More Singles and Doubles for Investors in Biotech Expected (Few Home Runs)

Biotech has been highlighted by us a few times in recent weeks because of the potential the current financial dynamics could have for companies and investors. This past weekend, fresh out of the JP Morgan Health conference, a number of major publications have echoed a similar sentiment. A weekend piece in Barron’s in particular, caught my attention — its overall conclusion is the same as our readers have seen on Channelchek, but the path taken to get to the conclusion is somewhat different.

Health Landscape

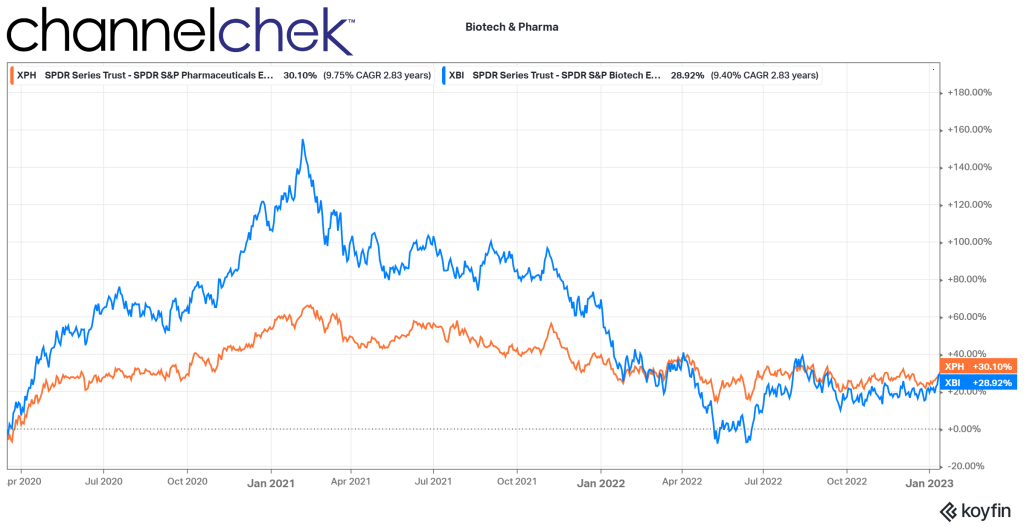

From March 2020 until February 2021, biotech stocks were on a tear. The increase of 155%, as measured by the XBI, can be attributed to the intense focus on healthcare during the period. Higher demand for anything healthcare-related drove share prices among the companies in this sector. This went a long way to provide capital to companies whose very nature are high costs and low revenue. The strength of the sector brought up the deserving, along with others that benefitted from biotech’s overall momentum.

The peak was nearly two years ago. Just as interest in biotech strengthened less than deserving companies, the weakness that followed has brought down many companies that would likely be valued much higher if not for the “throw the baby out with the bathwater” effect, especially with so many sector index fund investors.

This weakness must have been a painful transition for management of companies that are enthusiastic about the prospects of their research and development but now find they may be in survival mode and now spend more time pitching their story and plans while hoping for an overall rise in interest in the sector.

Biotech Mood 2023

The challenge for smaller biotech and medical device companies, which ordinarily spend many years developing products, while benefiting from few or none on the market, is that current valuations have made it a steeper uphill battle to raise new funds for their work and if they do, they may over dilute current shares.

There is a change in the mood of life sciences companies. the Barron’s article, titled, Tanking Biotech Stocks Will Mean a Big Year for Deals. Who Could Benefit? wrote, “With reality setting in, it’s a buyer’s market for companies looking for acquisitions and partnerships, according to the pharmaceutical and medical technology execs who gathered at the J.P. Morgan healthcare investor conference.” JP Morgan describes this annual event as the largest and most informative healthcare investment symposium in the industry. It connects global industry leaders, emerging fast-growth companies, innovative technology creators and members of the investment community.

The conference had been on hiatus for a couple of years in response to pandemic concerns. Certainly there was a lot of new and interesting information to be absorbed and understood.

An overall impression coming from this 41st health symposium is that management of the cash-starved small firms are in a situation where they either have to make a deal with a partner or acquirer or perish. The realization has set in that terms or prices they may have once been able to command are not today’s reality.

Geoff Martha , CEO of Medtronic (MDT), a medical device manufacturer, is quoted as telling Barron’s “We’re getting lots of calls from companies that literally we talked to six months ago.” He explained, back we’d offer, “we’ll buy you for X amount,” and the response would be, “No way, we’re worth [two times that].” The Medtronic CEO said they are now calling back trying to restart the conversations.

Tide Turning

Speaking about the terms now expected, the chief financial officer of Gilead Sciences (GILD) is quoted as saying, “It’s changed completely in terms of both the deal structures they’ll contemplate, the valuations that they’re thinking about,”

Large pharmaceutical companies such as Gilead have the means to provide a non-dilutive source of funds; they are coming off a number of very profitable years and are looking for more rewarding uses of their cash. This doesn’t mean they are willing to cut large acquisition checks; the current trend seems to be more partnering deals – collaborations that keep the best ideas moving forward.

The risk-reward analysis by the large pharmaceutical companies is versus low-return financial assets on the balance sheet. “We can make a lot of investments because it’s not high cost,” says Anat Ashkenazi, CFO of Eli Lilly (LLY). “And we know some of these will fail, some will succeed. That’s how we operate.”

This has ushered in a health industry where large companies with cash to spend are capable of placing many well analyzed bets on future devices and drugs from small companies that now must make a deal or risk perishing.

Take Away

When a small biotech company gets an infusion of cash from collaborating with a big pharmaceutical company, its stock typically reacts very positively. This is not the same level of reaction as an outright purchase, but worthwhile just the same. There is an atmosphere where these partnerships and collaborations are likely to occur with more frequency. This could add to the number of small biotech stock potential winners early in 2023.

Discover Inner Details from the Health Symposium

Investors eager to discover more about the companies at the JPM conference, what was said, where the industry is going, and actionable investor possibilities, can immerse themselves in this info deeper next week.

Here’s how.

Noble Capital Markets’ equity analysts and investment bankers attended the meetings, lunches, cocktail events, and interviewed company management. Next week they will share their collective takeaways. It is perhaps better than having endured the unusually bad weather yourself in San Francisco, get more information here!

Managing Editor, Channelchek

Sources

https://www.jpmorgan.com/solutions/cib/insights/health-care-conference

https://www.barrons.com/articles/biotech-partnerships-mergers-acquistions-51673643442