Image: Marco Verch (Flickr)

Debt Servicing Costs are Rising for the U.S. Treasury – What Does that Mean for Investors?

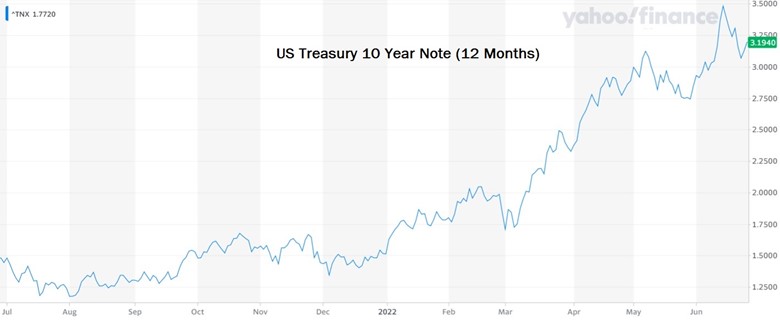

The U.S. Treasury will be spending far more to service the nation’s debt with the recent increase in interest rates. This rise in borrowing costs could put a damper on government spending in other areas that more directly fuel growth. Each month the Treasury rolls (refinances) a large amount of its maturing debt at current rates; in the case of most maturities, the interest rate is more than double the level from a year ago.

The Situation

Spending by the U.S. Gov’t on interest in the fiscal year that began in October 2021 adds up to about $310 billion through the end of May. This is a 30% increase from the same period a year earlier, using data from the Treasury Department. The federal deficit has actually shrunk somewhat within the year, and higher debt servicing costs in the form of interest rates are an increasing expenditure for the U.S. at a time when other federal spending has many competing priorities.

Interest rates (as measured by the USTN 10 yr. benchmark) declined from October 2018 (3.22%) up until July 2020 (0.53%). It has been trending higher since then and is now equal to the October 2018 level (3.20%).

Image: U.S. Treasury 10 Year note Yield (Yahoo Finance)

Economic Impact

Analysts say an increase in the cost of the federal government’s borrowing could pull from spending on anticipated initiatives and add to the overall U.S. debt servicing paid for by taxpayers. This burden is projected to reach its highest-ever levels as a share of the economy over the next decade, according to estimates from the nonpartisan Congressional Budget Office. “Rising interest costs simply grow our debt and increase the burden on the next generation, forcing them to pay more for our past than for our future,” said Michael Peterson, chief executive of the Peter G. Peterson Foundation, a nonpartisan group that advocates for deficit reduction.

Treasury yields have been held down by extraordinary purchases by the Federal Reserve. This was ramped up after the 2008 financial crisis and was revved up again in response to pandemic efforts. The cost, in part, from some of these stimulative actions, have caused inflation levels to be running well ahead of rates paid on bonds. The Fed has announced they would be letting their yield-controlling bond purchases roll-off at a specified pace, which will cause rates along the curve to move higher. Less money in the system and Treasuries drifting toward a more natural market rate will shift the entire curve upward. This shift is anchored at the Fed Funds overnight rate, which the Fed more directly orchestrates. The Fed has signaled it expects to notch up rates more in the coming months.

Since March, the Fed has raised the overnight Fed funds rate three times from near zero to a range between 1.5% and 1.75%. Most projections are for overnight rates to reach 3% to 3.50% by year’s end. Farther out on the curve, the 10-year treasury peaked as high as 3.50% this month and is currently (June 29) priced to yield 3.17%. The 10-year note is used as the benchmark from which lenders spread 30-year mortgage levels.

Treasury officials have indicated a large part of the increase in the government’s debt service costs so far this fiscal year has been tied to U.S. Inflation-Indexed Securities (TIPS). But as outstanding, lower-yielding securities are matured and replaced with higher-paying issues, the average interest rate across government securities gets locked in at higher levels. This will be gradual but impact government costs for an entire generation.

The Numbers

The U.S. has about $30 trillion in total public debt outstanding. As of late March, about 29% of outstanding Treasury securities were set to mature in one year or less. That debt, when refinanced, would quickly raise interest rate costs.

The Congressional budget office (CBO) has projected that in 2022, federal spending on net interest costs would reach $399 billion, compared with $352 billion in 2021. The average yield on the 10-year note from January through December they projected to be 2.4%, up from 1.4% last year.

Interest costs are expected to increase in each fiscal year through 2032 and total roughly $8.1 trillion over the next decade, which was completed in early March when interest rate forecasts were lower than today.

A CBO rule of thumb for scenario analysis uses a parallel shift of the curve upward by 0.50% to equate to $19 billion in higher interest costs over the year. Taking the scenario analysis out into the future, if the full curve of interest rates were 0.5 percentage points higher each year between 2023 and 2032, borrowing costs would be $1.3 trillion higher throughout the period.

Impact on

the Fed

The Fed holds a massive amount of securities it obtains through implementing monetary policy. Paul H. Kupiec, a senior fellow at the American Enterprise Institute estimates that, between December 31, 2021, and the end of May 31, 2022, the Federal Reserve lost $540 billion in market value on its massive portfolio of investments in Treasury bonds and mortgage securities. To put the loss in perspective, $540 billion is equivalent to 60 percent of the value of the Federal Reserve System’s entire asset holdings on September 1, 2008, just prior to the onset of the financial crisis.

Take Away

Markets participants have been hopeful that spending on many of the nation’s initiatives would significantly increase. This would provide opportunities to invest in infrastructure revamping, advances in health care, reduced carbon emissions, and other items laid out in the administration’s, American Rescue Plan.

Rescuing the country from higher and higher prices may put a damper on some of these initiatives, as higher debt servicing will take up a growing part of the budget as rates rise.

On the positive side, fixed income investors will receive higher interest payments which could stimulate and provide additional opportunities in other areas of the economy.

Managing Editor, Channelchek

Suggested Content

We Still Haven’t Reached the Inflation Finale

|

Michael Burry is Predicting More Red

|

Powell Caught Between Competing Political Agendas and Economic Reality

|

Since 2008, Monetary Policy Has Cost American Savers about $4 Trillion

|

Sources

https://www.gao.gov/blog/larger-federal-deficits-higher-interests-rates-point-need-urgent-action

https://www.washingtonpost.com/business/2022/06/27/fed-rate-rises-interest-national-debt/

https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny

https://mises.org/wire/who-owns-federal-reserve-losses-and-how-will-they-impact-monetary-policy

Stay up to date. Follow us:

|