Image Credit: Thomas Hawk (Flickr)

Investors Look for the Effects of Seemingly Unrelated Investment News

The story about Twitter (TWTR), Elon Musk’s Tesla (TSLA), and Trump Media & Technology (DWAC, *TMTR), can be viewed as a story of relationships. That is the relationship between the stocks of a social media start-up with aspirations to be unrestricted, a firmly entrenched social media giant, and a rich entrepreneur with aspirations to buy the entrenched social media giant to make it less restrictive.

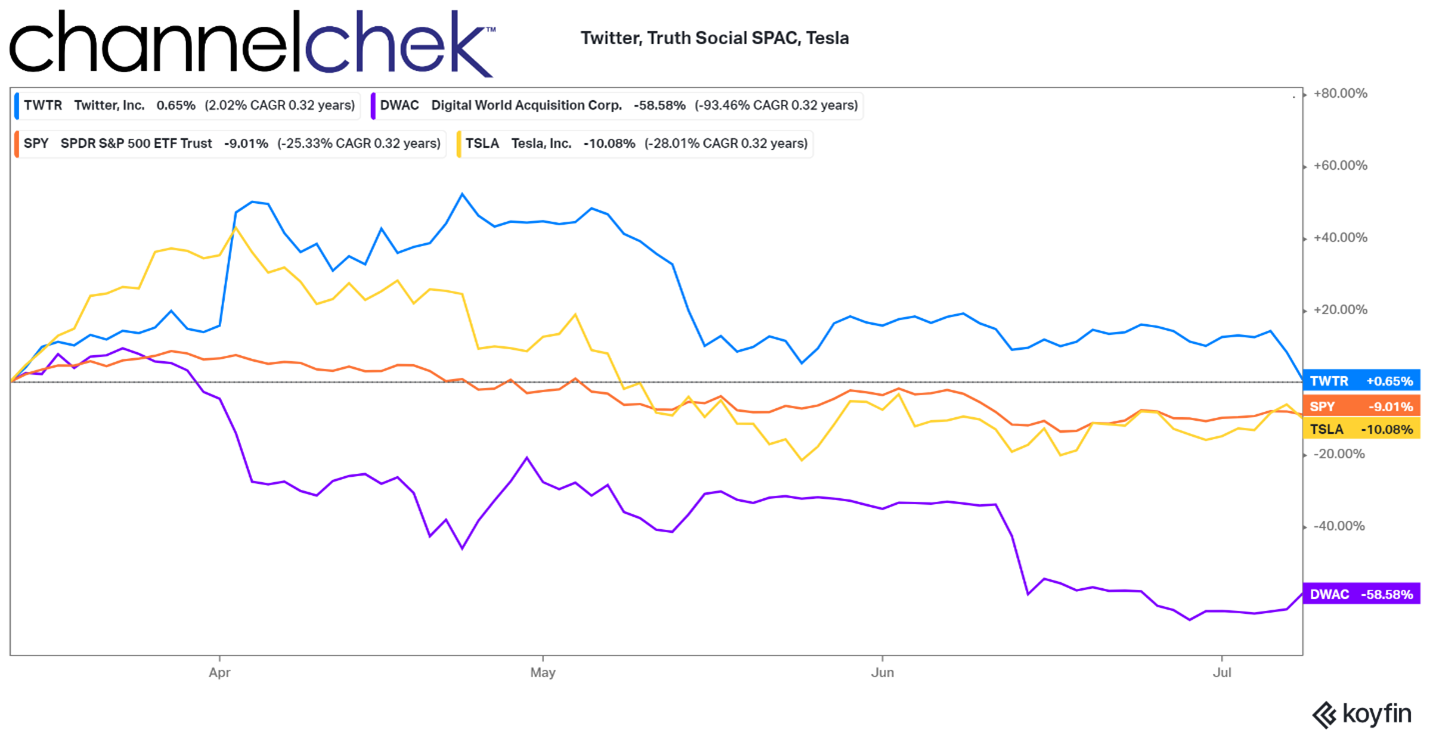

The stock price relationship between all of the above tells a story that investors can pull ideas from, especially if this is not the story’s end. In this case the best way to understand the not-so-complicated relationship is by looking at the chart below of the companie’s three tickers and the S&P 500.

Flashback to early April when Musk put out a few tweets suggesting he may be interested in buying Twitter. The SPAC waiting to close on Trump

Media fell in an equal amount to the rise in Twitter’s value. Beginning on April 14th when a final deal was struck between Elon Musk and Twitter’s Board, they again ran in equal and opposite directions, again with Twitter rising. For Tesla’s part, while the founder was borrowing against shares, the stock seemed to get an early bounce on the Twitter purchase news and then followed and performed similar to the overall market.

Source: Koyfin

Over the months that followed TWTR and DWAC seemed to trade disconnected. That is until last week when there was updated news to trade from. The news started as a rumor, and became official on Friday, Elon Musk withdrew his tender offer. One can see on the below chart that while Twitter traded off on the rumor and then the news, the SPAC in the de-SPAC

phase rose significantly.

While the financialnews had focused on the drama unfolding between the richest man in the world, and a company people love to hate, the start-up with ties to ex-President Donald Trump had been impacted in ways that investors could have benefitted from. In short when Elon Musk was going to buy Twitter, Trump Media’s value was negatively impacted, when Musk later took steps to rescind his tender offer Trump Media’s value was positively impacted.

If the saga is not over, expect more negative correlation between TWTR and the current ticker DWAC. Twitter’s board announced it decided to fight Musk’s decision to renege on his offer in court. This is an interesting turnaround from when the board first sought to decline and fight Musk’s offer. The saga is not likely to fade from the headlines quickly. And for Elon’s part, anyone that personally owns a company that launches rockets into space can tell you, that deciding to scrub a launch does not mean that it can’t be rescheduled.

Managing Editor, Channelchek

Suggested Content

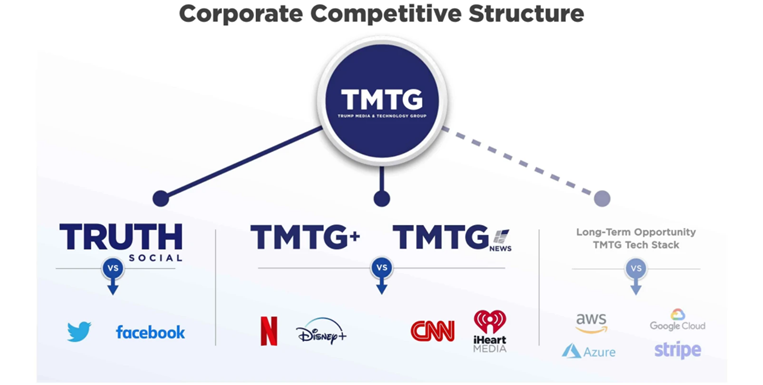

The Financing of Trump’s TRUTH Social and Video on Demand Service

|

What Would Failure Look Like to Elon Musk if He Buys Twitter?

|

Placing a Bid to Own a Public Company

|

Lifecycle of a Special Purpose Acquisition Company

|

Sources

https://www.cnbc.com/2022/07/11/twitter-shares-sink-after-elon-musk-terminates-44-billion-deal.html

Proposed acquisition of Twitter by Elon Musk – Wikipedia

https://investorplace.com/2022/07/why-is-digital-world-dwac-stock-roaring-higher-today/

https://app.koyfin.com/share/5629e1d417

Stay up to date. Follow us:

|