Image Credit H.B. Kang (Flickr)

Risk to Gold, Oil, and Stocks with Tapering

The largest single player in the financial markets is the U.S. Federal Reserve Bank. This is why anyone with assets, stocks, commodities, real estate, cryptocurrency, or debt securities should watch what they are watching. Gold traders are currently reacting based on this wisdom. The easier money comes from going with the Fed; this requires understanding the Fed’s targets and motivations. Assessing when the Fed could alter its direction helps investors take money off the table before the move becomes a reality.

| Total nonfarm payroll employment rose by 943,000 in July, and the unemployment rate declined by 0.5 percentage point to 5.4 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, in local government education, and in professional and business services. |

Employment Situation, July 2021 – BLS.gov

Gold’s Connection to Jobs Data

Gold dropped by 3.5% to $1,692.60 per ounce after the U.S. Department of Labor posted a much better than expected jobs report on Monday (August 9). The new data suggests that the Fed could soon have room to taper their buying of interest-bearing securities. As part of the Fed’s extremely easy monetary policy, the purchases have been ongoing since early last year. Should the Fed decide to taper sooner than planned, rates would move higher; higher rates strengthen demand for interest-bearing securities and deposits. The, “what may the Fed do?” thought process has commodity and other asset markets concerned.

Source Bloomberg: Gold Reverses its Recent Trend

Some of the degree of oil’s early reaction was likely due to thin trading volumes when Asian markets opened. Gold closed Friday 9Aug. 6) at 1813.30.

Impact on Other Markets

Pretty much every asset competes with the “risk-free” rate of U.S. treasuries. Rates have been so low for so long, investors have seen little reward in allocating to an asset class paying below the rate of inflation. The strength away from treasuries, from U.S. stocks, cryptocurrencies, even real estate is tied to money looking for a place to go to find a better return. The idea that the Fed may see a reason to raise rates and dampen concerns of an overheating, over-inflationary economy is now weighing on many sectors.

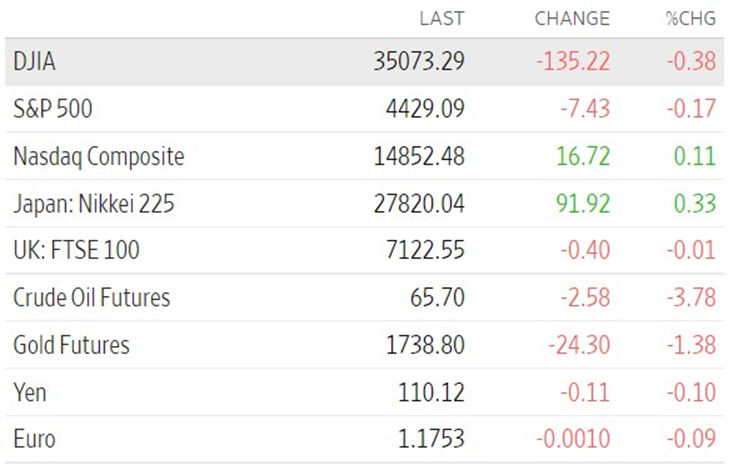

One hour into the stock market opening bell, Crude prices were down significantly. Remember, oil transactions are in U.S. Dollars. The Yen and Euro are weak against the dollar and the Dow and S&P are off with the Nasdaq up modestly.

Source WSJ.com at 10:30 Monday (Aug. 9)

Take-Away

It’s difficult to find one piece of data that can clearly and definitively suggest this is the tipping point for Fed policy. The Fed has recently said it will be patient. One crosscurrent to the added jobs is talk of new cases of the coronavirus. This factor runs counter to the jobs data in that there is talk of slowing or reversing the return to work momentum. There is every reason to believe that the Fed will eventually have to end the easy money stance. When they do, the huge treasury market will increase in attractiveness. The market has thought they have seen the change in tide many times this year. The false starts up until now have largely turned out to be buying opportunities.

Suggested Reading:

The Worst Trading Months of the Year (Statistically)

|

Is it Wise to Buy on Dips?

|

Investing in Leisure, Post Pandemic

|

What Metals Prices Can Tell us About the Economy

|

Sources:

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.wsj.com/market-data

Stay up to date. Follow us:

|