Image Credit: Mark Bonica (Flickr)

The Case for Small-Cap Stocks Leading Out of the Dip Got Stronger

Was June 16 the market bottom? Some investors are cautiously optimistic. But, just like the question, “are we in a recession?” We will only know by looking in the rear view mirror miles down the road. Let’s presume for a moment that markets have bottomed. The Wall Street Journal wrote, “Shares of many small, U.S.-focused companies have raced ahead of the broader stock market in July. Some investors think that signals more room to run for small-capitalization companies, which can often be more agile and react more quickly to economic changes, including a recession. Below we look at the case the Journal makes, and add some other insight as to expected price action.

The broader markets gave up a lot of ground from the very first opening bell in 2022. As of the June 30 halfway point, the S&P 500 fell 21%, its worst first-half performance since 1970. The Russell 2000 index of small-cap companies fell 24%, its worst first half since launching in 1984. So far this month, the Russell 2000 is up 4.3%, while the S&P 500 is up 3.6%.

As with all broad indexes, the return is a deep mix of the overperformers and underperformers. Just yesterday the index was up 2.38% which included Clovis Oncology (CLVS) which traded higher by double digits, while another company in the index, WD-40 (

WDFC), was down double digits.

The move could be the beginning of a return to the more common pecking order for stock indexes ranked by large, and small-capitalization values. The small caps have been trailing, whereas historically the small stocks outperform.

The Journal indicated, “Small caps tend to be sensitive to fears of an economic slowdown, since they often generate the majority of their sales in the U.S., compared with large multinationals. Even though many investors and analysts remain nervous about the potential of a recession, some say that after a brutal first half, the group looks due for a rebound.”

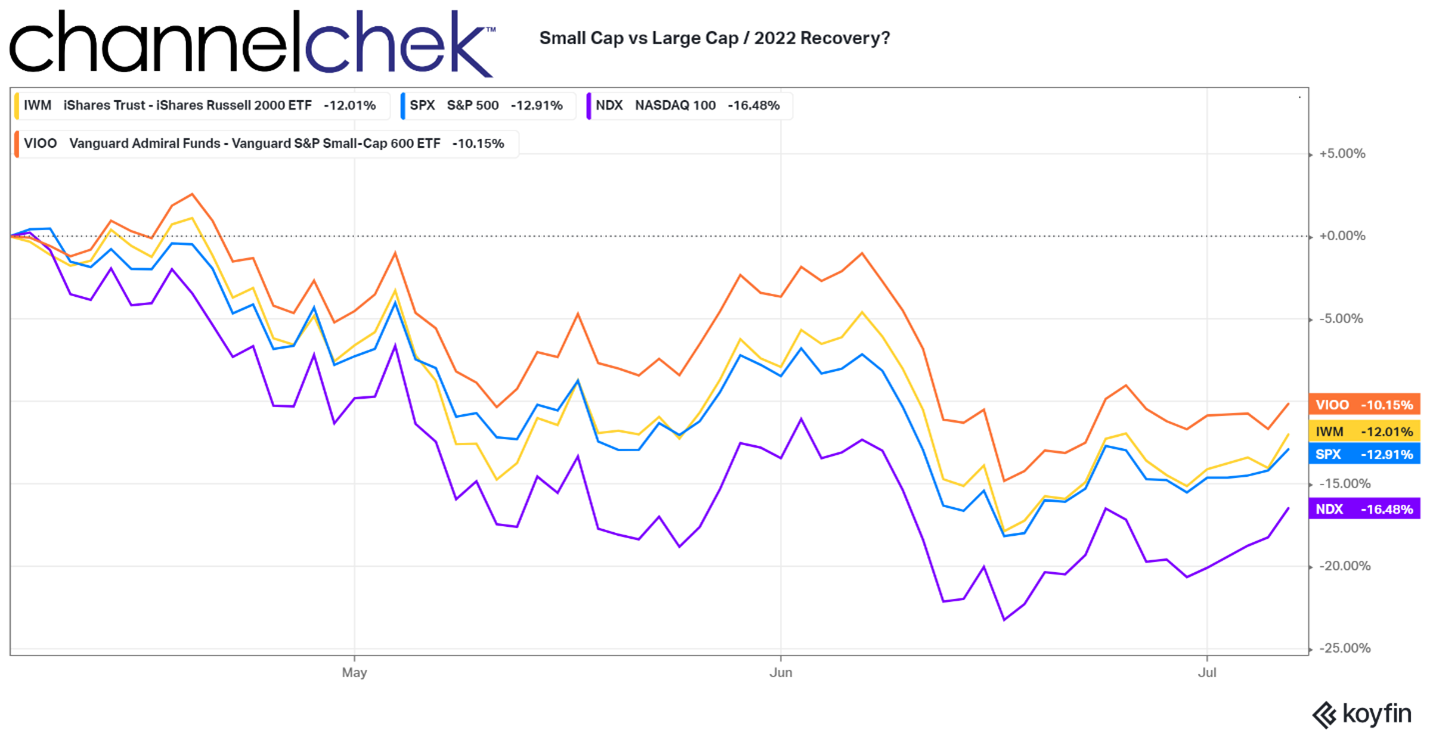

Below are two measures of small-cap stock performance (VIOO and IWM) plotted against the Nasdaq and S&P 500 since the low for all of them this year (June 16).

Source: Koyfin

One reason some market analysts believe small caps could be staging a rebound is valuations. The S&P 600 index of small-capitalization companies is trading at around 11.3 times its next 12 months of expected earnings, while the S&P 500 is trading at around 16.2 times expected earnings. Investors searching for value will find a wider variety of cheaper stocks among smaller caps. The Journal quoted Jurrien Timmer, the director of global macro at Fidelity as saying, “I would argue that a lot of the bad news is probably already in small caps.” Timmer said that small caps, which peaked earlier than the broader market, might be poised to hit their bottom earlier too. He was alluding to The Russell 2000 having hit its peak in November, while the S&P 500 hit its record two months later, in January.

Jill Carey Hall, US equity strategist at Bank of America, told the Journal, “The only other time small caps were this cheap relative to large caps was during the height of the tech-bubble period.”

In a recent interview of Chuck Royce, Chairman and Portfolio Manager at Royce Investment Partners, by Co-CIO Francis Gannon, Mr. Royce was asked: “What’s your current view on small-cap’s relative attractiveness versus large-cap?” In his response, he cautioned investors to avoid the temptation of being too comfortable with large caps. The reason given is that despite the dramatic decline in stocks in general, there hasn’t been a change in the undervaluation in small-caps relative to large. “Small-caps have averaged a 3% premium to large-caps over the past 20 years. At the end of June, however, small-caps were at a 20% discount, at their lowest relative valuation versus large-caps in more than 20 years,” explained Royce.

Take Away

There is no telling what markets will do tomorrow or the day after. We can only look back to gauge probabilities and expectations for the future – despite hearing over and over that “past performance is no indication of future results.” But by looking back, we can take the most basic statistical analysis, which is averages, and make projections. More specifically, the mean average or unweighted average. If we expect the various indexes to move toward or return to their mean average, we can make a better case than we have been able to in 20 years for the small-cap sector.

If you have an interest in small-cap stocks, arguably the best place to begin gathering data on small and microcap companies is Channelchek. Sign-up for free access to data for over 6,000 companies. Discover even more from current research on many of the companies written by analysts at Noble Capital Markets. By signing up you’ll receive the research and timely articles in your inbox each day. Sign-up

here.

Managing Editor, Channelchek

Suggested Content

The GameStop Stock Split Dividend is More Genius than it Appears

|

There’s Still a Swift Current Helping Some Infrastructure Related Companies

|

Will a Third Mandate be Added to the Fed’s Challenges?

|

What Rising Interest-Rates Has Meant for Small and Large-Cap Stocks

|

Sources

Stay up to date. Follow us:

|