What History Says About MegaCap Companies with NVDA’s Multiples

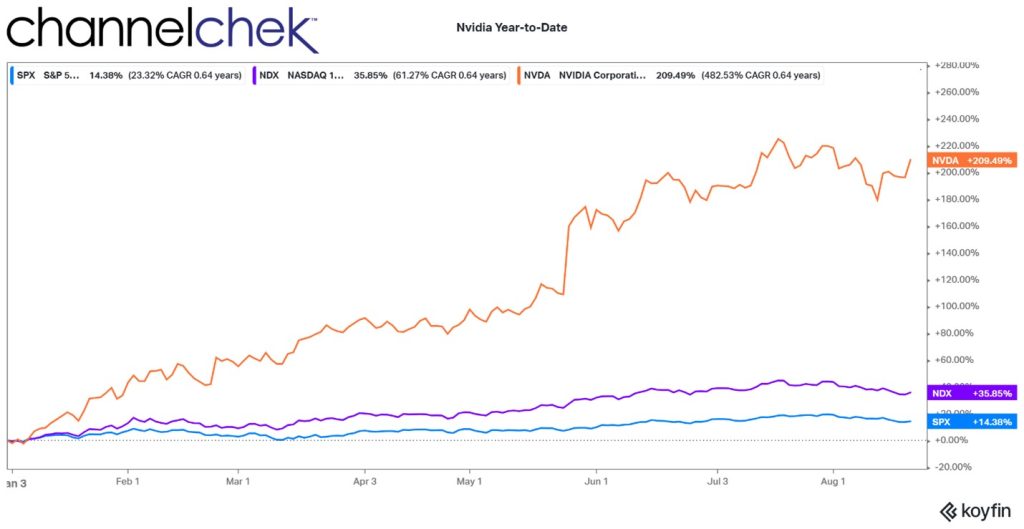

What’s riskier, a stock like Nvidia that has been moving up since the start of the year and has now risen more than 200%, or the stock you pick by throwing a dart at the Wall Street Journal? Nvidia (NVDA) will report earnings on Wednesday, the report has a significant risk of disappointing, even if it exceeds forecasts.

Background

The last time Nvidia reported quarterly results, the chip maker forecasted record revenue that was far above anything it had accomplished before. Naturally, investors sent the stock up and then up some more to the level we see today. On Wednesday, August 23rd, the company will share the actual results of its second-quarter earnings. If it doesn’t deliver or exceed expectations, there may be a lot of disappointed investors. Plus, a repeat projection of future earnings growth would seem necessary to maintain its trajectory. Nvidia’s current valuation is extremely high, it has been the poster child of the AI investment boom, it would seem there are more scenarios where it will disappoint the frenzy in the market for the stock then there are positives for a company with such high valuations.

What Does History Say?

The phrase “the bigger they are, the harder they fall” was used in the context of the stock market as early as the 19th century. In 1873, the New York Stock Exchange crashed, and many investors lost their life savings. The crash was blamed on the overvaluation of stocks. Since then, there have been a number of times the market and individual stocks have come to terms with the idea that the price has gotten ahead of itself, causing speculators to flee, causing a sharp decline.

Nvidia was big and has gotten bigger. As it relates to its report on second-quarter earnings on Wednesday, analysts have been expressing positive expectations. In a “buy the rumor sell the news” way of thinking, this alone may cause the stock price to deflate after the report.

An article published by Barron’s on August 21st points out, using data from WisdomTree, that Nvidia has a price-to-projected sales ratio, of 25, this jumps to a whopping 40 when using 12-month trailing sales.

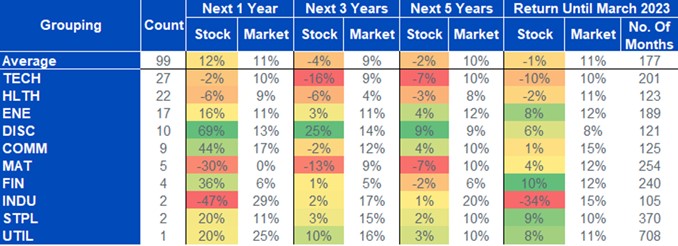

The company now holds the distinction of having the highest price-to-sales ratio in the S&P 500. It is only the 100th company to hold that title since the 1960s. Tech companies had been in this position 27 times, and utilities a mere once. What has happened to these mega-cap hot stocks in the years to follow?

Over the next year, the average price-to-sales monsters saw their price rise 12% versus the average for the market of 11%. Then, over the next three years, the average stock dropped 4% annually, compared to the market’s 9% rise. The relative fall off continued over the next five years, as the average for these stocks had fallen 2%, versus the market’s 10% gain, according to a book by Wharton economic professor Jeremy Siegel.

As illustrated in the table above, the underperformance is even greater for the tech companies that hold the biggest price-to-sales ratios. And the median performance for stocks at these price-to-sales ratios is even worse.

Take Away

Based on its guidance, there is little doubt that Nvidia is on track to post results that are beyond enviable. At least a dozen equity analysts have recently raised price targets on NVDA. But can the news be good enough in light of its current pricing and the history of tech stocks that have come before? NVDA would have been a great stock to have bought months ago and held; the current probabilities, based on history, now suggest the run-up is over, and the potential for a decline within a year has increased dramatically.

Managing Editor, Channelchek

Sources