The SEC May Impose Tougher Rules for Complex ETFs

According to a statement from SEC Chairman Gary Gensler, the regulator is likely to propose stricter guidelines surrounding investments in leveraged ETFs and inverse ETFs. The concern is that they might pose more significant risks to retail investors than other funds or the broader financial market. Gensler’s statement comes after SEC approval of rules that open the door to two new ETFs from Volatility Shares that allow investors to place leveraged or opposite bets on the Cboe Volatility Index (VIX). The VIX measures the 30-day implied volatility for the S&P 500.

Amplified Movement

When created, exchange-traded funds originally held and represented a simple portfolio of stocks or bonds, most often based on popular indexes. This grew to include sectors and was a favored low-cost way for an investor to gain exposure to a sector and portfolio diversification. The product has matured and there is now not only an ETF for every conceivable asset class but there are ETFs that are invested with the intent of returning double or triple the pegged asset classes return or loss. And, there are even ETFs designed to provide the opposite return or a multiple of the inverse return.

Many of the inverse ETFs and ETFs leveraged to provide a multiple of price movement of the underlying sector are used as tools for traders to hedge positions over short periods such as an overnight or long holiday weekend. Many are built with derivative products that decay over time and are not meant to be held long-term. If used appropriately, a self-directed investor can achieve similar benefits to the professional trader. One way this might work is if an individual is concerned about what an event occurring over the weekend may do to their $300,000, largely S&P 500 stock account, they may buy an option on $100,000 worth of a 3x leveraged ETF against the S&P. It then serves as insurance against large movements against their portfolio. Additionally, it prevents the individual from having to get out of their stocks. This is not how many individuals that have access to these funds are using them. Many are unwittingly investing long term with unwanted results.

SEC History with Complex ETFs

The inverse and multiple index ETFs are not just a concern of the current SEC Chair. Former Chair Jay Clayton raised concerns in 2020 that some exchange-traded products “may present investor protection issues—particularly for retail investors who may not fully appreciate the particular characteristics or risks of such investments.”

More recently, the SEC took actions against financial professionals that improperly recommended retail customers buy and hold the exchange-traded products that are designed for only short-term positions. In his statement, Gensler noted that these complex products can be risky even to sophisticated investors and that they can potentially create system-wide risks by “operating in unanticipated ways when markets experience volatility or stress conditions.”

Expectations

As these products grow in both size and number, regulators are seeing a need to consider the impact they may have on the broader financial system along with individual investors. Investor protections surrounding these ETFs are likely to grow. How far the rules will go in terms of restrictions as opposed to fuller disclosure is not yet known. Perhaps any move will be to make investors better understand the characteristics and risks of the more complex products.

Suggested Reading:

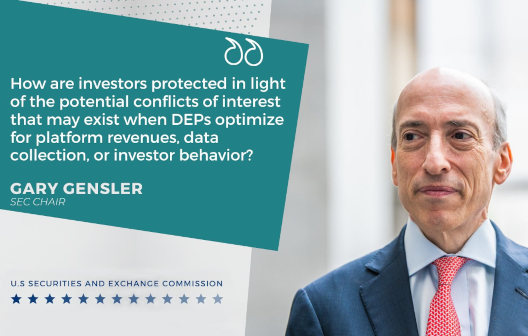

SEC Investigates Digital Engagement Practices in Broker Apps

|

Coinbase to Propose a Regulatory Framework for Digital Currency

|

Is Interest Paid on Crypto Holdings an SEC Violation?

|

When Was the Shortest Recession in Your Lifetime?

|

Sources:

https://www.etfstream.com/news/investors-pile-into-leveraged-etfs-despite-sec-systemic-risk-warning/

Stay up to date. Follow us:

|