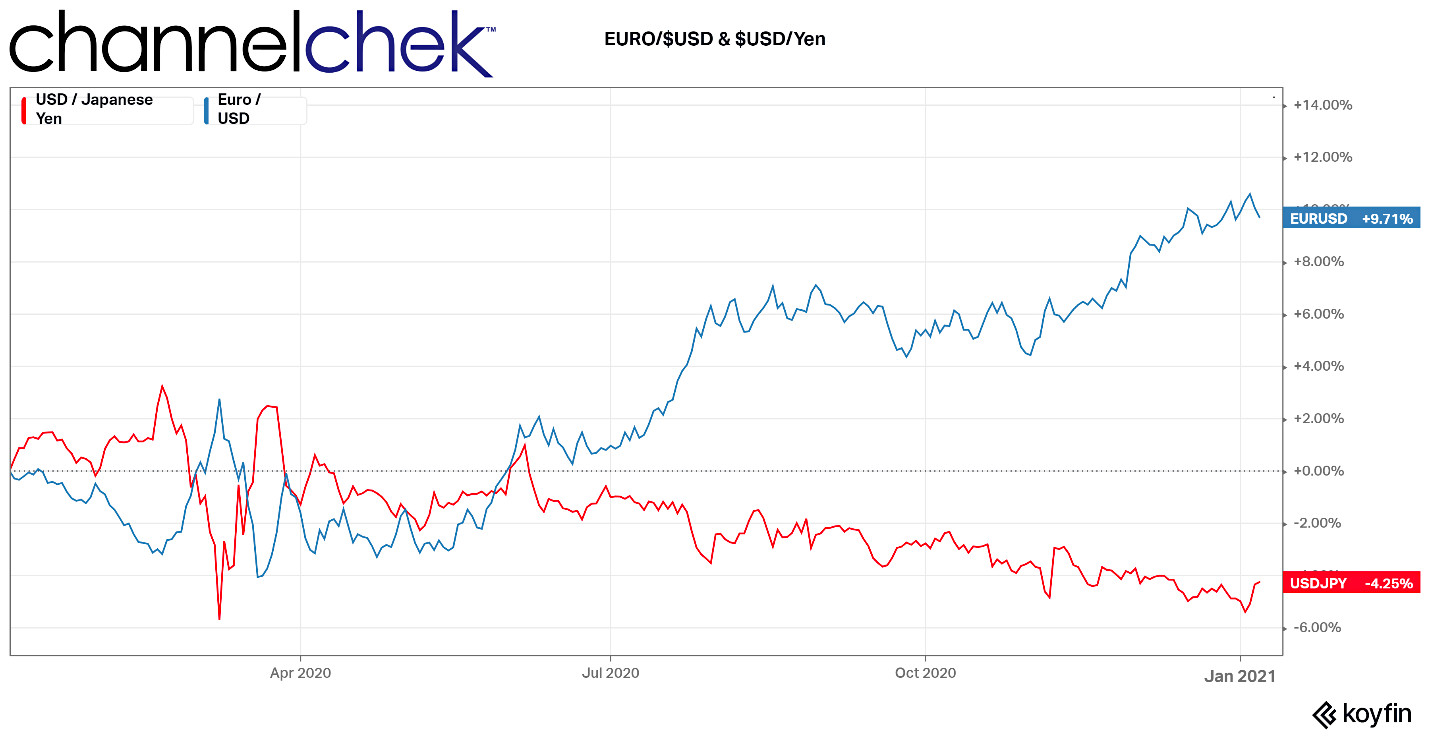

The U.S. dollar has been declining in value since late Spring 2020. Although other newsworthy trends may have taken exchange rates out of the spotlight; a new year is usually a time when investors readjust their focus. The change of economic priorities in Washington also signals investors to consider readjusting their radar to find investment opportunities with higher likelihood of success. Should the declining $US Dollar trend continue it may turn out to have a sizeable impact on asset prices in various sectors during 2021.

The last time equity investors paid much attention to currency valuation was 2011. For the benefit of readers in the market for less than 10 years, we’ll quickly recap some basics such as: What is a weak dollar? Why is the dollar weak? And then move to the important question, what industries may benefit from a weak dollar?

Weak Dollar

Supply and demand of a currency cause it to move higher and lower based on demand, assuming a stable money supply. If demand for either goods or financial assets priced in a currency rise, it exerts upward pressure on the currency’s value. For example, consider oil demand since the COVID slowdown. Most oil is purchased on global markets in $US Dollars. If worldwide economic activity slows and there are fewer barrels being purchased, there is a lower demand for dollars to exchange for crude oil. This lower demand helps depress the currency’s value. Another common example is interest rates. Currencies will be exchanged in order to buy notes of a country that has higher yields net of native inflation (after adjusting for sovereign risk). This is why rising real U.S. interest rates vs. other nations ordinarily coincide with a strengthening dollar — lower rates have the opposite effect.

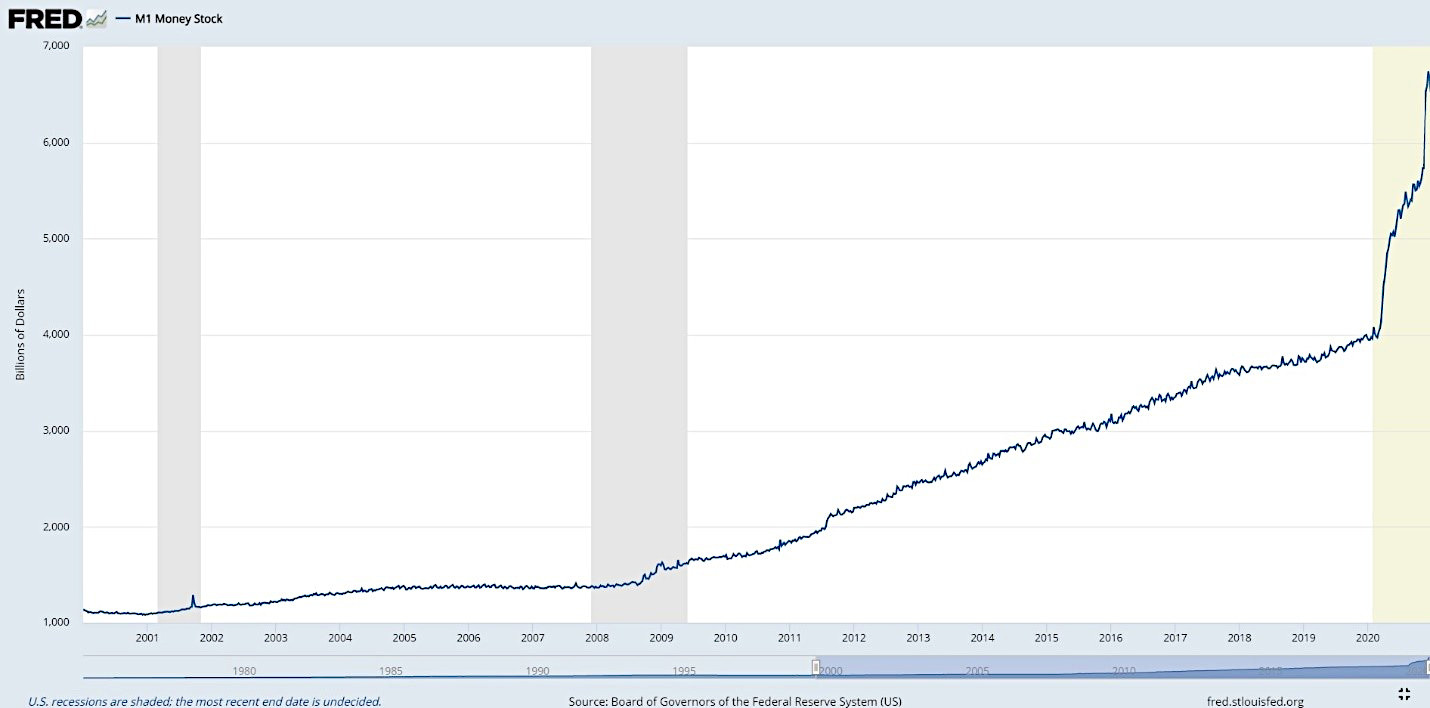

Since the 1980s money supply has mostly had a gentle upslope that steepened some starting in 2008. As mentioned above, an increase of supply of something without an offsetting increase in demand places downward pressure on the value of it (in this case the $USD). There has been an abrupt increase in the supply of money in circulation in recent months. The graph below of money supply (M1) shows the dramatic increase in currency.

Money Supply (M1) Since January 2000

Source: St. Louis Federal Reserve Bank

Although there are many factors that come into play when the push and pull of markets determine the price for anything, the two key economic ingredients remain supply, which has measurably increased, and demand which is slack because of artificially low rates and a slow world economy.

Impact on Stocks

As the pandemic fears lift and the cabin-fever of individuals from all over the globe help them decide they need a change of scenery, there will be interest in traveling to where their local currency goes the farthest. This makes travel and tourism companies located in the U.S. interesting as an investment. There’s potential for them to have the double benefit of increased overall travel and a weaker dollar steering international travelers to the U.S. Another industry with multiple tailwinds is entertainment. An interesting subset of entertainment is esports which has been enjoying growth in popularity since even before the lockdowns. Esports games know few boundaries for attracting audiences. As a result, many companies are not U.S. based, some of those publicly traded esports related companies that are may get an additional boost if the declining dollar trend continues.

Natural resource stocks are worth watching as well. If it comes out of the ground in the U.S. or a country with a closely correlated currency and is sold abroad someplace with a strong rising currency, the producer could experience higher profits on the same amount of work. Examples include mining of commodities used for building materials such as copper, silver, steel, etc. Any mine operations transacting in U.S. dollars or a correlated currency may get an added currency kicker.

When it comes to asking who benefits from a weaker dollar, one can’t ignore large multinationals. Whether the company does most of its manufacturing in the states and exports those products, or has production facilities across the globe, if sales in a strong currency and converted back to a weaker dollar the company benefits. Larger companies received a great deal of attention last year. Conversely, it would make sense for investors to exercise caution and spend extra time analyzing companies that import a lot of materials or offshore labor. As many of these companies’ stocks have experienced a strong 2020. Investors may prefer instead to determine the smaller suppliers of these large companies that are not as visible, yet benefitting.

While building a watch list for 2021, companies that import from nations experiencing strong currency gains versus the dollar may add have an added consideration as to upward potential.

Take-Away

There is no guarantee that the dollar will continue on its weaker trend. However, the ingredients that cause a weakening dollar seem to be heavily baked into the economic cake. The most recent stimulus may have even turned up the temperature higher by adding to the supply of cash in circulation.

It’s important to note that a strengthening or weakening dollar does not necessarily suggest a strong or weak stock market, it does however suggest sector rotation. The sectors with the higher probabilities of benefitting are those involved in exporting goods or in the case of entertainment, providing a service. The stocks that should be analyzed with the most caution are U.S. manufacturers that rely heavily on imports from countries with inflated currencies.

Paul Hoffman

Managing Editor, Channelchek

Suggested Reading:

Metals and Mining Industry Report, Jan. 4, 2021

US Debt as a Percentage of GDP Skyrocketing

Are you subscribed to Channelchek’s active YouTube channel?

Sources:

How

the Dollar Impacts Commodity Prices