The Market Averages Suggest this Move

Different investment timelines call for different investments.

Have you ever looked at a chart of a company you were interested in, let’s say year-to-date, and thought, wow, this company has just dipped to where it could be expected to start to bring in buyers and go up? Then you look at a five-year chart, and the same stock has been trending down for years, and is actually close to where, from a longer-term perspective, a technical analyst would view it as more likely to weaken. Based on time perspective, both expectations can coincide with each other. This is why it is important to understand your own investment time frame before pulling the trigger on a stock.

The big question that needs to be answered first is, are you expecting the trade to work out in minutes, weeks, or years? Often this is based on any future needs of your invested capital.

If a trader is trying to make incremental income, they may use a five-minute chart. An investor looking to gain by holding weeks or months may use a one or three-year chart. Longer-term investors, those that are looking to put to bed what they hope will be the next Apple or Tesla in terms of performance, may look at charts using 20 years, or the “Max” time period.

Those that are longer-term investors can be less cautious about the exact timing on most investments, or less concerned about deciding if this is the ideal timing. This is especially relevant today in light of recession talk, rate increases, global risk, and other possible disruptions.

In fact, last year’s downward market direction was a wake up call for a lot of less seasoned investors, coming off so many so many positive years before. And this years retracement back up, is a good reminder that over time, markets have always broken new highs.

As mentioned above, when times are less certain, the investor that is looking to hold for an extended period, is the investor less likely to question their decision; many actually average into a position based on calendar buys, not price targets.

Having the long view, or deciding uncertain markets has dictated a longer view, would likely steer the investor to include smaller companies. Smaller companies have had the best long-term performance. It’s a category that may be more volatile but over time, has served investors better.

Over the past few years, small cap stocks have participated far less in the upward trend. That is less than larger companies (on average) and far less than they have versus their own historical average relative to large caps.

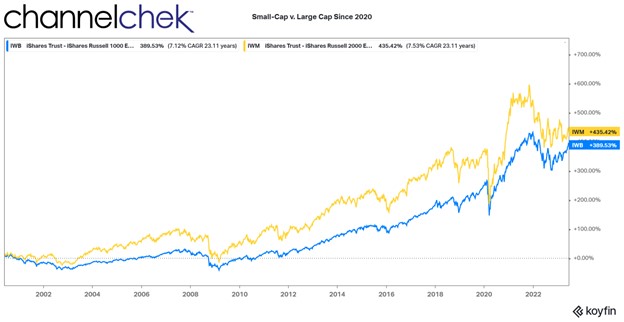

The chart above compares performance since the beginning of the decade of the Russell 2000 Large Cap performance (blue) to the Russell 2000 Small Cap index (gold). One thing that is evident immediately is the small cap stocks outperformed large caps long term by a large margin over time. The second is the trend is up. If you’d like, add a third which is there has been a significant dip in value (last year’s bear market).

“From our perspective, the uncertain present offers a highly opportune time to invest in small caps for the long run.” —Francis Gannon, Co-CIO Gannon Investment Partners (June 13. 2023)

Long term investors looking at this scenario could easily make a case for getting involved knowing that small caps historically overperform large caps. So if an investor is looking to maximize return, large caps may not have the highest probabilities. The above graph makes both points clear.

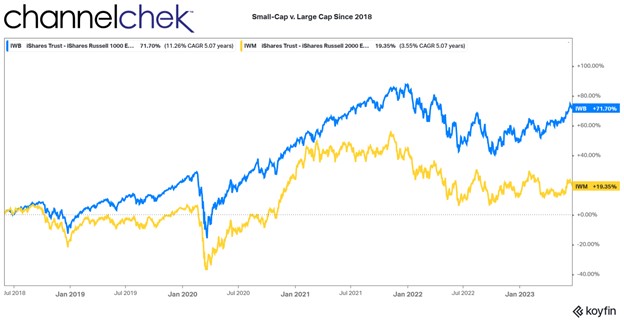

This second chart begins only five year ago. If one was to look at it by itself, the trendline over the years is upward, with gains in both large cap and small cap . But the large caps have a steeper upward pace. On the other hand, small caps are noticeably flat since the beginning of 2022.

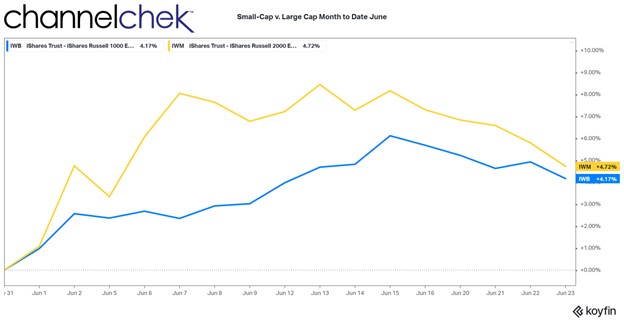

The last chart is just since the beginning of this month. Small cap stocks seem to finally have caught their tailwind, going up by more on most up days, and coming down by less on down days. Time will tell if this is a trend that will continue.

The small cap stock index won’t catch the large caps over night. If it happens, it will be months or years before investors that have been in small caps catch and pass those that have been in large cap stocks. Those investing now will outperform those that got in earlier. Of course, long-term investors are cautioned to also be diversified across many industries and of even market cap sectors.

Perhaps rebalancing the allocation after so many periods of small cap underperformance is a strategy that fits all the basic tenets that have been true of long-term investing.

They are:

Over time the stock market goes up and breaks new records.

Diversified portfolios spread risk and are less volatile.

Rebalance so allocations in sectors that have done well are not now undermining your asset mix.

Take Away

One can look at the same stock, over different time periods and see completely different trends. Those investing longer term, providing the company or industry isn’t in a decades long tailspin, reduce the risk of loss by letting time iron out the ups and downs.

Small cap stocks over time have outperformed larger companies. Assuming this hasn’t changed, when the volatility is “ironed out” small caps have a lot of catching up to do before they pass. This argues that they will return even greater comparative performance than if they were already ahead in recent years.

Managing Editor, Channelchek

Sources

Why the Time Looks Right for Small Caps —Royce (royceinvest.com)