What’s the Best Inflation Fighter for Your Savings? Stocks or TIPS?

At a minimum, an investor with an eye toward having more, not less, in the future needs to beat the rate of inflation. Ideally, since the investor ties up their money, the buying power in their account should provide the current inflation rate plus a risk premium over the medium to long term. During the past few months, a number of long-term savers/investors have asked me what I thought about TIPS as a means of exceeding inflation. I have strong opinions on these Treasury securities. My thoughts are rooted in having been a portfolio manager for the country’s second-largest fixed income fund manager back in 1996 when the U.S. Treasury asked for our input on the design of the new bond. The Treasury wanted us to approve of the bonds enough to invest in them – in early 1997 I pulled the trigger on $100 million in the first ever TIPS auction – that was 25 years ago, and there is now enough data to compare the performance of Stocks, TIPS and the rate of inflation. Which one provides better inflation “protection”?

Some Details on TIPS

If you aren’t aware of the intricacies and history of the Treasury Inflation-Indexed Securities, dubbed TIPS, as the working name for the project back in 1996, here’s what you should know in a two paragraphs.

Interest rates were declining through the late 1990s and the Treasury Secretary Robert Rubin had a plan to lessen the government’s interest rate burden by issuing a bond with costs that would be lower with the declining inflation and interest rates. The Canadians, British, and Australians all had a bond type that floated with the countries’ inflation index. The Canadian-style bond had a fixed rate of interest where the principal accreted upward with an inflation index. On this new principal, an unaffected fixed-rate (coupon) would pay interest. The British and the Aussies paid the inflation addition with the coupon, the bondholder didn’t have to wait until maturity to be compensated for price increases. The U.S. adopted the Canadian system of accreting to principal.

The new bond was to be helpful to the U.S. Treasury, the conservative investor, and even the Federal Reserve. Inflation was sinking at the time, so investors were attracted in part to the idea that the securities effectively have a floor since the Treasury would never lower the principal accretion to below zero even if deflation became a problem. Retirees were told they should be thrilled to have a low-risk investment to choose from that paid inflation plus. The U.S. Treasury was looking forward to being able to reduce the interest costs of its debt as there were still bonds outstanding that were paying 14%. As for the Chairman of the Federal Reserve, Alan Greenspan, he was thrilled he’d have a constantly updating investor-driven mechanism that would indicate the market’s current expectation of inflation.

Inflation “Get Real”

Through the late seventies and into the early eighties, inflation was a big influencer on all household decisions. Durable items like washing machines were purchased sooner rather than later because they may cost much more later. Even borrowing to buy made good financial sense. As for investing or saving, buying short bonds or CDs that always paid more than inflations and then reinvesting similarly when it came due provided the investor with a little more income than inflation (and sometimes a free toaster). The stock market had years where it had negative returns, but for the medium or long-term saver, it far exceeded inflation. This has not seemed to have changed.

“Get Real” is a slogan that had been used by brokers trying to build enthusiasm for TIPS when they first came out. It refers to real yield, or put another way, the yield after inflation. TIPS were designed to pay the inflation rate plus an interest rate, so the investor earns a real yield. What no one anticipated when the securities were designed is the real yield could go negative, thus providing the investor with inflation minus whatever supply and demand decided.

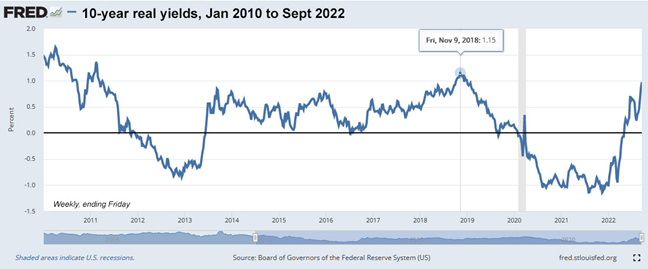

The chart below demonstrates that over a recent 11-year period, TIPS paid negative real rates about a third of the time. They did not provide the investors with a return above the rate of inflation as originally envisioned.

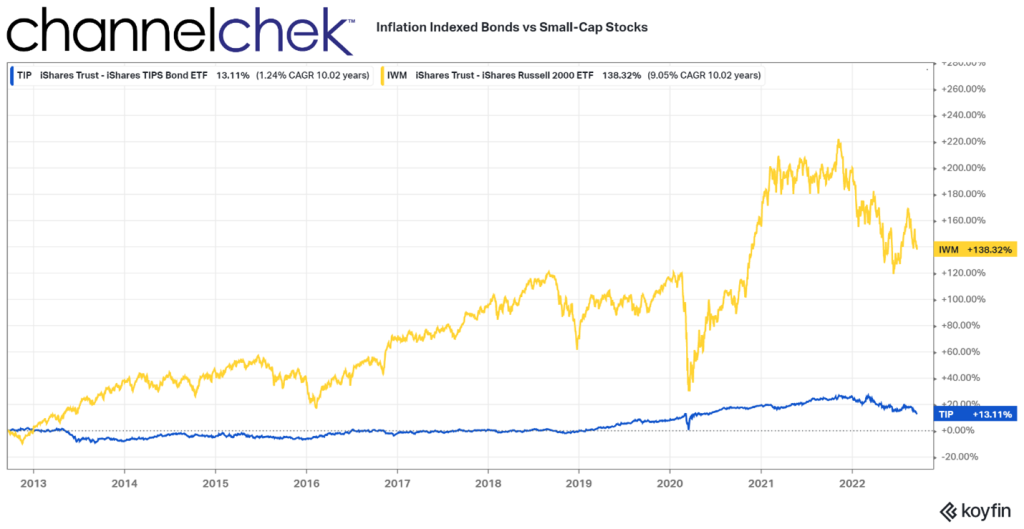

Stocks are not designed to be correlated with the rate of inflation, but they generally do well when the economy is flourishing or expected to flourish (these periods tend to be associated with inflation). And equities fall off when there is a contraction or expectations of a bad business climate. The chart below uses the Russell 2000 Small-Cap Index as a measure of stock market performance. The period shown demonstrates that if one is looking to keep up with or beat inflation by any margin, Small-Cap stocks can be viewed as far superior to TIPS.

During the period from August 2012 until August 2022, prices have risen a combined amount of 28.558%, according to a calculator provided by the Bureau of Labor Statistics. During the same period, an investment in TIPS provided 13.11% to the saver/investor. This equates to a real return of negative 15% over ten years. If the purpose of the investor is to keep up with and beat inflation, TIPS have failed as a decent option.

As for stocks, the downside over short periods has been much larger and deeper declines than TIPS. However, after year one, the declines were never large enough to show underperformance. TIPS failed its main goal of inflation plus. If an investor instead put money in small-cap stocks, they would have exceeded inflation by 110%.

While this is not predictive of the future, it is compelling evidence for anyone with a time horizon beyond a few years to look at the true risk profile of each. TIPS have performed worse than inflation. One reason for this is that bond prices have been held lower than the market would naturally have them because the Fed has taken so many on its balance sheet.

Take Away

The performance of the stock market over the medium to long term has a long history of beating returns of other assets, especially those of bonds. Treasury Inflation-Indexed Securities, the official name for the bond, does not have a “P” in it. The “P” was supposed to stand for “Protected.” Just prior to the first auction, the name was changed as government lawyers pointed out these may not protect the investor from inflation.

The Federal Reserve owns a third of the outstanding U.S. Treasuries, including a large allocation of TIPS. This unnatural demand holds prices artificially below where the market would price them without the Fed’s impact. This skewing of the results would have been upsetting to former Fed head Alan Greenspan who felt the main appeal to the security was their ability to help predict future inflation.

Stocks have risks, and bonds have risks, if it’s inflation you’re looking to overcome, inflation-linked bonds have been historically off the mark.

Paul Hoffman Managing Editor, Channelchek

Sources

https://www.nytimes.com/1982/02/05/business/record-set-on-30-year-us-bonds.html

https://www.treasurydirect.gov/instit/annceresult/tipscpi/tipscpi.htm

https://www.bls.gov/data/inflation_calculator.htm

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm