Is Bitcoin Cash More Functional as a Currency than Bitcoin?

What cryptocurrency is performing better this year than Bitcoin?

The other Bitcoin, that’s what.

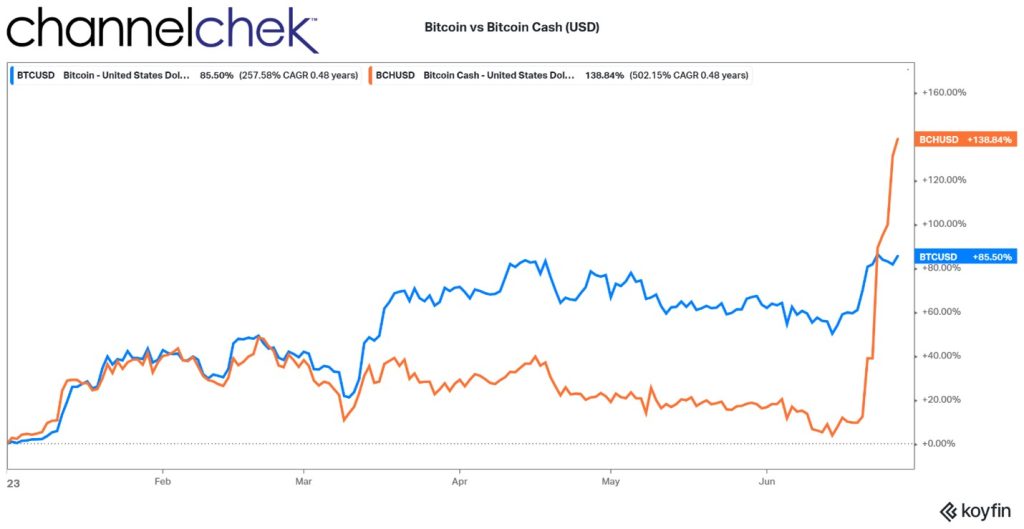

Recent headlines related to BlackRock’s application for a Bitcoin ETF, followed by Citadel, Schwab, and Fidelity’s plans to create a joint crypto exchange, further legitimized the digital asset class at a time when it seemed under fire from the SEC. The combined news of such big players caused an epic rally in BTC. But it also put BCH (the lesser-known Bitcoin “step-child”) on the radar of crypto investors. Bitcoin Cash (BCH) experienced price gains far greater than BTC.

About Bitcoin Cash

Bitcoin Cash sprang to life in 2017 as the Bitcoin blockchain developers were torn between two directions. The divide was resolved with a split in order to address the disagreement. At issue was the scalability and transaction capacity of Bitcoin “classic”. There were two different schools of thought, the big blockers and the small blockers, each with different solutions. The big blockers felt strongly that larger blocks of transactions were best, in August 2017, a separate ledger for Bitcoin Cash was created, it has its own development team and uses big block design.

The split is often referred to as the Bitcoin Cash fork, it resulted in two separate blockchains, Bitcoin (BTC) and Bitcoin Cash (BCH). The larger block size of BCH allows for more transactions per second.

Recent plans to include Bitcoin Cash on a new platform, owned by big Wall Street firms has ushered in a shift in market perception of the “step-child” cryptocurrency. Despite its being born out of dispute, Bitcoin Cash’s recent performance suggests that it is gaining traction in the eyes of investors.

The ticker symbol is “BCH”. However, some exchanges use the ticker symbol “BCH.X” to distinguish between Bitcoin Cash and other cryptocurrencies with the BCH ticker symbol, similar to “BTC” and “BTC.X” for Bitcoin.

Performance Drivers of BCH

Bitcoin Cash is up 138% so far in 2023, with much of that gain coming since the BlackRock SEC filing for a spot ETF, and the Citadel/Schwab/Fidelity exchange announcement. The exchange, called EDX Markets, backed by financial giants, is not registered with the SEC but carries significant weight due to its powerful partners. The platform lists only four cryptocurrencies: Bitcoin, Ether, Litecoin, and Bitcoin Cash.

This exclusive list has been interpreted by the market as a vote of confidence or an ordaining of sorts of those digital assets that will endure. This confidence has become even more important as the SEC has intensified its scrutiny of other blockchain projects.

BlackRock‘s application to the SEC isn’t the only one. It apparently has set off a wave of Bitcoin spot ETF applications. Bitcoin ETFs will allow greater participation in the asset class. Thus the sudden bullish sentiment across cryptocurrencies

Key Differences

Block size: Bitcoin Cash has a block size of 32 MB, while Bitcoin’s block size is 1 MB. This means that Bitcoin Cash can process more transactions per second than Bitcoin.

Development team: Bitcoin Cash is developed by a different team than Bitcoin. The Bitcoin Cash team is focused on increasing the scalability of the blockchain and making it more user-friendly.

Roadmap: Bitcoin Cash has a different roadmap than Bitcoin. The Bitcoin Cash roadmap includes plans to implement features such as Schnorr signatures and Segregated Witness.

Overall, Bitcoin Cash is a different cryptocurrency than Bitcoin. It has a larger block size, a different development team, and a different roadmap. Whether or not Bitcoin Cash is a better investment than Bitcoin is a matter of opinion and what it is to be used for.

Managing Editor, Channelchek

Sources