Image Credit: Chris Bentley (Flickr)

A 132-Year-Old Infrastructure Company Uniquely Positioned to Build the Future

While the markets have washed out most categories of stocks during the first half of 2022, an astute investor will sift through those that should not have gone down with the overall tide – reviewing companies that have actually gained ground in their business or ancillary businesses. One seemingly well-grounded company, in business for 132 years, was just interviewed by Noble Capital Markets Senior Analyst Joe Gomes. The conversation with the infrastructure service provider seemed to reconfirm that there is still forward movement in many industries and companies that are possibly value-priced courtesy of the downturn. This notion grew as management highlighted, during the interview, the company’s key role in old business lines and in the coming wave of energy production.

In the recorded C-Suite

interview, Great Lakes Dredge & Dock (GLDD), the largest provider of dredging services in the U.S. and only publicly-traded company providing this type of infrastructure improvement, explains GLDDs new division helping to construct offshore wind farms. U.S. offshore wind electric production has been accelerating with the administration’s plans to provide 30 gigawatts of electricity by 2050. To help them lead in this effort, Great Lakes Dredge and Dock has ordered a $197 million high-tech boat. This will be the first U.S.-flagged, Jones Act compliant subsea rock installation vessel for the construction of windmills. The ship will specialize in meticulously placing large rocks around the foundations of the offshore mills to protect them. Each offshore wind farm is expected to have at least 100 mills, or more pertinent to GLDD investors, 100 foundations.

No other company has announced procuring such a vessel; if demand requires, GLDD has a contractual option to order a second ship. The first will not be operational until late 2024. A second, if ordered, available sometime in 2027.

Great Lakes is in a unique position as offshore wind farm construction in the U.S. adheres to the Jones Act. This requires a US-flagged ship to be used, GLDD will have the first of its kind when delivered.

Source:

Koyfin

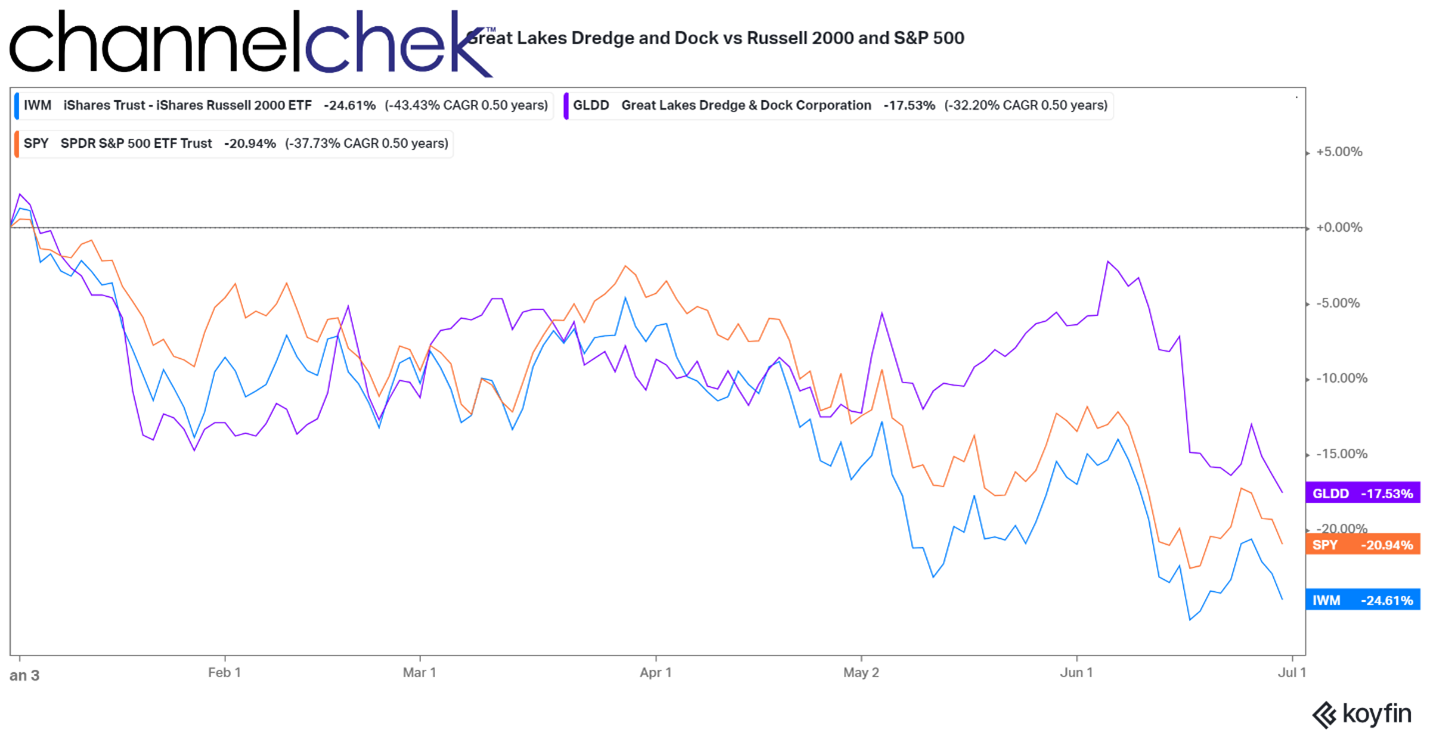

GLDD experienced a sharp selloff in January along with the rest of the market. Performance since late January has been well ahead of the broader indexes, and prospects for the future appear to be lining up well.

Great Lakes is currently involved with Empire Offshore Wind, a joint venture between Equinor (NYSE: EQNR) and BP (NYSE: BP). Empire Offshore Wind has chosen Great Lakes in consortium with Van Oord to perform the subsea rock installation work for the Empire Wind I and II wind farms in the East Coast of the United States. Empire Wind I and II are expected to provide over 2 Gigawatts of electric power to the State of New York.

To learn more about Great Lakes Dredge and Dock and their current business as well as their new division, watch the full C-Suite Interview, and review the most recent research report by one of the few equity analysts specializing in the name.

Managing Editor, Channelchek

Suggested Content

The Reason Investors are Hoping for Bad Economic Statistics

|

Winners and Losers from the American Jobs Plan

|

Michael Burry is Predicting More Red

|

C-Suite Interview with Great Lakes Dredge & Dock (GLDD) June 16, 2022

|

Sources

Channelchek C-Suite Interview Podcast (GLDD)

Stay up to date. Follow us:

|